Thursday, 31 October 2019

Bitcoin Price Slides 2% After Deribit, Coinbase Flash Crash

Another flash crash has occurred for bitcoin (BTC), this time on the Coinbase Pro and Deribit exchanges.

via CoinDesk https://www.coindesk.com/bitcoin-prices-slides-2-after-deribit-coinbase-flash-crash

Mt. Gox Rehabilitation Plan Deadline Extended Again

Victims of the Mt. Gox hack will have to keep on waiting for the next step in their long journey toward reimbursement.

Nobuaki Kobayashi, trustee for the defunct cryptocurrency exchange, announced that the deadline to form a concrete plan to compensate defrauded customers has been extended to March 31, 2020. The Tokyo District Court has agreed to his request just as the previous deadline of October 28, 2019, was about to expire.

The announcement states that a large number of claims “that the Rehabilitation Trustee fully or partially disapproved remains undetermined,” and that “it is not possible at this moment to make appropriate provisions in a rehabilitation plan on modifications of the rights of the rehabilitation claims, repayment methods, and appropriate measures for the undetermined rehabilitation claims.”

Therefore, it goes on, “it is not practically possible to have meaningful discussions with relevant parties about repayment methods.”

The Long Road to Rehabilitation

The rehabilitation process for Mt. Gox has been a particularly thorny issue in the cryptocurrency space, as huge numbers of users lost large amounts of money due to hacks and mismanagement at the upper levels of the company. In August 2018, Kobayashi began the rehabilitation process, claiming that individual users had a window of a couple of months to file themselves in, before forever losing the opportunity.

After first opening the application process to corporate clients, the proceedings have encountered several snags. For starters, since the exchange operated so early in the cryptocurrency space, the estimated 850,000 BTC that the company lost has risen astronomically in price. Kobayashi raised $230 million from the sale of large chunks of crypto assets in September 2018, but this does not even cover the valuation of these assets at 2014 prices. When estimating based on the current value of one bitcoin, such assets would be worth a whopping $7.65 billion.

In April 2019, Mt. Gox began publicly making tweaks to its civil rehabilitation plan for defrauded customers. Although the initial announcement claimed that the window for entering the program would close, Kobayashi began automatically enrolling defrauded users that had not already done so themselves. He could only begin this process using the information he had, however, so only customers who had submitted all relevant KYC information in 2014 were eligible.

Still, the plan to connect these enrolled customers with any sort of actual remuneration is no closer to becoming a reality, especially now that the deadline to even have a plan has been pushed back.

The post Mt. Gox Rehabilitation Plan Deadline Extended Again appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/mt-gox-rehabilitation-plan-deadline-extended-again

Bitcoin Needs ‘Real Use Cases’ to Become Digital Gold, Says ICE Chief

Bitcoin might become "digital gold," but first it needs to be used more in everyday business, said the Intercontinental Exchange's chief executive.

via CoinDesk https://www.coindesk.com/bitcoin-needs-real-use-cases-to-become-digital-gold-says-ice-chief

Binance to Open Beijing Office Amid China’s Renewed Blockchain Push

The world's largest cryptocurrency exchange by volume is establishing a new outpost in China's capital city.

via CoinDesk https://www.coindesk.com/binance-to-open-beijing-office-amid-chinas-renewed-blockchain-push

Russian Aluminum Plant Set to House Cryptocurrency Mining Farm

International economic sanctions have propelled many countries toward cryptocurrencies — from Venezuela to Iran. Now, U.S. sanctions imposed on one Russian company have paved the way for a cryptocurrency mining operation to take over a decidedly industrial facility.

Rusal Turns to Cryptocurrency Mining in Face of Sanctions

One such establishment is Rusal, an aluminum giant owned by Oleg Deripaska, an aide to Russian President Vladimir Putin. In April 2018, Deripaska was named by the U.S. Office of Foreign Assets Control (OFAC) as a “Designated Russian oligarch,” thanks to his close ties to the Kremlin. Rusal was immediately hit with significant economic sanctions following this designation.

According to an October 29, 2019, report from local news medium RBC, Rusal has been unable to manufacture anything since the sanctions were slapped on it. Looking to maintain cash flow under these circumstances, the company has agreed to lease a section of its Nadvoitsy Aluminum Plant, located in the northern Karelia region, to the Russian Mining Company (RMC).

RMC reportedly plans to install cryptocurrency miners in the plant and utilize its cheap power sources.

RMC is run by Russian tech entrepreneur Dmitry Marinichev. After raising $43 million in a 2017 ICO, RMC established a cryptocurrency mining farm in a plant that formerly belonged to automobile company Moskvich, according to RBC. The company also established two mining pools; BitcoinRussia, which is dedicated to bitcoin mining, and a separate pool for mining ether.

RBC quotes data from BitcoinRussia, showing the pool had processed 1,815 bitcoin in payment to its participants. But between April and May 2019, the Moskvich plant was shut down as it became unprofitable.

Other Cryptocurrency Initiatives for RMC

Now that RMC has a new location for cryptocurrency mining, Marinichev wants to relaunch the decentralized mining pool as well.

The RMC has also reached a funding agreement with British cryptocurrency exchange and wallet provider Cryptonex. The exchange will provide RMC with 42 million CNX (the native token of Cryptonex, which is valued at $2.07 at press time). The funding would be used by RMC to procure and deploy miners to be used in its mining farms.

