Sunday 31 May 2020

Crypto Long & Short: The Emergence of Prime Brokers Adds Resilience but Also Risk

Coinbase, BitGo and Genesis all have strong growth trajectories and balance sheets. But with that stability comes a certain degree of centralization.

via CoinDesk https://www.coindesk.com/crypto-prime-brokers-resilience-risk-coinbase-bitgo-genesis

Let's Talk Bitcoin! #436 'We Need 30 Different Words for Different Kinds of Censorship'

The rallying cry of the totalitarian is "He farted first", but if both systems have produced similar outcomes, is there much of a difference? Inspired by a recent article inthe Atlantic, in today's wide-ranging discussion the hosts of Let's Talk Bitcoin! dig deeply into the questions of censorship, propaganda and how things are both better and worse than in years past.

The episode is sponsored byeToro.comandThe Internet of Money Vol. 3

Shownotes:

- Who are they censoring from and how do we unpack this manipulation?

- The rallying cry of the totalitarian is always "He farted first"

- Who gets to decide what is censored?

- The squeaky wheel of child pornography gets the attention, the much more insidious problem of silencing certain voices, or giving preference to other voices.

- Propaganda goes hand-in-hand with censorship

- Propaganda is harder to detect 'reverse censorship'

- Private platform curation have the right to moderate which can be interpreted as censorship.

- You have to choose if you're a publisher or a platform

- What if AT&T listened to your phone calls, sold ads against them and disconnected you whenever you say something that would trouble sponsors?

- Common carriers vs. publishers

- FOSTA, SESTA and turning platforms into publishers

- Crony capitalism will always co-opt government

- The only way to win is not to play

- The only way to not be coopted as a protocol is to have it not be owned by anyone.

- It may be impossible to be a platform if you're not a protocol

- Information overload and compartmentalization

- Are the solutions that are being proposed the solution that we need to solve this problem?

- What kind of side effects does the solution have?

- It's one thing to say "there are idiots out there who have not developed critical thinking and are easily swayed and we need to fix this" and a whole other thing to say "And that's why only the landed gentry should vote"

- Do tech companies think they're helping?

- Benevolent fascism is still fascism

- The public school system was never meant for the average person to be able to form their own opinion, "it is for factory men not philosophers"

- Manufacturing consent with the power to control, censor, frame, set up the base assumptions of belief and then seek to nail them down.

- A dictatorship of the mind is far more effective than a dictatorship of violence.

- If Let's Talk Bitcoin! Were on Youtube, we wouldn't be able to say the word Covid-19.Avoiding totalitarian controlsmeans missing opportunities presented by big would-be platforms.

- Government surveillance vs. private surveillance provided to the government

- What we learned from Edward Snowden

- Does China commercialize surveillance?

- If both systems have produced the same outcome, is there much of a difference between them?

- A virtual prison camp

- Suppression of information does not translate to changing reality

- Biblical verses in the blockchain and

- "A platform puts data out but search is editorialism"

- Phone numbers, the yellow pages, cocaine and liability

- Privacy, anonymity and another form of censorship

- We need 30 different words for different kinds of censorship

- Is it censorship when private companies do it?

- Where did the word censorship come from and what words should we be using?

- "The problem with censorship is not the content, it's the person in which the control is vested"

- Is this worse because of growing polarization and partisanship?

- Was the internet free-er when nobody used it?

- Letters to the editor and platforms that amplify

- Even more insidious than censorship are the algorithms choosing what is seen and by who.

- Geographic boundaries vs. idealogical boundaries and the demise of newspaper monopolies on local discourse

- 5G and Coronavirus: Niche ideas wouldn't propagate if censorship worked

- The Streisand effect, reach and survivor bias

- The influence that Google's page-rank has on congressional primaries

- A generational divide in social media management skills and critical thinking

- Masks, conspiracy theories and narrative control

- Manipulating the wisdom of the crowds as manipulating the wisdom of society

- Censorship by private forces for profit and by government for state control, and the coalition of the two.

- Censorship as controlling access to the publishing of information vs. controlling what is amplified vs. how much reach it has.

- A big difference is visible in implementation of severe consequences for speech

- The chilling effect of harsh penalties and being "disappeared" for speech

- Ostracism, state punishment or private corporate consequences

- What are your favorite words or terms for specific kinds of censorship?Send us an email atadam@ltbshow.com

- If you light your brainfarts on fire, is that flaring?

Credits

This episode of Let's Talk Bitcoin features Stephanie Murphy, Jonathan Mohan, Andreas M. Antonopoulos and Adam B. Levine. Music provided by Jared Rubens and Gurty Beats, with editing by Jonas.

Photo by Sebastiaan Stam on Unsplash

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/lets-talk-bitcoin-436-we-need-30-different-words-for-different-kinds-of-censorship

‘We Need 30 Different Words for Censorship”, Feat. Andreas M. Antonopoulos

The rallying cry of the totalitarian is "He farted first", but if both systems have produced similar outcomes, is there much of a difference? Today's wide-ranging discussion features Stephanie Murphy, Jonathan Mohan, Adam B. Levine and Andreas M. Antonopoulos

via CoinDesk https://www.coindesk.com/we-need-30-different-words-for-censorship-feat-andreas-m-antonopoulos

Why Family Offices Should Consider Digital Assets for Their Portfolios

While institutional capital remains on the digital assets sidelines, family offices have shown willingness to diversify into crypto, says Constantin Kogan of BitBull Capital.

via CoinDesk https://www.coindesk.com/why-family-offices-should-consider-digital-assets-for-their-portfolios

Saturday 30 May 2020

Is Bitcoin Trading a Dirty Business? With Willy Woo - WBD222

Location: Zoom

Date: Sunday 10th May

Project: Hypersheet

Role: Co-Founder

On May 11th, at block 630000 Bitcoin had its 3rd halving, cutting the block reward issued to the miners from 12.5BTC to 6.25BTC. This reduction in the subsidy is seen by many as a bullish event for Bitcoin. With the block reward cut in half, the amount of Bitcoin available for the miners to sell in the market drops from 1800 BTC/day to 900 BTC/day, reducing the sell pressure from newly minted coins.

Bitcoin's recent drop in price has been attributed, by some, to miners selling off some of their Bitcoin, to support lower revenues with the blog subsidy halving.

While miners have typically been the largest sellers in the Bitcoin market, now that the subsidy has again cut in half, Willy Woo has claimed the majority of the sell pressure will not come from the exchanges.

Woo puts this down to the rise in popularity of the derivatives and futures markets on exchanges such as BitMex and Deribit. These exchanges take fees of up to 0.075% per trade and offer high leverage options of up to 100x. As the popularity of these exchanges has grown, so have the fees.

With the selling pressure from miners dropping and the sell pressure from the exchanges growing, is trading detrimental to the growth of Bitcoin?

In this interview, I am joined by Willy Woo, an on-chain analyst and the co-founder of Hypersheet. We discuss Bitcoin trading, the rise of the unregulated, high leverage futures platforms and if trading is damaging to the growth of Bitcoin.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/is-bitcoin-trading-dirty-business-willy-woo

Stablecoins Are the Bridge From Central Banks to Consumer Payments

Stablecoins can mediate between central bank digital currencies and the consumer payments universe, says Sila's Alex Lipton.

via CoinDesk https://www.coindesk.com/stablecoins-are-the-bridge-from-central-banks-to-consumer-payments

Friday 29 May 2020

To Get Serious About Decentralization, We Need to Measure It

Blockchains aim to democratize influence and control, broadening access to capital and data. But we lack metrics to whether projects achieve decentralization.

via CoinDesk https://www.coindesk.com/serious-decentralization-we-need-to-measure-it

Behind ‘Prime Broker’ Buzzword Lies a Complex Strategy Game for Crypto Firms

Coinbase, BitGo and Genesis all announced plans to become prime brokers this month. Here's what the trend reveals about the state of the industry.

via CoinDesk https://www.coindesk.com/crypto-prime-brokers-coinbase-tagomi-bitgo-genesis

Money Reimagined: What CoinDesk’s Style Debate Says About Crypto as Public Tech

Blockchains are flexible new forms of public infrastructure, says Michael Casey. Plus: with China rushing in, Africa is a prime battleground for the future of money.

via CoinDesk https://www.coindesk.com/money-reimagined-what-coindesks-style-debate-says-about-crypto-as-public-tech

Blockchain Bites: Magic’s Raise, Compound’s Distribution and Trump’s Twitter War

In the war between Trump and Twitter, decentralized systems may win.

via CoinDesk https://www.coindesk.com/blockchain-bites-magics-raise-compounds-distribution-and-trumps-twitter-war

Russia Is About to Drop the Crypto ‘Iron Curtain,’ Industry Warns

Russia's crypto community is pushing back against a set of bills that could impose onerous restrictions on startups and individuals in the country.

via CoinDesk https://www.coindesk.com/russia-is-about-to-drop-the-crypto-iron-curtain-industry-warns

Bitcoin News Roundup for May 29, 2020

With bitcoin and many traditional markets down on the day, CoinDesk's Markets Daily is back!

via CoinDesk https://www.coindesk.com/bitcoin-news-roundup-for-may-29-2020

Unhashed Podcast - Another Porno Shitcoin

On this episode of the Unhashed Podcast: Bitmex shits on Eth 2.0 and for good reason! Blockfi is hacked - and via Sim Swapping...smg. And...JK Rowling gets the full force of Bitcoin Twitter dumped on her.

WEEKLY NEWS WRAP UP:A few weeks ago, Bitmex Research issued a very detailed report about Ethereum 2.0. The report starts off as follows: 'œWe examine Ethereum 2.0, which is set to launch as early as July 2020, assuming there are no further delays. However, the launch may not be as important of an event as it sounds. Initially, Ethereum 2.0 will mostly operate as a test network for the new proof of stake consensus system. Most of the economic activity and smart contracts will remain on the original Ethereum network, which will continue to exist as a parallel system to Ethereum 2.0. There will be a one way peg, where Eth1 can be transferred into Eth2, but the reverse will not be possible. Given the decision to scale via sharding, we believe Ethereum has little choice other than to attempt this incredibly complex multi year transition to a new network.' In conclusion, Bitmex Research had this to say: 'œThere is one thing that stands out to us above everything else, Ethereum 2.0 is exceptionally complicated. With so many committees, shards and voting types it seems reasonably likely that something will go wrong and that there will be significant further delays.'

Advancing Bitcoin has released the videos of the talks from their February 2020 conference, but in a somewhat unusual move, the videos were put behind a paywall. Conference attendees are free to watch the videos, but anyone else would have to pay around 60 dollars in order to get access. Adam Fiscor, lead developer of Wasabi Wallet and one of the presenters at the conference, had the following to say on Twitter: 'œTo be honest I'm pretty uncomfortable with it. I didn't know this is how it'll be uploaded.' And in another tweet he said: 'œPersonally, I don't think this is unethical as it's common practice outside Bitcoin. Though if I'm in the position, I'll reconsider participating next time as I prefer free propagation of information and I may even take a stance on it.'

JPMorgan Chase, the United States' largest bank, has reportedly taken on U.S. cryptocurrency exchanges Coinbase and Gemini as customers. A report from the Wall Street Journal on May 12 cited unnamed sources apparently familiar with the matter, who highlighted that the move is the first time the banking giant has served clients from the crypto industry. Both exchange accounts were reportedly accepted in April, with transactions now starting to be processed, sources told the WSJ. JPMorgan Chase is not processing Bitcoin (BTC) or other cryptocurrency transactions on behalf of the exchanges but is providing cash-management services and handling dollar transactions for their U.S.-based clients. The bank will reportedly process all wire transfers and dollar deposits and withdrawals via the Automated Clearing House network.

On May 14th, BlockFi was breached: 'œ"On May 14th, there was a data incident at BlockFi that exposed certain client account information for a brief period of time. While no information was accessed that would enable the intruder to access your account or your funds, we believe it is in the interest of transparency to share the following details with you, and all of our other clients who were potentially affected. Your funds, passwords, and non-public identification information are secure and no BlockFi client or company funds were impacted or at risk. No action is required by you'.a BlockFi employee's phone number was breached and utilized by an unauthorized third party to access a portion ofBlockFi's encrypted back office system. This type of breach is commonly referred to as a SIMport. The unauthorized third party was able to do this by obtaining unauthorized access to the employee's phone and email via a cell phone network vulnerability.

JK Rowling's Bitcoin Twitter Overdose

PRICE ANALYSIS:Number go Sideways

ONE FINAL NOTE:Firstly, Support us on Patreon.

Make sure you are storing your crypto on something secure like a Ledger and backing it up on something sturdy like a Billfodl. If you buy these items through the links above, we do take a cut of the profits but it also helps support the show - a win/win for all involved.

And also...thanks for stopping by and listening. If you want to help us grow, there are several ways you can help out.

You can donate bitcoin to us at the address on the donate page on our website unhashedpodcast.com, you can also sponsor our show by getting in touch with us at mailbag@unhashedpodcast.com, or there are a few other things you can do that will cost you nothing but a little time - you can rate our show on itunes or wherever you are listening to this, you can tell a friend about us, or most easily, you can retweet our tweets announcing each episode and follow us @unhashedpodcast or join our telegram channel at t.me/unhashedpodcast.

Again thanks for listening and helping us grow. See you on the other side.

PRODUCERS OF THE SHOW:It's time to thank the people who are making this show happen:

A big thank you to our VIP patrons:

Scott Offord from Crypto Mining Tools

MKUltra07

And Peter McCormack from the What Bitcoin Did Podast

Thanks so much for your contributions.

If you want to help contribute, you can go to patreon.com/unhashedpodcast or send Bitcoin to the address on the about page of unhashedpodcast.com

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/unhashed-another-porno-shitcoin

Citizen Bitcoin - Jeff Booth: The Money of Tomorrow

Today we sit down with Jeff Booth author of the new book The Price of Tomorrow. Jeff is a long time tech entrepreneur - He led BuildDirect, a technology company that aimed to simplify the building industry, for nearly two decades and he invests in and sits on the boards of many tech companies. Needless to say Jeff has his finger on the pulse of the global tech industry. In this disucssion we dive into the ideas he's fleshed out in The Price of Tomorrow - deflationary technology in the time of inflationary monetary policy - the deep societal problems caused by inflationary money - how deflationary technology could combine with the deflationary money that is Bitcoin. We soberly examine the current state of affairs but also consider a bright future ahead and the path to get there.

@CitizenBitcoin on Twitter

Citizen Bitcoin Layer One merch collection

Music: Moon in the Sky by Hobotek

Links from the episode:

Swan Bitcoin - The Best Way to Buy Bitcoin

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/citizen-bitcoin-jeff-booth-the-money-tomorrow

In Trump Versus Twitter, Decentralized Tech May Win

Campaigners against Section 230 said Trump’s intervention might derail their cause, but it could offer an opportunity for decentralized tech.

via CoinDesk https://www.coindesk.com/trump-versus-twitter-decentralized-tech-section-230

Discovery Science to Premier Crypto-Funded TV Series About … Dragonchain?

A new TV series tracking the story of Disney-linked blockchain firm Dragonchain was fully funded in cryptocurrency. It's scheduled to go live July 4 on Discovery Science.

via CoinDesk https://www.coindesk.com/discovery-debuts-series-crypto-paid

Maker (MKR) is launching on Coinbase Pro

On Monday, June 8, transfer MKR into your Coinbase Pro account ahead of trading. Support for MKR will be available in all Coinbase’s supported jurisdictions, with the exception of New York State. Per previous launches, transfers will open during business hours, Pacific time.

On Monday, June 8, we will begin accepting inbound transfers of MKR to Coinbase Pro. Trading will begin on or after 9AM Pacific Time (PT) the following day, if liquidity conditions are met.

Once sufficient supply of MKR is established on the platform, trading on our MKR-USD and MKR-BTC order books will start in phases, beginning with post-only mode and proceeding to full trading should our metrics for a healthy market be met.

Maker (MKR) — Maker is an ERC20 token that describes itself as “a utility token, governance token, and recapitalization resource of the Maker system.” The purpose of the Maker system is to manage another Ethereum token, the DAI stablecoin, that seeks to trade on exchanges at a value of exactly US$1.00.

Please note that MKR is not yet available on Coinbase.com or via our Consumer mobile apps. We will make a separate announcement if and when this support is added.

The Stages of the MKR Launch

There will be four stages to the launch as outlined below. We will follow each of these stages independently for each new order book. If at any point one of the new order books does not meet our assessment for a healthy and orderly market, we may keep the book in one state for a longer period of time or suspend trading as per our Trading Rules.

We will publish tweets from our Coinbase Pro Twitter account as each order book moves through the following phases:

- Transfer-only. Starting on Monday, June 8, customers will be able to transfer MKR into their Coinbase Pro account. Customers will not yet be able to place orders and no orders will be filled on these order books. Trading will begin on or after 9AM Pacific Time (PT) the following day, if liquidity conditions are met.

- Post-only. In the second stage, customers can post limit orders but there will be no matches (completed orders). Order books will be in post-only mode for a minimum of one minute.

- Limit-only. In the third stage, limit orders will start matching, but customers are unable to submit market orders. Order books will be in limit-only mode for a minimum of ten minutes.

- Full trading. In the final stage, full trading services will be available, including limit, market, and stop orders.

One of the most common requests we receive from customers is to be able to trade more assets on our platform. Per the terms of our listing process, we anticipate supporting more assets that meet our standards over time.

You can sign up for a Coinbase Pro account here to start trading. For more information on trading MKR on Coinbase Pro, visit our support page.

A note regarding the previous launch of MKR on Coinbase Pro

In April 2019, Coinbase Pro launched support for MKR in a limited number of jurisdictions. Due to limited liquidity, these books failed to meet our metrics for a healthy market and did not proceed to trading, meaning no trades were executed.