The post Russian Aluminum Plant Set to House Cryptocurrency Mining Farm appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/russian-aluminum-plant-set-to-house-cryptocurrency-mining-farm

Pre-Brexit, Koine Wins E-Money License from UK’s FCA, Now Seeking Luxembourg, UAE, U.S. Permissions

Digital asset custodian Koine secured an e-money license from U.K. regulators, while it now looks abroad to prepare for a future Brexit.

via CoinDesk https://www.coindesk.com/pre-brexit-koine-wins-e-money-license-from-uks-fca-now-seeking-luxembourg-uae-u-s-permissions

SEC, CFTC Charge XBT Group With Selling Unregistered Swaps for Bitcoin

The SEC and CFTC have settled charges with XBT Corp. after alleging the company sold unregistered security-based swaps for bitcoin.

via CoinDesk https://www.coindesk.com/sec-cftc-charge-xbt-group-with-selling-unregistered-swaps-for-bitcoin

Global Banking Watchdog to Study Capital Requirements for Crypto Assets

UK Banking Pilot Aims to Streamline Compliance Using Factom Blockchain

Crypto startup Knabu is launching a 30-day pilot today to put regulatory reporting on the blockchain.

via CoinDesk https://www.coindesk.com/uk-banking-pilot-aims-to-streamline-compliance-using-factom-blockchain

Video: Vitus Zeller on Team Satoshi and Bitcoin Advocacy Through Sports

German entrepreneur and Bitcoin enthusiast Vitus Zeller began his Team Satoshi athletic initiative in January 2019. By virtue of the #TeamSatoshi hashtag (now popular among Bitcoin sports enthusiasts), a worldwide torch is passed on Twitter between marathon runners who embrace and promote the values of sound money. In this exclusive Bitcoin Magazine interview, held on the second day of The Lightning Conference in Berlin, Zeller explained how it all started and how a personal challenge grew into a global phenomenon.

From Tour de Satoshi to Team Satoshi

It all started with Zeller’s desire to celebrate the 10th anniversary of Bitcoin’s Genesis Block, so he embarked on a 10-day challenge to bike across the Swiss Alps. His journey, which he called the “Tour de Satoshi,” was more than a personal tribute to Satoshi Nakamoto: Every night, he paid for his hotel room with bitcoin as a way of raising awareness and spreading adoption. Zeller’s trial also bears the symbolism of transformation: He began riding his bicycle in the defining city of the Renaissance (Florence, Italy) and stopped in Frankfurt, Germany, at the European Central Bank.

“Tour de Satoshi was a winter bike tour through Italy, Switzerland, Lichtenstein, Austria and Germany. I went from Florence to the European Central Bank, trying to pay every night with Bitcoin.”

— Vitus Zeller

In August 2019, Zeller upped the stakes by inviting other athletes to join a triathlon challenge across Switzerland and Germany. Seven Bitcoin enthusiasts would run, cycle and swim over a distance of 222 miles and pass a torch along the way. This effort gave birth to the Team Satoshi concept.

“We had a triathlon through Switzerland and Germany. It was joined by other bitcoiners, including Jeremias from LocalBitcoins and Anita from the ‘Bitcoin & Co.’ podcast,” said Zeller.

A Tribute to Hal Finney

Less than a month later, Team Satoshi became even more popular thanks to a tribute to Bitcoin pioneer Hal Finney. As a way of remembering the day when Finney ran his last half-marathon prior to entering a phase of ALS-induced physical deterioration, bitcoiners all around the world have been encouraged to go out for a run and publish a screenshot of their performance on Twitter under the #RunForHalFin hashtag.

“We also did the memorial run for Hal Finney during which we asked bitcoiners to join for a run in memory of Hal. Ten years ago, in 2009 he ran his last half-marathon.”

— Vitus Zeller

Just a couple of months on, Team Satoshi is still expanding and spreading the word about Bitcoin and the cypherpunk values of freedom of information, human rights, free speech, privacy and freedom of transactions.

“We also started a Lightning Torch called #TSTorch or #TeamSatoshiTorch, and it’s being handed, just like the Olympic torch, from athlete to athlete,” Zeller said. “The idea is that each athlete adds the kilometers run during the trial or competition and sends that amount of satoshis to the next athlete. Yesterday, for example, we had an athlete who ran an ultramarathon in Singapore and is now handing the torch to another bitcoiner who’s running a marathon in Slovenia in the name of Team Satoshi. A week later, somebody else is running at the New York City Marathon. There is quite a lot going on and we are planning an event for the halving.”

Anyone Can Join Team Satoshi

As Zeller explained, there are no physical trials or financial requirements involved in becoming a part of Team Satoshi. Participation is voluntary and is only based on ideological compatibility and the willingness to reveal one’s identity to the public.

Furthermore, the organization is decentralized enough to allow athletes and enthusiasts to create accounts on teamsatoshi.org and create pages of their own, containing personal initiatives and trials. In the long term, this can become a fundraising platform through which athletes get funded with bitcoin.

“You just need to be a Bitcoin enthusiast who likes the cypherpunk ideas, and you need to want to put your face out there,” Zeller explained. “If you fulfill these two criteria and truly want to join Team Satoshi, you can create a login at teamsatoshi.org. You can create a page there and maybe even get your own donations and your own event sponsors.”

The post Video: Vitus Zeller on Team Satoshi and Bitcoin Advocacy Through Sports appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/video-vitus-zeller-on-team-satoshi-and-bitcoin-advocacy-through-sports

Bisq Unveils New Trade Protocol Promoting Principles of Decentralization

Bisq, a prominent decentralized cryptocurrency exchange, has launched a major software update promising new features such as a new trade protocol that further reinforces the trustless nature of the system.

The Bisq developers announced this update via blog post on October 29, 2019, promising two major changes: a new trade protocol that removes the influence of third-party arbitrators and a way for new accounts to gain accreditation as a reputable trader of crypto assets without compromising user anonymity or site security. A leading Bisq developer (who wishes to remain anonymous) spoke with Bitcoin Magazine about this development.