Maker (MKR) is launching on Coinbase Pro was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/maker-mkr-is-launching-on-coinbase-pro-1f7bb7c844a9?source=rss----c114225aeaf7---4

Design Fiction: Real Solutions, Unreal Problems

‘Passwordless Login’ Startup Magic Raises $4M From Naval Ravikant, Placeholder

Ethereum startup Magic just raised $4 million from investors like Naval Ravikant, SV Angel, Placeholder and Volt Capital to make passwords less of a pain.

via CoinDesk https://www.coindesk.com/passwordless-login-startup-magic-seed-round-naval-ravikant-placeholder

Digital Dollar Project Calls for 2-Tiered Distribution System in First White Paper for US CBDC

The Digital Dollar Project's first white paper describes how a two-tiered system underpinning a tokenized dollar could modernize the U.S. financial system.

via CoinDesk https://www.coindesk.com/digital-dollar-project-calls-for-2-tiered-distribution-system-in-first-white-paper-for-us-cbdc

First Mover: Bitcoin Rally Shows Traders Don’t Care That Goldman Hates Their Asset Class

Traders can also gloat over how much better bitcoin is performing in 2020 than Goldman Sachs shares.

via CoinDesk https://www.coindesk.com/first-mover-bitcoin-rally-goldman-sachs

Bitcoin Rally Falters as Stocks Drop Ahead of Trump’s China Speech

Bitcoin's bulls are taking a breather as the traditional markets get the jitters over rising tensions between the U.S. and China.

via CoinDesk https://www.coindesk.com/bitcoin-rally-falters-as-stocks-drop-ahead-of-trumps-china-speech

GSX Group’s New Digital Securities Venue Tokenizes First Client Shares

Gibraltar Stock Exchange Group's recently launched GRID venue has tokenized the shares of adtech firm tribeOS.

via CoinDesk https://www.coindesk.com/gibraltar-stock-exchange-group-tokenizes-company-shares-tribeos

Blockchain ID Solution Aims to Tackle Spike in Delivery Fraud Amid Coronavirus Measures

Nuggets, a digital identity and payments platform, has developed a way to accept deliveries without needing a physical signature to combat a spike in fraud during the coronavirus pandemic.

via CoinDesk https://www.coindesk.com/blockchain-id-solution-aims-to-tackle-spike-in-delivery-fraud-amid-coronavirus-measures

It’s Tough Getting Approved in Gibraltar, Says Green-Lighted Crypto Derivatives Exchange

It's tough getting regulated on "the Rock," says crypto derivatives exchange, ZUBR.

via CoinDesk https://www.coindesk.com/gibraltar-regulator-crypto-derivatives-exchange

Thursday 28 May 2020

Libra Payments Can Boost Facebook’s Ads Business, Zuckerberg Says

Libra can make it easier for Facebook's users to buy goods advertised on its platform, which would incentivize businesses to buy more ads, CEO Mark Zuckerberg said Wednesday.

via CoinDesk https://www.coindesk.com/libra-payments-can-boost-facebooks-ads-business-zuckerberg-says

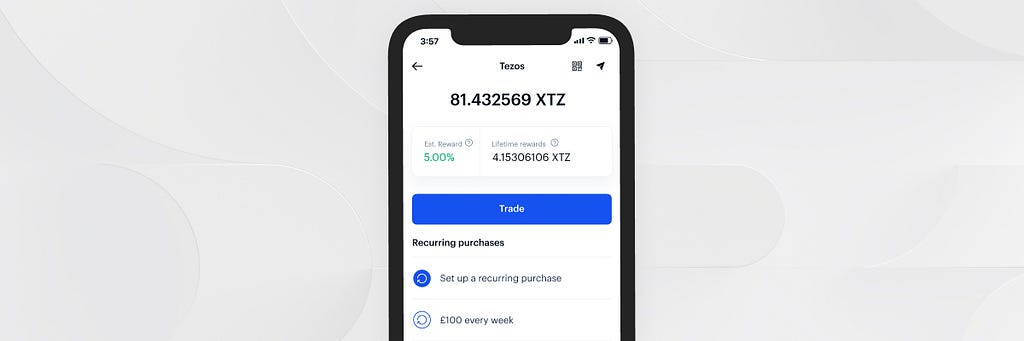

Coinbase Extends Tezos Staking Rewards to 4 European Countries

Coinbase is rolling out its Tezos staking service to the U.K., Spain, France and the Netherlands.

via CoinDesk https://www.coindesk.com/coinbase-extends-tezos-staking-rewards-to-4-european-countries

Compound’s Approach to DeFi Governance Starts With Giving Away COMP Tokens

Users of the Compound lending platform will begin earning COMP governance tokens in mid-June.

via CoinDesk https://www.coindesk.com/compound-defi-governance-token-comp

Bitcoin News Roundup for May 28, 2020

Goldman talks down cryptocurrencies while Minecraft boots up tokenized assets. It's another episode of Markets Daily from CoinDesk!

via CoinDesk https://www.coindesk.com/bitcoin-news-roundup-for-may-28-2020

Coinbase launches staking rewards for customers in the UK, France, Spain and The Netherlands

By Rhea Kaw, Product Manager

At Coinbase, we’re focused on offering more ways for customers to earn rewards by holding crypto. Following our recent launch of Tezos staking rewards for our US customers, we’re now rolling out this feature for Coinbase users in the UK and certain EU member countries*. Coinbase will stake Tezos on behalf of customers and distribute rewards directly to customer accounts. Since the US launch of staking rewards, customers have earned over $2 million in Tezos staking rewards.

With yields on savings accounts and government bonds at record lows — and in many cases negative — in the UK and across Europe, staking offers our customers a simple way to earn rewards on assets held in their Coinbase accounts.

Staking lets you earn rewards with your crypto by participating in the network of a particular asset. When you stake your crypto, you make the underlying blockchain of that asset more secure and more efficient. And in exchange, you get rewarded with more assets from the network.

With today’s launch, Coinbase is offering an easy, secure way for UK and certain EU customers to actively participate in the Tezos network. While it’s possible to stake Tezos on your own or via a delegated staking service, it can be confusing, complicated, and even risky with regard to the security of your staked Tezos. We’re changing that with staking rewards on Coinbase.

With Coinbase staking rewards:

- You can begin earning rewards on your crypto. The current estimated annual return for Tezos staking on Coinbase is ~5%. You’ll see your pending rewards increase in real-time in the app, and once your initial holding period completes (35–40 days), you’ll receive rewards in your account every 3 days.

- You will always maintain control. Your Tezos always stays in your account; you just earn rewards while keeping your crypto safely on Coinbase. You can opt out any time you want.

The return rate stated by Coinbase is a projection based on the rewards we’ve generated over the past 90 days. The Tezos network sets the underlying return rate depending on the number of staking participants. Coinbase distributes the rewards to customers and keeps a portion as commission. Also note, that like many cryptocurrencies, the price of the staked asset, in this case Tezos, is subject to market dynamics and will fluctuate in price as dictated by the market.

To get started, simply buy Tezos on Coinbase or send Tezos to your Coinbase account from an external wallet, and you’ll start earning rewards immediately.

*Staking is available to eligible Coinbase customers in the US, UK, France, Spain and The Netherlands

Coinbase launches staking rewards for customers in the UK, France, Spain and The Netherlands was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/coinbase-launches-staking-rewards-for-customers-in-the-uk-france-spain-and-the-netherlands-4ebed6beb277?source=rss----c114225aeaf7---4

US Court Freezes Assets Linked to Alleged $9M ICO Scam

A federal court has frozen assets raised from investors in the Meta 1 Coin token sale.

via CoinDesk https://www.coindesk.com/us-court-freezes-assets-linked-to-alleged-9m-ico-scam

Bitcoin Price Tests $9.4K as Demand for Put Options Drops

Put options – a bet on bitcoin's price – are declining alongside a rise in the leading cryptocurrency by market cap's price.

via CoinDesk https://www.coindesk.com/bitcoin-price-tests-9-4k-as-demand-for-put-options-drops

VeChain to Develop Drug-Tracing Platform for Pharma Giant Bayer

Bayer China is tapping VeChain to help it track clinical trial drugs along the blockchain.

via CoinDesk https://www.coindesk.com/vechain-drug-tracking-platform-bayer

OKCoin Grants $100,000 to BTCPay Server Toward Its Open-Source Development

Today, San Francisco-based cryptocurrency exchange OKCoin announced a $100,000 donation to open-source bitcoin payment processor project BTCPay Server.

The funding comes as part of the OKCoin Independent Developer Grant, which was launched last year. BTCPay Server’s product is free to use and its dependent on such contributions to continue operations.

“Supporting infrastructure projects is key to our mission at OKCoin [and] we believe that the most impactful way to do this is by backing independent open-source developers; the ground troops and projects dedicated to creating and improving the core infrastructure that the rest of us build on,” the exchange said in a statement shared with Bitcoin Magazine. “BTCPay Server … encourages adoption and greater use of Bitcoin by increasing its utility across global merchants, allowing businesses to transact in the cryptocurrency.”