According to this developer, throughout the development cycle of Bisq, the biggest challenge has been “attracting more developers who really care about privacy, security and freedom. Bisq is uncompromising in its approach to handling these principles, and it’s devised a slew of tools and approaches to accomplish its goal of becoming a maximally decentralized bitcoin exchange network that promotes these principles.”

Bisq is particularly noteworthy as a truly decentralized cryptocurrency exchange due to its DAO, or decentralized autonomous organization. Founder Manfred Karrer originally ran Bisq with a more traditional company structure when he founded the organization, but since May 2019 he has fully removed his unique privileges and access. In Bisq’s current state, the DAO infrastructure, first formalized in April 2019, now allows Bisq to be operated directly by its stakeholders and contributors, although longtime developers like Karrer still play a major role.

Resolving Disputes, Peer-to Peer on Bisq

This version 1.2 update to Bisq has removed the role of the third-party arbitrators as a key holder entirely. So its trade protocol now works by means of a 2-of-2 multisig escrow, rather than 2-of-3, as this third key was for the arbitrators.

Arbitration in the old versions of Bisq “was always considered an imperfect solution to the problem of dispute resolution,” said the Bisq source. “It required users to trust anonymous third parties, and legal advice from the early days of the project indicated arbitrators were in a grey area because of their key in the multisig escrow. So it wasn’t great for anyone, but it worked reasonably well while developers worked on the Bisq DAO and other elements of the software critical to trading. Furthermore, until the Bisq DAO actually launched, there just wasn’t a way to implement anything better.”

Additionally, this update has reworked the dispute resolution system into a three-layered version, with the express purpose of keeping the process streamlined. The first layer is an encrypted chat platform between the two parties conducting a trade, allowing both to privately hash out any minor discrepancies that may arise.

“We’ve received a lot of compliments about trader chat,” the source said. “As with many issues, there’s simply no reason for a third party to intervene.”

They went on to state that this change to protocol has “increased speed and privacy for solving a lot of issues. Otherwise, if things go well, the new trade protocol really shouldn’t affect a user’s daily experience.”

Third-Party Arbitration — But Without the Third Key

If direct communication between the two parties does not resolve the issue, a third party can be involved, first to mediate arguments between the two (the second layer of the three-layer dispute resolution system), and then as a last resort to act as a final arbiter themselves (the third layer). Dubbed “bonded contributors” in Bisq’s general trading rules, these special third-party actors can make suggestions and moderate discussion, but ultimately they do not have any control over funds. In the rare (emphasis Bisq’s) circumstance that neither of these methods of recourse still work, the rules claim that Bisq is able to award funds.

To avoid abuse, this final method of recourse works like this: After one or both parties reject the recommendations of the mediator or the session runs out a predetermined amount of time, all of the funds in question are forwarded to Bisq’s donation address. Since the system is based on either the deal timing out or the traders choosing to reject the bonded contributor’s official requests, no individual arbitrator at Bisq actually has the power to jettison the money like this; only the actions of the traders can trigger the failsafe. From there, it will take anywhere from one to three weeks for the arbitrators to resolve the situation. The expectation is that this process will discourage bad actors.

“Removing the third key should make Bisq more resistant to legal concerns,” the developer explained. “Because they no longer have a key, dispute agents (mediators and arbitrators) don’t need to be as highly trusted as before, so it will be easier to find dispute agents who can communicate in other languages as Bisq grows around the world.”

The source indicated hope that these new features will keep the dispute system easy to navigate, although they admitted that “the process may take a bit longer for those with rare issues.” Nevertheless, this will only affect “a small number of trades,” and the developers “expect mediation to handle the vast majority of issues that trader chat doesn’t solve.”

A Model for What’s Possible for Decentralized Exchanges

Trying to become acclimated to these tools and work environment can be very difficult for potential new developers at Bisq, but the source stated that “it’s rather thrilling to see how they come together to create a microcosm challenging conventions for everything from financial rules, to how free software can work, to how people collaborate for work, to what it means to be a company and so much more.”

In the immediate future, Bisq is planning to work first and foremost on fixing some bugs before getting to work on what our contact called “some serious quality-of-life upgrades” further down the line. Those interested in some of the technical specifications of these plans can find out more about them here.

“I think the possibility of any of this influencing the rest of the crypto space is wishful, but I would like to think it shows people what becomes possible with a separate microeconomy,” the Bisq source said. “Bitcoin is a great monetary tool, but it’s capable of so much more. I hope Bisq’s endeavors serve as a model to the space of what’s possible.”

The post Bisq Unveils New Trade Protocol Promoting Principles of Decentralization appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/bisq-unveils-new-trade-protocol-promoting-principles-of-decentralization

Charting the course of Bitcoin, 11 years and counting

Eleven years ago today, the Bitcoin white paper was published, forever changing technology, finance, and our relationship with money.

As with other technologies, money has gone through many upgrades over the years. It’s evolved from trading seashells and metal coins to tapping apps and swiping cards, and from facilitating transactions between neighbors to connecting billions of people worldwide. However, our current financial system still has constraints that result in billions of people unable to open a bank account or access stable currencies, international transactions that can take days, and more.

Bitcoin is the latest breakthrough in a technology that’s millennia old. And although Bitcoin was invented only 11 years ago, it’s already changed the way the world thinks about money. To celebrate the 11th anniversary of the publishing of the Bitcoin white paper, we examine eleven quantitative indicators that Bitcoin is gaining momentum, enabling economic opportunity, and increasing global utility.

Few transformative technologies have captured the public’s interest — and imagination — as quickly as Bitcoin has in just 11 years. Email was invented in 1972 but it took until 1997 for adoption to surpass 10 million people. The television set was invented in 1927 but by the end of the 1940s only 2% of American families owned one. Bitcoin, on the other hand, went from an idea in 2008, and a first transaction in 2009, to over 27 million users in the US alone in 2019, or 9% of Americans.¹

The first Bitcoin transaction occurred on Jan. 12, 2009, when Satoshi Nakamoto sent 10 BTC to computer programmer Hal Finney. Since then, activity on the network has steadily accelerated, up and to the right, regardless of movements in price.

Bit-sized fact: On Sep. 24, 2019, over 820,000 unique addresses transacted bitcoin on the network.

According to Google Trends, interest in Bitcoin has been spreading across the world since 2009. For many years, a new country took the top spot for highest relative interest in Bitcoin, indicating growing global interest in the technology.

In 2009, Austria had the highest relative interest, followed by Kazakhstan (2010), Estonia (2011), Finland (2012), Ghana (2015), Nigeria (2016), and South Africa (2017).

Bit-sized fact: Americans typed “Bitcoin” into Google more times in 2018 than they searched for a range of headline-making phrases, from “royal wedding” to “election results.” Read more in the recent Coinbase Report: United States of Crypto.

More than 55,000 nodes — essentially computers running the Bitcoin software — are connected to the Bitcoin network. Nodes are the fundamental source of truth for the Bitcoin ledger, and are responsible for recording and validating transactions. While the Bitcoin network could theoretically operate on just a handful of computers, more nodes increases decentralization and security. By allowing anyone with a computer and internet access to run a node, Bitcoin allows anybody, anywhere, to have a vote in this global system.

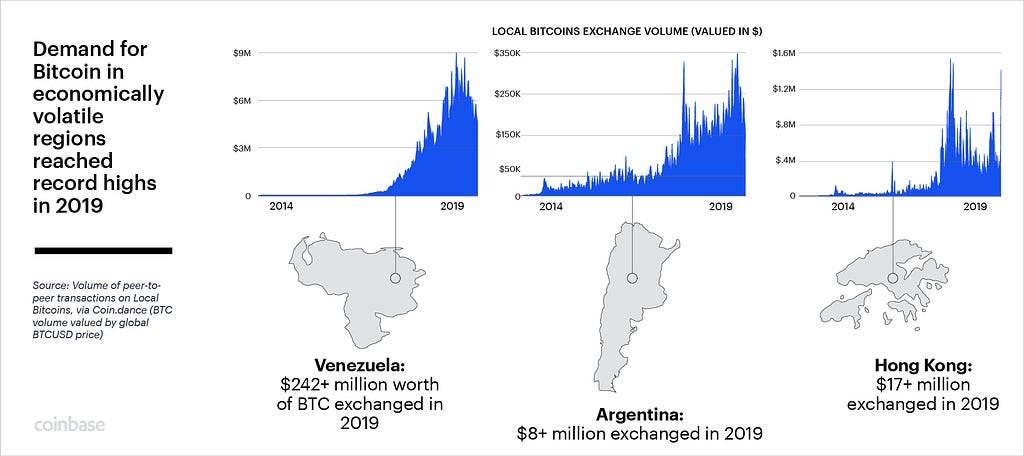

Although Bitcoin was first conceived as a peer-to-peer electronic cash system, it’s become much more than that — it’s now also a popular investment and store of value, similar to gold. This is especially true in areas with high economic volatility.

According to a national survey of 4,415 people that Coinbase conducted in partnership with Qriously, investors think cryptocurrency, e.g. Bitcoin, will have a higher return than ETFs, index funds, and stock in their own company ten years from now.²

Since 2013, bitcoin has outperformed the world’s most popular stock indexes, including tech stocks and the S&P 500. While bitcoin’s price fluctuates, it’s trending up and to the right following many bull runs. This year, bitcoin has also outperformed world stock market indexes, generating a +132% return. In comparison, the Nasdaq 100 generated +17%, the S&P 500 +12%, the FTSE Europe 100 +11%, and the FTSE ASEAN 40 -3%.

Bit-sized fact: Investors aged 18–34 are more likely to hold crypto than precious metals in their financial portfolios, and 1 in 4 investors with an MBA or PhD hold crypto as part of their financial portfolio, according to a survey Coinbase conducted with Qriously.³

If you had bought $10 worth of bitcoin starting on Oct 21, 2015, and continued to do so every month for the next four years, your total investment of $480 would be worth around $3,337 today — a gain of 595% (as of 10/21/19). Dollar-cost averaging, or buying bitcoin on a regular cadence, is a popular way of gaining long-term exposure to this new asset class. Buying bitcoin on a regular cadence is also called “stacking sats,” in reference to the satoshi, which is equal to 0.00000001 BTC.

Bit-sized fact: 77% of investors with higher incomes ($200k+/year) who have cryptocurrency in their portfolio own bitcoin, according to the Qriously survey.⁴

In Venezuela, Argentina, and Hong Kong, three regions that experienced high economic volatility this year, peer-to-peer BTC exchange LocalBitcoins.com experienced premium prices and surging volume. Argentina and Venezuela’s economies are being wracked by inflation, corruption, and capital controls.⁵ And Hong Kong, which is consistently ranked #1 on the Index of Economic Freedom, is currently experiencing political dysfunction and mass protests.⁶ Since 2013, volumes on Argentine peso, Hong Kong dollar, and Venezuelan bolivar bitcoin pairs have exceeded $600 billion in total value. Recently, coinciding with heightening tensions, Hong Kong bitcoin volumes have similarly reached record highs.⁷

Bitcoin was originally created to be “electronic cash” that could be used for everyday transactions instead of traditional cash or credit, but that hasn’t been the main driver of its growth to date, outside of a few regions experiencing economic volatility. However, millions of people are already transacting on the Bitcoin network, thousands of stores are accepting Bitcoin payments, and new technologies are making it even faster and cheaper to use Bitcoin daily.