This is the second donation in OKCoin’s grant program, with the first going to Bitcoin Core developer Fabian Jahr. It matches the largest-ever donation awarded to BTCPay Server, a $100,000 grant from Square Crypto.

“For us, it means recognition,” BTCPay Server contributor Pavlenex told Bitcoin Magazine of the donation. “It means we are doing something good when a corporate entity thinks we are worth receiving a big donation like this.”

He added that the donation will allow the BTCPay Server team to focus on its goal of driving adoption of its product and of Bitcoin around the world, ultimately becoming a set of technologies that others build upon.

“Basically, we’ll be able to focus more and produce even more features,” Pavlenex said. “Feature-wise, we want to use this grant to improve our API and user experience. Our main focus is allowing people to build stuff on top of BTCPay Server. In the future, BTCPay should become more of a tech stack than a payment server.”

These efforts toward adoption and creating a world in which the promise of cryptocurrency can be realized more widely are aligned with OKCoin’s vision for the grant program.

“The BTCPay project sustainably advances cryptocurrency adoption,” said OKCoin CEO Hong Fang, per the company statement. “Their efforts support our vision of a responsible financial ecosystem built upon digital assets. Our intention is that the grant helps accelerate the pace of Bitcoin development and highlights the significance of independent developers like BTCPay.”

The post OKCoin Grants $100,000 to BTCPay Server Toward Its Open-Source Development appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/okcoin-grants-100000-to-btcpay-server-toward-its-open-source-development?utm_source=rss&utm_medium=rss&utm_campaign=okcoin-grants-100000-to-btcpay-server-toward-its-open-source-development

Bank of Russia Wants to Put Mortgage Issuance on a Blockchain

Russia's is eyeing use cases for blockchain even as proposed legislation will clamp down on crypto.

via CoinDesk https://www.coindesk.com/bank-of-russia-blockchain-mortgage

Genesis Hires Ex-Galaxy Digital Staffer to Run New Derivatives Trading Desk

The derivatives desk will expand the company’s suite of products as it aims to attract more institutional clients to its newly acquired prime brokerage arm.

via CoinDesk https://www.coindesk.com/genesis-hires-ex-galaxy-digital-staffer-to-run-new-derivatives-trading-desk

Torus Goes Blockchain-Agnostic With New DirectAuth Dapp Login Tool

Seamless login for the decentralized apps (dapps) of any blockchain. That’s the vision for Torus Labs’ new identity solution, DirectAuth.

via CoinDesk https://www.coindesk.com/torus-goes-blockchain-agnostic-with-new-directauth-dapp-login-tool

Handshake Domains Bring in $10M as Race for Censorship-Resistant Websites Heats Up

During the coronavirus crisis, Handshake may be the leading free-speech-oriented crypto project. But is it just beginner’s luck?

via CoinDesk https://www.coindesk.com/handshake-domains-bring-in-10m-as-race-for-censorship-resistant-websites-heats-up

First Mover: Chainlink ‘Marines’ Are HODLing and Here’s Why You Should Care

Chainlink, the blockchain oracle provider, apparently has not only a devoted group of backers known as "LINK Marines," but a surprisingly committed crew of long-term investors. Here's why.

via CoinDesk https://www.coindesk.com/first-mover-chainlink-marines-hodling-investing-oracles

Gemini First US Exchange to Integrate With Samsung’s Blockchain Wallet

Samsung Blockchain users in the U.S. and Canada can now connect to Gemini’s mobile app to buy, sell and trade crypto.

via CoinDesk https://www.coindesk.com/gemini-first-us-exchange-to-integrate-with-samsungs-blockchain-wallet

$103M Bailout Denied for Coronavirus-Hit Firms in Switzerland’s ‘Crypto Valley’

The finance director of Switzerland's "Crypto Valley" has been denied a request for extra assistance for blockchain and crypto startups affected by coronavirus funding drought.

via CoinDesk https://www.coindesk.com/103m-bailout-denied-for-coronavirus-hit-firms-in-switzerlands-crypto-valley

Enjin’s New Minecraft Plugin Lets Players Spawn Blockchain Assets

Players can now drop blockchain assets into their Minecraft servers, enabling ownership over in-game items and currencies.

via CoinDesk https://www.coindesk.com/enjin-minecraft-plugin-blockchain-assets-servers

Defying Corona Crash, BlockTower Crypto Fund Stretches 30% Total Return to 73%

When coronavirus shutdowns roiled financial markets, BlockTower Capital more than doubled its cryptocurrency hedge fund's previously so-so returns.

via CoinDesk https://www.coindesk.com/defying-corona-crash-blocktower-crypto-fund-stretches-30-total-return-to-73

Wednesday 27 May 2020

Why Innovation Matters (and How Not to Screw It Up), Feat. Matt Ridley

The “Rational Optimist” author gives his take on the economic history and possible futures of prosperity’s most important driver: innovation

via CoinDesk https://www.coindesk.com/why-innovation-matters-and-how-not-to-screw-it-up-feat-matt-ridley

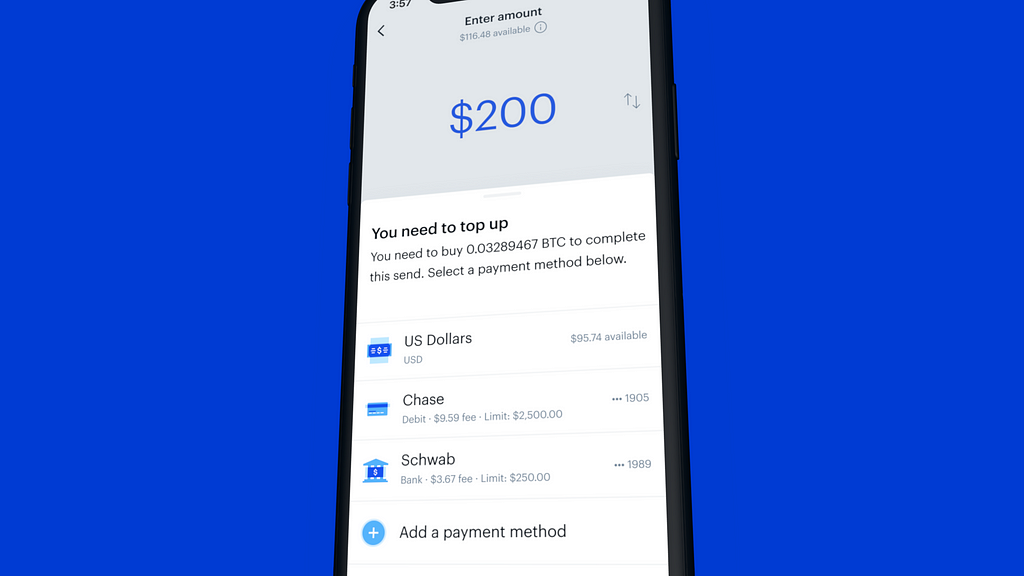

Making ‘money moves’ on Coinbase

You can now top up your balance as you are sending crypto

By Paul Katsen, Product Manager

Today we’re announcing three improvements to help customers send crypto more easily, confidently, and efficiently.

Easily top up your balance as you send

If you don’t have enough crypto to complete a send, you can now top up your balance right away to buy and send in one fell swoop.

With this feature, we’ll make sure you use an instant payment method that allows you to send your newly purchased funds instantly. You’ll be able to purchase more crypto as you are sending, so it feels as seamless as a payment directly from your bank account.

Confidently track when your crypto will arrive

We’ve also added ETAs (estimated time of arrivals) to transactions. When sending crypto, the time of arrival can vary, depending on the crypto network. We’re now including estimated times so customers can send crypto more confidently.

Efficiently send crypto on-chain

We’re always looking for ways to help our customers best use their crypto. As a result of our recent upgrade to transaction batching, for example, bitcoin network fees are now nearly 75% lower for each transaction on Coinbase.

We’re excited to continue improving the crypto send experience for our customers, and build on the foundations we set this year.

Sign up for a Coinbase account or download our iOS or Android app to get started.

Interested in a career in crypto? If you enjoy working on high-impact, crypto-first challenges, check out all our open positions here. We’d love to hear from you.

Making ‘money moves’ on Coinbase was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/making-money-moves-on-coinbase-5d5205252e2f?source=rss----c114225aeaf7---4

Goldman Sachs: Cryptocurrencies ‘Are Not an Asset Class’

Goldman Sachs held an investor call Wednesday to discuss current policies for bitcoin, gold and inflation. The stalwart investment bank is still no fan of bitcoin or other cryptocurrencies.

via CoinDesk https://www.coindesk.com/goldman-sachs-cryptocurrencies-are-not-an-asset-class

The $10B Stablecoin Industry Has a Fraud Problem It’s Not Addressing

If stablecoins are used for apparently illegal activity, should issuers step in to stop it? So far, they've been reluctant to do so, says our columnist.

via CoinDesk https://www.coindesk.com/10b-stablecoin-industry-has-fraud-problem-its-not-addressing

Bitbuy, Knox Team to Offer Insured Custody for Bitcoin on Exchange

Today, insured bitcoin custody provider Knox has announced its partnership with Canadian cryptocurrency exchange Bitbuy in a sign of growing interest for offline and insurable third-party storage solutions.