Bitcoin’s ability to settle immense value across borders, 24/7, is unprecedented in the history of money. Every day, billions of dollars worth of value is successfully transferred through the Bitcoin blockchain. On Dec. 7, 2017, $48.7 billion worth of bitcoin was transferred across the network — Bitcoin’s highest volume to date — and on June 18, 2019, over $21 billion worth of bitcoin was transferred.

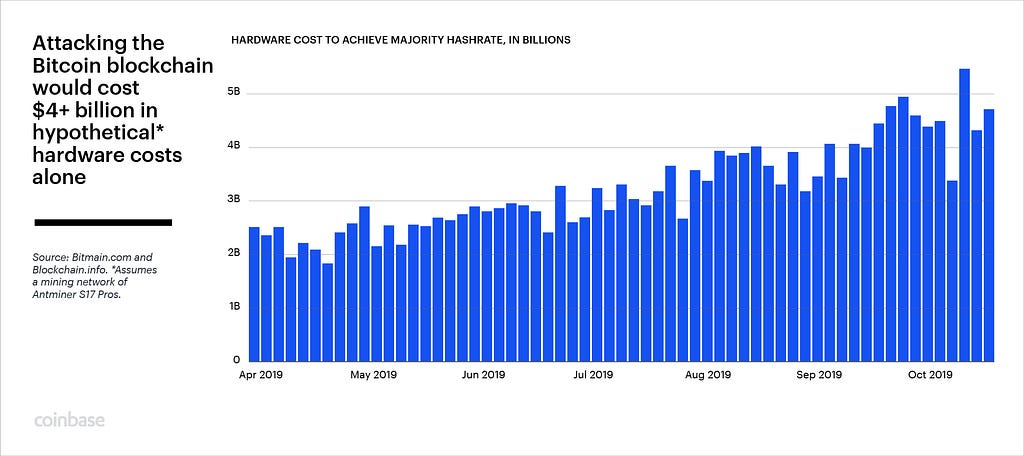

Bitcoin’s best known attack vector involves a bad actor altering the Bitcoin network by controlling more than 50% of the network’s computing power, or hash rate. Known as a 51% attack, this would allow the attacker to double-spend their transactions and/or censor other’s transactions.

Bitcoin’s hash rate is important because it measures how secure the network is. The higher the hash rate, the more computing power is needed to compromise it. Bitcoin’s hash rate recently reached a record high of 108 million terahashes per second. Bitcoin is far and away the largest computational network ever created, and the most secure blockchain. This means controlling a majority of that computing power requires an enormous amount of computer hardware — hardware that would cost over $4 billion to buy outright. And even if someone happened to have a few billion burning a hole in their pocket, the costs to acquire, store, and power that hardware would be exorbitant.

Compared to the legacy financial system, Bitcoin fees and transaction time are minimal. Sending an international wire transfer by major US banks costs around $45, can take days to process, and can be done only during banking hours. Bitcoin transactions, on the other hand, typically cost around $0.75,⁸ can be done 24/7, are instantly seen on the network, and are widely regarded as secure after confirmation of six blocks, which happens in about one hour.

Bit-sized fact: In September 2019, a Bitcoin address transferred over $1 billion dollars worth of bitcoin for a $700 fee. That fee is just 0.00007% of the total value.⁹

A current limitation is the number of transactions the Bitcoin network can process per second, currently around seven. The Bitcoin Lightning Network is one path to increased throughput by using the concept of a bar tab. Instead of settling every single transaction on the Bitcoin blockchain every single time, the Lightning Network allows individuals to carry a bar tab with everyone else, where many transactions can take place back and forth and only the final consolidated balance is periodically settled on the main Bitcoin blockchain.

The number of Lightning channels has grown 19x in this year alone, and Lightning Network node participation recently surpassed 10,000 nodes in 83 countries around the world.¹⁰

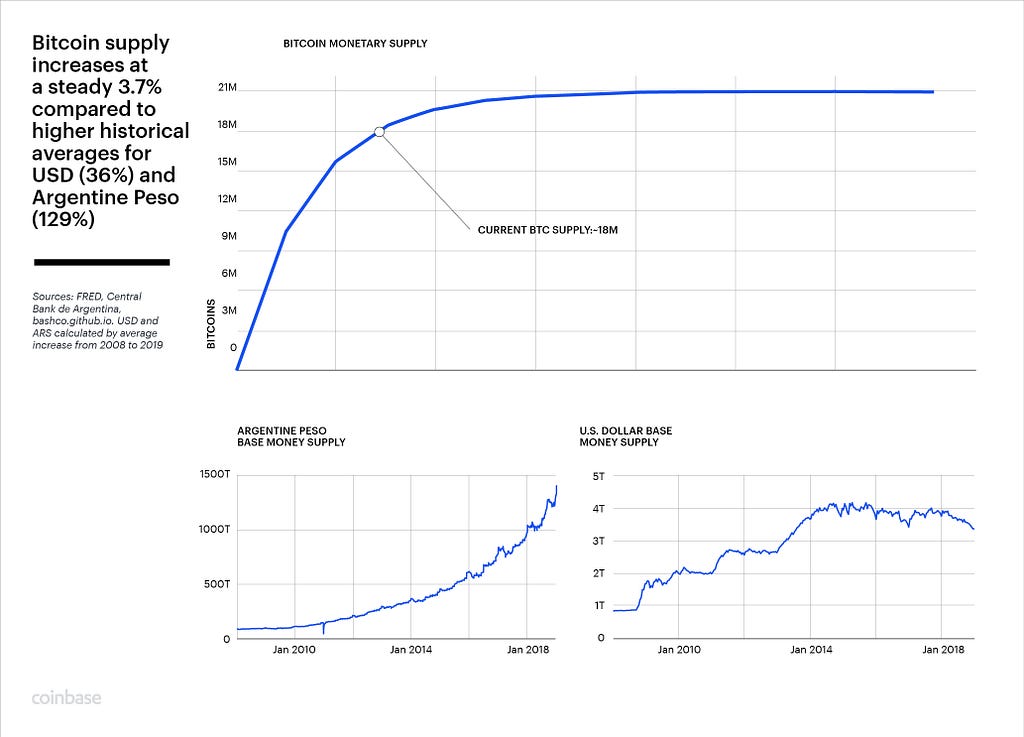

Bitcoin’s underlying code controls how much new bitcoin is created and limits the maximum amount of bitcoin that may ever exist. Today, on Bitcoin’s 11th anniversary, over 18 million bitcoins have been mined, further edging toward the 21 million maximum, which is estimated to be reached in year 2140.