“Bitbuy is partnering with Knox … allowing its clients to have their bitcoin stored in an offline vault with insurance up to the full value of holdings,” according to a press release shared with Bitcoin Magazine. “This is a significant development for the burgeoning cryptocurrency industry, and makes Bitbuy the world’s first platform to find a way to keep the full value of its bitcoin cold storage holdings insured, which usually represents the vast majority of a platform’s client holdings.”

Creating a Custody Solution That Works for Bitcoin

For Bitcoin, custody is critical. A fundamental tenet of the technology is its power to free users from the third parties that control the traditional financial system — the banks that can withhold funds and policymakers who can bar access. “Not your keys, not your coins” has become shorthand for this philosophy that BTC custody should not be trusted to middlemen.

But personally holding private keys is a solution that doesn’t make sense for institutions or groups of more than a few individuals. It’s not viable for organizations to join the Bitcoin ecosystem without some form of third-party custody.

As Alex Daskalov, founder of Knox, explained to Bitcoin Magazine upon its launch in September 2019, “Second best thing you can do if you’re not going to hold your private keys is that you should have the right to have the full value of the assets insured.”

Daskalov explained that, upon its launch, Knox’s insurance broker matches it with insurance based on a sliding scale of how much it’s willing to cover, up to as much as $100 million. These insurance companies issue written attestations that they are willing to cover deposits up to certain thresholds and these attestations can serve as some added confidence for customers.

Bringing Better Insurance to Exchanges

This latest partnership is targeted at an avenue where Bitcoin custody could use a new solution: for holdings left on cryptocurrency exchanges.

“Many cryptocurrency users leave their bitcoin on-platform to make them readily available,” per the Knox release. “Platforms typically rely on internal storage systems for their offline holdings — typically 95 percent — that they secure on behalf of their clients. Custodial exchanges are not financially compensated for this service and treat it as the cost of doing businesses.”

As the Bitcoin community has learned repeatedly, cryptocurrency exchanges are decidedly unsafe places to leave your funds. That fact may have affected many Bitbuy users after the Canadian exchange QuadrigaCX went bankrupt while owing $190 million in clients’ digital assets last year.

“Bitbuy … will be moving all its bitcoin holdings over to Knox, which will securely store Bitbuy clients’ bitcoin in a fully segregated and insured custody account,” the release states. “The Knox insurance policy covers the risk of theft and loss, including internal theft such as collusion, up to the value of the holdings held in cold storage subject to the full policy terms, conditions and exclusions.”

Bitbuy clients will not be required to pay any additional fees for this protection, as the exchange decided to absorb the costs itself.

“Deep liquidity and asset security shouldn’t be mutually exclusive,” said Adam Goldman, president and founder of Bitbuy, according to the release. “We’re excited to be pushing forward the limits of the experience for Bitcoin.”

The post Bitbuy, Knox Team to Offer Insured Custody for Bitcoin on Exchange appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/bitbuy-knox-team-to-offer-insured-custody-for-bitcoin-on-exchange?utm_source=rss&utm_medium=rss&utm_campaign=bitbuy-knox-team-to-offer-insured-custody-for-bitcoin-on-exchange

Bitcoin Audible - How the Lightning Network will Grow Following Bitcoin's third Halving

'œIt's going to be really interesting to replicate some of the token-based authentication schemes that we already have with centralized providers but do it with self-sovereign identity, which is pseudonymous and which is persistent across the network.' - Chris Dannen

An article by Peter Chawaga at BitcoinMagazine.com that touches on the many topics discussed during the Bitcoin Halving Livestream with many of the Lightning pioneers. With LSATs, keysend, LN messaging apps, and the new infrastructure layer for monetary applications. The future is bright, and today's episode is a great little morsel about what it to come.

Check out the original article and the 2 great videos exploring all of this stuff further at the links below:https://bitcoinmagazine.com/articles/how-the-lightning-network-will-grow-following-bitcoins-third-halvingElizabeth Stark on BitcoinHalving - https://www.youtube.com/watch?v=CEim0y0Vw68Jack Mallers, Will Reeves, Chris Dannen, & Alex Leishman - https://www.youtube.com/watch?v=z1mpftgg2Ls

Auto-Fund with USD, Auto-Stack your BTC, & Auto-Withdraw to your keys. The simplest, lowest cost way to secure your future.SwanBitcoin.com/guy

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/how-the-lightning-network-will-grow-following-bitcoins-third-halving

Blockchain Bites: Google Validates Theta, Coinbase and BitGo Eye Crypto Prime Brokerage

Polkadot launched the blockchain of blockchains while an IMF official said CBDCs could spur financial innovation.

via CoinDesk https://www.coindesk.com/blockchain-bites-google-validates-theta-coinbase-and-bitgo-eye-crypto-prime-brokerage

Bitcoin Transaction Fees Decline as Network Congestion Eases

After facing a heavy load of transactions earlier this month, bitcoin's network has returned to a more normal level, recent developments suggest.

via CoinDesk https://www.coindesk.com/bitcoin-transaction-fees-decline-as-network-congestion-eases

Bitcoin News Roundup for May 27, 2020

While the yuan weakens against the U.S. dollar, Coinbase makes an acquisition to grow its institutional trading infrastructure. It's another episode of CoinDesk's the Markets Daily podcast.

via CoinDesk https://www.coindesk.com/bitcoin-news-roundup-for-may-27-2020

Huge Washington Unemployment Fraud Warning to Other States

CryptoKitties Creator Debuts NBA Game on Its Own Blockchain

Blockchain meets basketball in the newest game from Dapper Labs, the developers of CryptoKitties.

via CoinDesk https://www.coindesk.com/cryptokitties-creator-debuts-nba-game-on-its-own-blockchain

Number of Bitcoins on Crypto Exchanges Hits 18-Month Low

The total amount of bitcoins held in cryptocurrency exchanges wallets dropped to an 18-month low just above 2.3 million on Monday, according to data estimates from Glassnode.

via CoinDesk https://www.coindesk.com/number-of-bitcoins-on-crypto-exchanges-hits-18-month-low

Google Signs On as Network Validator for Blockchain Video Network Theta

Google is teaming up with Theta Labs in a move meant to help the video delivery network onboard users through Google Cloud.

via CoinDesk https://www.coindesk.com/google-signs-on-as-network-validator-for-blockchain-video-network-theta

‘Focus on Retirement’: Crypto Custodian Rolls Out Hybrid IRA Offering

South Dakota's Kingdom Trust is teaming with Kraken to offer a retirement savings platform where users can manage stocks, ETFs and crypto in one account.

via CoinDesk https://www.coindesk.com/kingdom-trust-partners-with-kraken-to-offer-hybrid-crypto-fiat-retirement-accounts

First Mover: EOS Has Still to Prove Itself After Spiraling Down This Past Year

Nearly two years after EOS first launched, the so-called "ethereum killer" has been able to surmount some of the problems that have previously hamstrung it. But is that enough?

via CoinDesk https://www.coindesk.com/first-mover-eos-has-still-to-prove-itself-after-spiraling-down-this-past-year

Coinbase Buys Tagomi as ‘Foundation’ of Institutional Trading Arm

Crypto exchange Coinbase is finally acquiring Tagomi, a prime brokerage platform specializing in digital asset trading for institutional clients.

via CoinDesk https://www.coindesk.com/coinbase-tagomi-acquisition-institutional-trading-arm

Crypto Custodian BitGo Joins Race to Provide Prime Brokerage Services

BitGo is entering the prime brokerage space following the launch of its lending business, announcing a new entity to serve institutional traders.

via CoinDesk https://www.coindesk.com/crypto-custodian-bitgo-joins-race-to-provide-prime-brokerage-services

Coinbase to acquire leading institutional crypto brokerage, Tagomi

The acquisition will cap off a period of strong institutional focus for Coinbase, and comes at a time when the world’s most recognized professional investors and funds are giving increasing attention to the asset class.

Over the past eight years, Coinbase has built one of the most trusted names in crypto by providing clients with industry-leading trading and custody platforms. Today, we’re at an inflection point in the industry, with some of the world’s top hedge fund and macro investors entering the space and searching for the right infrastructure through which to engage with crypto.

This is why we’re excited to announce that we’ve agreed to acquire Tagomi, the leading crypto prime brokerage platform. The acquisition will bolster our offerings for advanced traders and the most sophisticated crypto investors.

We’ve seen a swell in demand from institutional investors over the past year, driving tremendous growth in our Coinbase Custody offering and increased volumes on our trading platforms. This has led us to build advanced features such as margin trading for institutional investors and new tools to help investors segregate their trading strategies. Most recently, we expanded Coverage for larger clients by adding Brett Tejpaul as Head of Institutional Coverage to our leadership team.

The addition of Tagomi will round out our product suite for the fast-growing institutional trading market. It will allow us to offer custody, professional trading features, and prime brokerage services on one platform, giving sophisticated investors the seamless, powerful trading experience they have come to expect in equities and FX markets.

Since launching 18 months ago, Tagomi has become the platform of choice for many advanced traders, hedge funds, and family offices, including well-known names such as Paradigm, Pantera, Bitwise, Muticoin, and many more. The company has also built out an executive team with a rare blend of traditional financial services and crypto experience, led by co-founders Greg Tusar, Jennifer Campbell, and Marc Bhargava. The Tagomi bench brings experience from leading firms like Goldman Sachs, Citadel, KCG, Tower Research, and USV.

We’re proud to build the foundation for the next wave of crypto investors by bringing onboard the first electronic prime brokerage in crypto. Even in a time of uncertainty, we view now more than ever as the time to push forward our mission of building the crypto-economy. We recognize that the journey is only just beginning, but we’re excited to be builders, and we welcome Tagomi to our mission.

The acquisition is subject to customary closing conditions, including regulatory approvals, and is expected to close later this year.

Coinbase to acquire leading institutional crypto brokerage, Tagomi was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/coinbase-to-acquire-leading-institutional-crypto-brokerage-tagomi-50558d41eef2?source=rss----c114225aeaf7---4

Slipping Yuan May be Good for Bitcoin Price, Past Data Suggests

With historical data suggesting an intermittent correlation, bitcoin traders may do well to keep an eye on the ongoing slide in the yuan, analysts say.

via CoinDesk https://www.coindesk.com/yuan-bitcoin-price-data

TradeLens to Digitize India’s Largest Private Port Operator

Adani Ports and Special Economic Zone is set to utilize the IBM-Maersk platform to speed up processes after COVID-19 highlighted issues with the existing system.

via CoinDesk https://www.coindesk.com/ibm-maersk-tradelens-digitize-india-port-operator

Brazilian Retailer Eyes Services for the Unbanked With Acquisition of FinTech Firm Airfox

Via Varejo snapped up the Boston-based firm to further its aim of providing financial services to millions of unbanked Brazilians.

via CoinDesk https://www.coindesk.com/brazilian-retailer-via-varejo-acquires-boston-airfox-unbanked-financial

Tuesday 26 May 2020

Reflecting on Bitcoin at the Third Halving

For only the third time in history, Bitcoin’s mining subsidy was cut in half this month. It was a moment that garnered attention from around the world, reminded us of the protocol’s programmable scarcity and inherent value proposition and gave some of the space’s technological and cultural principals reason to reflect on the past and future.

Further Reading: What Is the Bitcoin Halving?

Bitcoin Magazine’s BitcoinHalving.com live stream, held for 21 hours continuously around the third Halving, shared some of these reflections with thousands of viewers and created a broadcast that reminds us why the technology has been so important to date, and of the vast potential it still holds.

Samson Mow’s Bitcoin Predictions for After the Halving

In a video for the BitcoinHalving.com live stream, Blockstream CSO Samson Mow offered predictions for Bitcoin’s fourth epoch, the period between this most recent Halving and the next. For instance, he weighed in on the potential energy use of Bitcoin mining in the coming years — something Blockstream has a firsthand stake in.

“Right now, we’re probably using 77 terawatt hours per year, and that’s really miniscule compared to 157,000 terawatt hours per year that’s being used for everything else around the world,” Mow explained. “I think at the next Halving, we’ll be doing pretty well if we can reach 0.1 percent [of the world’s total energy use]. It could be higher, but we also see a lot of efficiencies being gained all the time by ASIC manufacturers.”

When asked to offer a prediction for one of the biggest issues in Bitcoin, which is only poised to grow as interest in the technology does, Mow offered some more advice based on his own experience.

“For us at Blockstream, we actually see a lot of people getting scammed by cloud mining schemes. They’re using our name and even before we started mining, they were scamming using this concept,” he said. “But I think overall, the biggest new scam is always the new coins that are coming out. The new coins that promise to be better than bitcoin or solve some deficiency of Bitcoin.”

Reflecting on the Halving and Bitcoin’s Epochs With Andreas M. Antonopoulos

As an author and educator for Bitcoin and other cryptocurrencies since its earliest days, Andreas M. Antonopoulous brought some historical perspective to the BitcoinHalving.com live stream. In a discussion with Christie Harkin, he shared some of that perspective as a way to add context to the most recent Halving.

“Those were the obscure years,” Antonopoulos said of Bitcoin’s time before the 2012 Halving. “I remember going to the first conference in San Jose and meeting basically everyone. The entire Bitcoin community almost at the time that was in the U.S. was there. And you could fit everybody in a room.”

Eight years and two Halvings later, the Bitcoin community spans the world and totals innumerable self-described “Bitcoiners.” But, as Antonopoulos continued, some lessons learned will likely still apply in this latest epoch.

“I think that the same prediction that I made the previous two Halvings applies again, which is that a whole lot of nothing is going to happen, for now,” he said. “The monetary effects take quite a while to make themselves felt in the markets… It’s gonna take a long time before the signal from the fundamental change in the inflation … becomes a dominant signal that is really felt in the market.”

Celebrating the Growth of Bitcoin Art at the Halving

Beyond energy use predictions or price expectations for Bitcoin’s new epoch, the BitcoinHalving.com live stream leveraged the spotlight of this historic moment to recognize the vibrancy of the Bitcoin community.

This, of course, meant checking in with some of the space’s most vibrant artists about their work and outlook for the near future.

“My goal in general is to — if not find someone else who connects with my work in some sort of way through their journey through discovering Bitcoin and crypto and what it does for them financially or in terms of the principals — then is at least to bring interest and awareness to other people that maybe aren’t familiar with it,” visual artist Josie Bellini explained. “I’ve even been able to share with some of my friends through artwork the meanings behind what’s going on in them… Bringing them on that journey with me through artwork.”

The conversation included six artists who work in a range of media and approach the creation of “Bitcoin art” in various ways. But each of them shared a positive outlook, pride in their messaging and enthusiasm for what the Bitcoin community has in store next throughout the panel.

“My artistic process is I first take a bunch of ASIC motherboards and I crush them into a fine powder and then what I do is take the fine powder and I draw a 21-sided star and then I light candles and I channel the spirit of Satoshi and he visits me and it’s pretty glorious and I do whatever he tells me,” Brekkie von Bitcoin, a visual artist, advocate and creative director, said with a satirical tone. “If I do it wrong… I get this Craig Wright form that appears with devil horns.

To see more of Bitcoin Magazine’s 21-hour BitcoinHalving.com live stream, visit our YouTube page.

The post Reflecting on Bitcoin at the Third Halving appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/reflecting-on-bitcoin-at-the-third-halving?utm_source=rss&utm_medium=rss&utm_campaign=reflecting-on-bitcoin-at-the-third-halving

Libertarianism & Politics with Adam Brown & Sean Finch - WBD221

Location: Zoom

Date: Tuesday 5th May

Project: The Libertarian Party

Role: Party Leader & Coordinator

Long before Bitcoin dropped on the world, libertarians have criticised government-issued fiat money, arguing that it goes against their core beliefs of political freedom and autonomy, viewing gold as a superior currency. Many libertarians were early to Bitcoin, understanding its sound monetary policy.

I have spoken with many US-based libertarians, but like any political movement or philosophy, there is no one size fits all approach, and the libertarians range in their beliefs from full anarcho-capitalists to minarchists. So, I wanted to get a different perspective from libertarians in the UK, engaged in the political process to ultimately reduce then bring an end to the state.

In this interview, I talk to Adam Brown & Sean Finch, the party leader and coordinator for the UK Libertarian Party. We discuss the current political landscape, the push for less government, healthcare and freedom of speech.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/libertarianism-politics-adam-brown-sean-finch

Look to Design, Not Laws, to Protect Privacy in the Surveillance Age

In the smart home era, we need to take privacy protection into our own hands, says the co-founder of IoTeX. Privacy laws won't help us.

via CoinDesk https://www.coindesk.com/look-to-design-not-laws-to-protect-privacy-in-the-surveillance-age

Polkadot Goes Live as Web3 Foundation Pushes Prospective Mainnet

Polkadot is now live, following the launch of its first “chain candidate” (CC1).

via CoinDesk https://www.coindesk.com/polkadot-goes-live-as-web3-foundation-pushes-prospective-mainnet

Blockcrunch - Why the CryptoKitties Team is Building a New Blockchain - Roham Gharegozlou, Dapper Labs, Ep. 101

What do the NBA, UFC, Ubisoft and Warner Music have in common? They are all partners with Dapper Labs, the company behind CryptoKitties.

Roham Gharegozlou (@rohamg), CEO of Dapper Labs, joins us in discussing:

Story behind the most popular crypto gameWhy does Dapper Labs need Flow, its new blockchain?Flow vs. sharding chains vs. EthereumTactics for closing big partnershipsHost: Jason Choi (@MrJasonChoi). If you enjoyed the show, consider tipping! This show is not financial advice.