By programmatically controlling the number of new bitcoin created, Bitcoin’s supply inflation is predictable and steady. Fiat currencies, on the other hand, can have wildly fluctuating supplies that are impossible to predict. Since 2008, the average supply increase for the US Dollar has been 36% per year, and 129% per year for the embattled Argentine peso. In comparison, Bitcoin’s annual supply increase is currently 3.7%, and will fall next year to 1.7%.

What’s next for Bitcoin?

Hal Finney, the computer developer who was the recipient of the world’s first Bitcoin transaction, said: “the computer can be used as a tool to liberate and protect people, rather than to control them.” Bitcoin is the world’s first global currency that harnesses the power of computers — and humankind’s innate need to innovate — to enable worldwide economic freedom. We’re looking forward to what 2020 brings in Bitcoin adoption, innovation, and interest.

Footnotes

- Bitcoin is a Demographic Mega-Trend: Data Analysis

- To assess investors’ sentiments about cryptocurrency, Coinbase commissioned a study conducted by Qriously of 4,415 people ages 18+ in the US. The survey asked questions about their investment strategy, portfolio holdings, and thoughts on cryptocurrency.

- 19% of investors aged 18–34 hold cryptocurrency and 16% hold precious metals according to a Qriously survey of 983 people.

- According to a Qriously survey of 38 people.

- Venezuelans in Argentina get sense of deja vu as crisis builds

- Index of Economic Freedom, 116 Days of Hong Kong Protests

- Coin.dance

- CoinMetrics.io 2019 average median fee

- The $700 was optional; the transaction fee could have been as low as $0.75, Blockchain.info

- 1ML.com, Internet Archive

Coinbase doesn’t provide investment advice, and this article shouldn’t be viewed as investment advice. Always make your own independent assessment of whether any particular investment or investment strategy is right for you, your risk tolerance, and financial means, before entering into a transaction. When in doubt, consult with a professional financial advisor.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., and its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

All images provided herein are by Coinbase.

Charting the course of Bitcoin, 11 years and counting was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/charting-the-course-of-bitcoin-11-years-and-counting-b4e17969d4e1?source=rss----c114225aeaf7---4

Blockstack Will Pay Liquidity Provider GSR to Trade Its STX Token

Blockstack has hired GSR Markets to provide liquidity for its "stacks" token, according to an SEC filing.

via CoinDesk https://www.coindesk.com/blockstack-will-pay-liquidity-provider-gsr-to-trade-its-stx-token

New Blockchain-Based System Will Track Steers From Hoof to Plate

Peruvian customers will now be able to access a blockchain of beeves.

via CoinDesk https://www.coindesk.com/new-blockchain-based-system-will-track-steers-from-hoof-to-plate

Longtime Bitcoin Advocate Launches Broker-Dealer for Crypto Firms

Longtime bitcoin advocate Bruce Fenton has created a new broker-dealer for digital asset firms and financial advisors called Watchdog Capital.

via CoinDesk https://www.coindesk.com/longtime-bitcoin-advocate-launches-broker-dealer-for-crypto-firms

Belgian Finance Watchdog Increases List of Suspected Crypto Scams to 131

The Financial Services and Markets Authority has issued another warning about cryptocurrency trading sites that may be fraudulent.

via CoinDesk https://www.coindesk.com/belgian-finance-watchdog-increases-list-of-suspected-crypto-scams-to-131

Bitcoin May See November Price Boost With Halving Due in Six Months

Bitcoin looks likely to see price gains next month as the effects of the May 2020 mining reward halving start to kick in.

via CoinDesk https://www.coindesk.com/bitcoin-may-see-november-price-boost-with-halving-due-in-six-months

Bitcoin Dissident Sees Dark Warnings in China’s Blockchain Push

Grave concerns about the evolution of blockchain technology from someone who lived in China and used bitcoin for its censorship-resistant value.

via CoinDesk https://www.coindesk.com/bitcoin-dissident-sees-dark-warnings-in-chinas-blockchain-push

Bitcoin’s White Paper Turns 11 as Network Passes Milestones

Happy birthday, bitcoin.

via CoinDesk https://www.coindesk.com/bitcoins-white-paper-turns-11-as-network-passes-milestones

There’s a New Way to Get Your Stolen Crypto Back

There's as much as $10 billion in stolen crypto out there. A joint venture from Coinfirm and Kroll looks to help people get their funds back.

via CoinDesk https://www.coindesk.com/theres-a-new-way-to-get-your-stolen-crypto-back

Developed Countries Have Little Need for CBDCs, Says Bank of Korea Official

The Bank of Korea has again poured cold water on the idea of adopting a central bank digital currency, according to remarks made by an official of the central bank.

via CoinDesk https://www.coindesk.com/developed-countries-have-little-need-for-cbdcs-says-bank-of-korea-official

Wednesday, 30 October 2019

Japanese Merchant Bank Signs Deal to Tokenize Estonian Properties

MBK, a Tokyo-based and Tokyo Stock Exchange-listed merchant bank, has signed a deal for the tokenization of property in Estonia.

via CoinDesk https://www.coindesk.com/japanese-merchant-bank-signs-deal-to-tokenize-estonian-properties

The Tatiana Show Ep. 229 Mati Greenspan

Mati Greenspan stops by this episode of The Tatiana Show. Mati is a Senior Market Analyst for our newest sponsor eToro. Having over a decade's experience working in financial advice, he manages portfolios for the company's VIP clients and handles eToro's Premium Club Network.