BTC: 3EFSLnPpme6Lo6DynN1bVV9owooueFvEmJETH: 0xdec40AA30B9C562aB4b839529BfC290C1B5Da61E

Resources:

Subscribe to my essays here: jasonchoi.substack.com

Musical credits:

Transition track: "BHANGER" by Phortissimo. Used with permission

Outro track: "LEMMiNO - Infinity [Chill]" is released under a Creative Commons license (BY-SA) 4.0 Music provided by BreakingCopyright: https://youtu.be/uweorwa3q34

Disclaimer: Jason Choi is an investor at Spartan Capital, the hedge fund arm of The Spartan Group. All opinions expressed by Jason and podcast guests are solely their own opinions and do not reflect the opinion of The Spartan Group and any of its subsidiaries and personnel. This podcast is for information purposes only and should not be relied upon as a basis for investment decisions.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/blockcrunch-why-the-cryptokitties-team-building-new-blockchain-roham-gharegozlou-dapper-labs

Blockchain Bites: Facebook’s Calibra Facelift and Tencent’s ‘New Infrastructure’ Investments

Facebook's digital wallet subsidiary has rebranded as Novi while a series of bitcoin transactions cast doubt on Craig Wright's claims.

via CoinDesk https://www.coindesk.com/blockchain-bites-facebooks-calibra-facelift-and-tencents-new-infrastructure-investments

To See Libra’s Potential, Look at the Philippines, Not the US

Some have written off Libra as a watered-down project. But you can see its potential in places where Facebook use is high and payment standards are low.

via CoinDesk https://www.coindesk.com/to-see-libra-potential-impact-look-at-the-philippines-not-the-us

Bitcoin News Roundup for May 26, 2020

Remember that time you claimed to be Satoshi Nakamoto? It's the inevitable return of CoinDesk's Markets Daily Bitcoin News Roundup.

via CoinDesk https://www.coindesk.com/bitcoin-news-roundup-for-may-26-2020

ErisX Releases API for Bulk Trading of Bitcoin, Ether

ErisX has released a block trading API for futures contracts and spot market trades to help large traders.

via CoinDesk https://www.coindesk.com/erisx-releases-api-for-bulk-trading-of-bitcoin-ether

India’s Central Bank Removes Lingering Confusion Over Banking for Crypto Firms

India's commercial banks can indeed provide banking services to traders and firms dealing in cryptocurrencies, the RBI has clarified.

via CoinDesk https://www.coindesk.com/india-banks-cryptocurrencies-rbi-central-bank

Facebook’s Calibra Rebrands to Novi, Details Wallet Tie-Up With WhatsApp

In the run-up to launch, libra's digital wallet subsidiary has been given a new look and a new name: Novi, which means "new way."

via CoinDesk https://www.coindesk.com/libra-facebook-blockchain-digital-wallet-novi-calibra

Bitwage Rolls Out Bitcoin 401(k) Plan With Help From Gemini

The crypto payroll provider claims its "world's first" bitcoin 401(k) plan can help U.S. companies cross the crucial 75% threshold with their small business loans.

via CoinDesk https://www.coindesk.com/bitwage-bitcoin-401k-plan-pensions

First Mover: Bitcoin Could Get a Boost From Central Bank Digital Currencies

CBDCs might seem to be anathema to the mission statement of bitcoin, but they may prove to be a valuable on-ramp for new investors.

via CoinDesk https://www.coindesk.com/bitcoin-boost-central-bank-digital-currencies

Bitcoin Bounce Stalls at $9K Amid 2% Rise in S&P 500 Futures

Bitcoin briefly crossed back above $9,000 earlier on Tuesday amid signs of an improved risk appetite in the traditional markets.

via CoinDesk https://www.coindesk.com/bitcoin-bounce-stalls-at-9k-amid-2-rise-in-sp-500-futures

VideoCoin Adds Cash Payments and Rewards in Bid to Take On AWS

Halsey Minor’s VideoCoin platform launches Wednesday with fiat payment rails that aim to move the project beyond the limited sphere of crypto.

via CoinDesk https://www.coindesk.com/videocoin-adds-cash-payments-and-rewards-in-bid-to-take-on-aws

Tencent Is Pouring $70B Into New Tech Including Blockchain

The web giant is earmarking funding for emerging technologies as it seeks to grow after the COVID-19 epidemic.

via CoinDesk https://www.coindesk.com/tencent-invest-blockchain

Thailand Turns to Blockchain to Boost Renewable Energy Push

A Thailand public-private joint venture has inked a deal with blockchain startup Power Ledger to encourage renewables trading and uptake.

via CoinDesk https://www.coindesk.com/power-ledger-thailand-blockchain-renewable-energy-trading

Monday 25 May 2020

Indian Crypto Exchange CoinDCX Raises $2.5M From Polychain Capital, Coinbase Ventures

India's largest crypto exchange, CoinDCX, has secured a $2.5 million strategic investment led by Polychain Capital with support from Coinbase Ventures.

via CoinDesk https://www.coindesk.com/indian-crypto-exchange-coindcx-polychain-capital-coinbase-ventures

Chain Reaction - Ian Cassel: A Legendary Investor's Search For A 100-Bagger

On this episode, Tom Shaughnessy interviews a long time friend Ian Cassel. We discuss Ian's journey as a legendary startup/microcap investor, the creation of MicroCapClub which is the most prestigious microcap investing community, what Ian looks for in an investment and management team and so much more.

Checkout MicroCapClub: https://microcapclub.com/

Support The Show

- ZenLedger is the official tax software of Chain Reaction for crypto investors and accountants. Get a 15% discount when you use code Chain15.

To sponsor this top crypto research podcast, email Tom@DelphiDigital.io

Disclosures: This podcast is strictly informational and educational and is not investment advice or a solicitation to buy or sell any tokens or securities or to make any financial decisions. Do not trade or invest in any project, tokens, or securities based upon this podcast episode. The host may personally own tokens that are mentioned on the podcast. Tom Shaughnessy owns tokens in ETH, BTC, STX, SNX, RUNE, sUSD and HNT. Let's Talk Bitcoin is a distribution partner for the Chain Reaction Podcast, and our current show features paid sponsorships which may be featured at the start, middle and/or the end of the episode. These sponsorships are for informational purposes only and are not a solicitation to use any product or service. Guest host Kevin Kelly holds tokens in BTC, ETH, RUNE, and LEO.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/chain-reaction-ian-cassel-legendary-investor-search-100-bagger

Zcash’s First Halving May Solve Its Inflation Problem

Zcash (ZEC) is due for its first mining reward halving later this year. The event could solve a major problem for the privacy-focused cryptocurrency.

via CoinDesk https://www.coindesk.com/zcash-cryptocurrency-first-halving-inflation

Presenting Bitcoin’s Best During the Halving

The Bitcoin mining subsidy halving is a once-every-210,000-blocks event during which attention from all over the world is pointed at the original cryptocurrency.

Further Reading: What Is The Bitcoin Halving?

During the third-ever Halving, Bitcoin Magazine presented the 21-hour BitcoinHalving.com live stream, featuring the space’s thought leaders and biggest personalities sharing their outlooks for this new era. This meant offering a stage where they could conduct high-level presentations for thousands of viewers.

Bitcoin, the Mycelium of Money Presentation

Brandon Quittem of Swan Bitcoin took to the live stream to present “The Mycelium of Money,” his explanation of the unprecedented power of Bitcoin that compares the technology to living fungi.

“Some of Bitcoin’s best characteristics are simply reflections of successful evolutionary strategies found in nature, specifically in the fungi kingdom,” Quittem said. ”How is it possible that some anonymous founder can simply release software to the public and the software goes on to replicate itself and be used by tons of people in only just 10 or 11 years that it’s been around? And not to mention it has a reasonable chance to replace the financial operating system that humanity uses to coordinate themselves. And the answer is: because Bitcoin’s alive, or at least it appears to be.”

Many analogies have been used to describe the power of Bitcoin’s technology as well as its revolutionary potential, which can be difficult to grasp. Throughout the presentation, Quittem drew parallels between Bitcoin and fungi, describing how the former’s attributes can be understood through the lens of the latter.

“Let’s talk about the life cycle of a mushroom,” Quittem said at one point in the talk. “So, most of the mushroom’s life or the fungi’s life is spent underground. It’s in the mycelium form… And when the conditions hit that perfect moment, they explode into life and a mushroom’s produced… Interestingly, this maps perfectly with how Bitcoin’s hype cycles have gone over time. In Bitcoin land, most of its time is spent underground in its mycelial form. People aren’t really paying attention, the price action’s boring… and then, all of a sudden, the conditions are perfect … and all of the world starts paying attention to Bitcoin.”

A Bitcoin Presentation Explaining Miniscript

Andrew Poelstra, the director of research for Blockstream, took to the livestream to demonstrate Miniscript, a “stripped down” version of the Script programming language that he has worked on to make Bitcoin programming easier.

“Miniscript is, in a theoretical sense, more limiting than Script,” Poelstra told Bitcoin Magazine in August 2019. “But it can do everything that people actually use Script for.”

During his presentation, Poelstra described some of the problems that developers run into with Script to illustrate the benefits of Miniscript.

“The problem with Script then is that you wind up with massive scripts where different people have inserted different kinds of code,” he explained in one example. “How are you going to reason about that?… With Miniscript, we saw we had that tree-like structure. Problem solved. You don’t need to think about interoperability.”

To watch the rest of Bitcoin Magazine’s Halving live stream, visit our YouTube page.

The post Presenting Bitcoin’s Best During the Halving appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/presenting-bitcoins-best-during-the-halving?utm_source=rss&utm_medium=rss&utm_campaign=presenting-bitcoins-best-during-the-halving

Craig Wright Called ‘Fraud’ in Message Signed With Bitcoin Addresses He Claims to Own

Bitcoin keys from coins Wright claims to own were used to sign a message calling him a "fraud."

via CoinDesk https://www.coindesk.com/craig-wright-called-fraud-message-signed-bitcoin-addresses-satoshi

As Bitcoin Falls to 2-Week Lows, Small Investors Look to Be Buying

While bitcoin is losing altitude, small investors look to be gaining exposure to the top cryptocurrency, data suggests.

via CoinDesk https://www.coindesk.com/bitcoin-price-falls-2-week-lows-investors-buying

Telegram Quits Court Fight With SEC Over TON Blockchain Project

Telegram has thrown in the towel in its court battle against the U.S. Securities and Exchange Commission (SEC) and will no longer be appealing the ban on its blockchain token project.

via CoinDesk https://www.coindesk.com/telegram-withdraws-appeal-sec

Binance CEO Says Steem Too Centralized but Exchange Must Support Controversial Hard Fork

Binance is forced to "technically" support last week's hard fork of the Steem blockchain, according to the exchange's CEO, Changpeng Zhao.

via CoinDesk https://www.coindesk.com/binance-ceo-cz-steem-centralized-exchange-hard-fork

Crypto Long & Short: Innovation Cycles, Crypto Venture Funds and Institutional Investors

With so much attention on institutional involvement in crypto asset markets, we overlook that they are already here through VC investments – less fast-paced, perhaps, but important to keep an eye on for what they reveal about cycles.

via CoinDesk https://www.coindesk.com/a16z-andreesen-horowitz-innovation-crypto-venture-funds-institutional-investors

Sunday 24 May 2020

Spiritual Reflections on the Bitcoin Halving

The Bitcoin halving was like New Year's Eve with no time differences and everyone committed to a nonviolent revolution against financial tyranny.

via CoinDesk https://www.coindesk.com/spiritual-reflections-on-the-bitcoin-halving

Saturday 23 May 2020

Bitcoin is Reshaping the World with Robert Breedlove - WBD220

Location: Zoom

Date: Monday 4th May

Project: Parallax Digital

Role: Founder & CEO

The properties for measuring the soundness of money include divisibility, durability, portability, recognizability and scarcity. Current government-issued and controlled fiat money fit some of these characteristics but, with the central bank's ability to print money at will, the current system completely fails as a scarce resource.

Historically metals have been the best form of money, with gold outcompeting all other metals to become the number one metal used as a currency and store of value. It is durable, recognisable and scarce; however, government-issued fiat became a better form of cash as it is more portable and divisible. Since 1971, when the US came off the gold standard, and the government has been able to issue more fiat, the purchasing power of the dollar has fallen. As such, gold has proven to be a better store of wealth than fiat.

Many see Bitcoin as digital gold with the added benefits of being highly divisible and able to be sent anywhere in the world quickly and at low cost. Bitcoin also offers censorship resistance, immutability and the ability to store wealth out of the reach of the government.

Bitcoin is a new paradigm in money.

In this interview, I talk to Robert Breedlove the Founder and CEO of Parallax Digital. Robert recently wrote An Open Letter to Ray Dalio explaining how Bitcoin will reshape the world. We discuss Bitcoin's ability to outcompete the current financial system.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/bitcoin-is-reshaping-the-world-with-robert-breedlove

Central Bank Digital Currencies Need Decentralization

To reap the full benefits of digital currencies, central bankers need to consider decentralizing some authority, say the authors of a new report.

via CoinDesk https://www.coindesk.com/central-bank-digital-currencies-need-decentralization

Friday 22 May 2020

The Shadow of Satoshi’s Ghost: Why Bitcoin Mythology Matters

How the myth-making around Satoshi reinforces what makes bitcoin unique in the landscape of global monies.

via CoinDesk https://www.coindesk.com/the-shadow-of-satoshis-ghost-why-bitcoin-mythology-matters

Louisiana State Senate to Consider Crypto Business Licensing Bill

The Louisiana State House of Representatives passed a bill on Wednesday to regulate and license virtual currency businesses. A Senate committee will now evaluate the proposal.

via CoinDesk https://www.coindesk.com/louisiana-state-house-virtual-currency-licensing-bill

Blockchain Bites: Iran and Russia Revisit Crypto Regulations, Bitcoin Pizza Day 10 Years Later

Ten years ago today someone spent 10,000 bitcoin on about $30 worth of pizza. Today, nations are redrafting crypto regulation and crypto firms report millions in revenues.

via CoinDesk https://www.coindesk.com/blockchain-bites-iran-and-russia-revisit-crypto-regulations-bitcoin-pizza-day-10-years-later

Money Reimagined: Designer Money for a Machine-Run Post-COVID World

The pandemic is likely to accelerate a shift to automation, putting people out of work and raising the need for new types of money.

via CoinDesk https://www.coindesk.com/money-reimagined-designer-money-for-a-machine-run-post-covid-world

Binance, Eosfinex Join EOSDT Stablecoin Governance Board

Binance and eosfinex are joining the oversight team for Equilibrium, the decentralized finance group behind the EOSDT stablecoin.

via CoinDesk https://www.coindesk.com/binance-eosfinex-join-eosdt-stablecoin-governance-board

10 Years After Laszlo Hanyecz Bought Pizza With 10K Bitcoin, He Has No Regrets

Laszo Hanyecz's 10,000 BTC pizza buy 10 years ago has a special place in bitcoin folklore, highlighting, however expensively, that participation is necessary for network success.

via CoinDesk https://www.coindesk.com/bitcoin-pizza-10-years-laszlo-hanyecz

Fed Up With Its Fork of Stellar, Kin Is Looking to Move Onto Solana

The Kin Foundation is seeking to move the kin cryptocurrency onto the Solana blockchain, according to a proposal shared with CoinDesk.

via CoinDesk https://www.coindesk.com/fed-up-with-its-fork-of-stellar-kin-is-looking-to-move-onto-solana

RenBTC Quietly Goes Live in Latest Bid to Bring Bitcoin Into Ethereum

RenBTC, the latest implementation of bitcoin on the Ethereum blockchain, quietly went live this week, though the general public can't yet mint thier own tokens.

via CoinDesk https://www.coindesk.com/renbtc-quietly-goes-live-in-latest-bid-to-bring-bitcoin-into-ethereum

Canaan Reports $5.6M Loss in Q1 Despite Bitcoin Miner Price Cut

The China-based manufacturer had cut the pricing for its bitcoin miners by half during the first three months.

via CoinDesk https://www.coindesk.com/canaan-reports-5-6m-loss-in-q1-despite-bitcoin-miner-price-cut

Colombia, Deloitte, ConsenSys Sign On to WEF’s ‘Blockchain Bill of Rights’

The cryptocurrency industry just gained an organized structure for collaborating with world leaders, thanks to the World Economic Forum.

via CoinDesk https://www.coindesk.com/wef-blockchain-bill-of-rights-colombia-deloitte-consensys

Thursday 21 May 2020

Blockchain Bites: Satoshi’s Sword of Damocles

Yesterday, some of the earliest mined bitcoin moved after more than a decade of dormancy. Whale Alert – a popular, mostly-automated Twitter account that tracks major crypto transactions – broadcasted the message across the cryptoverse, saying 40 coins mined in the first month of the network’s operation had transferred from a “possible #Satoshi owned wallet,” […]

via CoinDesk https://www.coindesk.com/blockchain-bites-satoshis-sword-of-damocles

Crypto Custodian Anchorage Teases Growth Plan With 2 Executive Hires

Anchorage now has six executives in its C-suite, hiring a head of finance and head of sales with experience in both tech and Wall Street.

via CoinDesk https://www.coindesk.com/crypto-custodian-anchorage-teases-growth-plan-with-2-executive-hires

OmiseGO (OMG) is now available on Coinbase

Starting today, Coinbase supports OmiseGO (OMG) at Coinbase.com and in the Coinbase Android and iOS apps. Coinbase customers can now buy, sell, convert, send, receive, or store OMG. OMG will be available for customers in all Coinbase-supported regions, with the exception of New York State.

OmiseGO (OMG)

OmiseGo (OMG) is an Ethereum token that powers the OmiseGo smart contract platform, which allows for businesses and individuals more financial freedom through financial services and investments. The platform’s goal is to facilitate moving funds between payment systems and decentralized blockchains like Ethereum. This allows for better banking and financial services for everyone, including people in developing countries who don’t have access to traditional banking services.