Tatiana and Mati dive into his background where he began paper trading at the age of 13 and began working in financial markets in 2008. A chance email blast in 2013 led to his discovery of Bitcoin and his interest in the crypto space.

Mati gives his thoughts on the Federal Reserve's current policies and what effect they will have on the economy. He also gives tips for beginning traders, ways to diversify your portfolio, and the risks and rewards of trading Bitcoin.

About the Guests:

Mati has been at eToro for over five years as a Senior Market Analyst and has over a decade's experience working in financial advice.

At eToro, Mati works as a portfolio manager for VIP clients with a minimum equity of $1 million and manages eToro's Premium Club Network.

He also provides a daily market update, providing experts analysis on financial news and cryptocurrencies for clients, partners and media.

He studied Financial Markets at Yale University before moving on to the Economics of Money and Bank and Columbia, becoming a fully licensed Portfolio Manager in 2017.

More Info:

Etoro.com

Friends and Sponsors of the Show:

Celsius.network/get-the-app/ use code Tatiana

*You have been listening to the Tatiana Show. This show may contain adult content, language, and humor and is intended for mature audiences. If that's not you, please stop listening. Nothing you hear on The Tatiana Show is intended as financial advice, legal advice, or really, anything other than entertainment. Take everything you hear with a grain of salt. Oh, and if you're hearing to us on an affiliate network, the ideas and views expressed on this show, are not necessarily of the those of the network you are listening on, or of any sponsors or any affiliate products you may hear about on the show.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/the-tatiana-show-ep-229-mati-greenspan

Two Plead Guilty in Conspiracy Involving Uber, LinkedIn, Others: U.S. Justice Dept

Canadian Fund Manager to List Bitcoin Fund on Major Stock Exchange

Canadian investment fund manager 3iQ plans to launch a closed-end bitcoin fund on the Ontario Stock Exchange later this quarter.

via CoinDesk https://www.coindesk.com/canadian-fund-manager-to-list-bitcoin-fund-on-major-stock-exchange

Genesis Clocks Quarterly Surge in Cash and Stablecoin Lending

For the first time this year, BTC-denominated loans now represent less than 60 percent of Genesis' portfolio.

via CoinDesk https://www.coindesk.com/genesis-clocks-quarterly-surge-in-cash-and-stablecoin-lending

There’s Now a DAO for Deciding Which Blockchains to Stake On

StakerDAO will allow participants to vote on where to best earn rewards as validators in a given proof-of-stake network.

via CoinDesk https://www.coindesk.com/theres-now-a-dao-for-deciding-which-blockchains-to-stake-on

CME Reveals Details of Upcoming Bitcoin Options Contracts

CME Group revealed the product specifications for its bitcoin options contracts on Wednesday, targeting a 2020 launch.

via CoinDesk https://www.coindesk.com/cme-reveals-details-of-upcoming-bitcoin-options-contracts

Bitcoin Just Hit $1 Billion in All-Time Transaction Fees

On Oct. 30, 2019, the bitcoin blockchain reached $1 billion in cumulative transaction fees. “This milestone is a really cool milestone just because it shows how much people value block space,” said Bryan Aulds, founder of bitcoin wallet Billfodl. “And that it’s something people don’t mind paying for, which I think is really important moving […]

via CoinDesk https://www.coindesk.com/bitcoin-just-hit-1-billion-in-all-time-transaction-fees

Video: Shift Cryptosecurity on Its Base Node and BitBox02 Wallet

During The Lightning Conference in Berlin, Bitcoin security company Shift Cryptosecurity presented two new products: a revised vision for their popular hardware wallet BitBox (which also has a BTC-only version) and a Bitcoin and Lightning node called the BitBoxBase, which promises to sync the entire Bitcoin blockchain in less than two days’ time and deliver an overall seamless experience.

In order to offer more details on these products and explain how they work and what kind of innovations they bring to the space, we interviewed two key figures from the company: CEO and co-founder Douglas Bakkum (inventor of the original BitBox hardware wallet) and hardware enthusiast Stadicus (who is in charge of the node division).

According to Bakkum, Shift Cryptosecurity’s philosophy is to “focus on the whole user experience, prioritize simplicity and govern decisions with hardware.”

Correspondingly, the two releases manage to follow this ethos while also providing some features which set them apart from the competition.

BitBox02: “The Best of Both Worlds Between Ledger and Trezor”

Bakkum has emphasized two areas of improvement for the second version of the BitBox hardware wallet: usability and security. In order to make backups more convenient for users, the BitBox02 includes a microSD card insert which saves an encrypted version of the private key and removes so-called “mnemonic anxiety” (fear of forgetting or losing the 12 or 24 words which make up the recovery seed phrase).

“For new users, it’s really confusing to understand seed keys, so external backups are extremely easy to understand and it happens instantly,” Bakkum told Bitcoin Magazine.

Furthermore, the BitBox02 is designed to combine the best features found in the two most popular hardware wallets on the market: It contains a general purpose microcontroller and runs open-source software like the Trezor, and also includes a security element in the form of a physical chip, as Ledger wallets do.

“We take what we think is the best of both worlds between Ledger and Trezor,” said Bakkum.

Bakkum also advocated for open-source firmware by saying that concealing the code may have fatal repercussions for the users, even when the intentions are good.

“In a lot of fields, it’s probably okay to be closed source, but in crypto where one mistake means you can lose your funds, I think it’s just a completely bad idea,” he said.

BitBoxBase: The First Retail Bitcoin and Lightning Node Running c-lightning

The BitBoxBase node prototype presented during The Lightning Conference featured a slick, black, 3D-printed cover which housed a palm-sized ROCKPro64 with 4 GB of RAM and an attached terabyte SSD. Before an interview with Bitcoin Magazine, node engineer Stadicus said that he was still experimenting with various hardware specifications and settings in order to deliver the best experience with the lowest production costs. However, it’s unlikely that anything except for the casing and cables will change before the official release date — which is expected to be in the first quarter of 2020.

“You see quite a few Lightning nodes out there,” Stadicus told Bitcoin Magazine. “They start with Lightning and then move a little bit toward the on-chain stuff, but to me it’s a little bit the other way around. First you want to solve the on-chain Bitcoin issues to give the users sovereignty and privacy and then we can add the fun stuff on top. I think this is probably the main differentiator between our product and Casa’s.”

The Base is meant to complete the ecosystem of Shift Cryptosecurity products by empowering users with more privacy to validate and store their own transactions without relying on third-party devices.

“We’re working on a product ecosystem that combines hardware and software to give you as much financial sovereignty as possible,” Stadicus said. “Having a secure cold storage solution with a hardware wallet, together with our BitBox app, offers a holistic user experience and maximizes individual sovereignty.”

Aside from the hardware architecture, what truly sets the BitBoxBase apart from the rest of available retail node solutions is the decision to use Blockstream’s c-lightning client for Lightning Network transactions.

“One reason why we chose c-lightning is that it has all these great server-side plugin capabilities, so we can program in any language that we want – and we usually use Go – and add functionality,” Stadicus said. “So, for example, if you want to open a channel from your hardware wallet, you cannot do that directly from either c-lightning or lnd. But with c-lightning, you have these hooks to get into the program, write your own feature and use that to just add an additional functionality that is important for the whole ecosystem.”

The decision to not use lnd like the other major Bitcoin and Lightning node manufacturers comes with a trade-off, as applications such as ZapWallet and Joule can no longer be used.

“It was a hard choice for us because we deliberately gave away that whole suite of free applications, but we think that if you really want to have an easy plug-and-play solution, then that’s not the way to go, anyway,” Stadicus noted. “So, we decided that if we’re going all in, then we can use c-lightning. And I guess the little rebel in me was also [saying] that everybody is building on lnd so, we must go for c-lightning to avoid following the rabbit like everyone.”

On the BitBox App and Why Hardware Security Matters

Just as the heart was the element that connected the brain with the hands in Fritz Lang’s “Metropolis,” Shift Cryptosecurity is working on a software implementation which bridges its hardware products. Their effort is generically called the BitBoxApp and is designed to be light and universal to all operating systems.

“We build hardware, but we also require good software for it,” Bakkum said. “Right now, we have a cross-platform desktop app that you can find on iOS, Windows and Linux. We also have a mobile version that we plan to release pretty soon, so that you will be able to plug your BitBox02 directly into your phone with a USB-C connection. That’s a big focus on usability and simplicity, and in the future we will try to add different types of services that are useful.”

Bakkum advocates the use of hardware wallets and nodes, even for newcomers to Bitcoin.

“For people new in the field, I think it’s extremely important to get their bitcoins secure, especially when exchanges are a ticking time bomb,” he said. “Your mobile wallet or desktop computer are also ticking time bombs, and so the best way to do it is via dedicated encrypted hardware.”

“From a certain point on, you should really care about privacy,” added Stadicus.

The post Video: Shift Cryptosecurity on Its Base Node and BitBox02 Wallet appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/video-shift-cryptosecurity-on-its-base-node-and-bitbox02-wallet

2 Plead Guilty in 2016 Uber and Lynda.com Hacks

Ripple Invests in Biometric Cybersecurity Startup’s $2.2 Million Round

Keyless, a London-based cybersecurity startup, claims to be the first firm to combine biometrics and cryptography.

via CoinDesk https://www.coindesk.com/ripple-invests-in-biometric-cybersecurity-startups-2-2-million-round

Russian Aluminum Plant Pivots to Bitcoin Mining Following US Sanctions

Metal giant Rusal is renting its facilities to the Russian Mining Corporation following 2018 U.S. sanctions.

via CoinDesk https://www.coindesk.com/russian-aluminum-plant-pivots-to-bitcoin-mining-following-us-sanctions

Beijing's Backing Could Tip Scales in Race for Blockchain Supremacy, Industry Figures Say

Pay Your Friends to Protect Your Keys: One Startup’s New Take on Crypto Custody

Vault12 is rolling out its crypto custody solution, which lets users pay their friends in ether to protect their private keys.

via CoinDesk https://www.coindesk.com/pay-your-friends-to-protect-your-keys-one-startups-new-take-on-crypto-custody

Leaked Transcript Details Power Struggle Inside Bitcoin Mining Giant Bitmain

A transcript of a Bitmain staff meeting reveals an ugly power struggle inside the world's biggest bitcoin miner maker that led to the abrupt ousting of co-founder Micree Ketuan Zhan.

via CoinDesk https://www.coindesk.com/leaked-transcript-details-power-struggle-inside-bitcoin-mining-giant-bitmain

CoinGecko Now Tracks Data From 20-Plus Crypto Derivatives Markets

The data aggregator has added a new service tracking the growing number of crypto derivatives products.

via CoinDesk https://www.coindesk.com/coingecko-now-tracks-data-from-20-plus-crypto-derivatives-markets

4 Minute Crypto - 3 Reasons Bitcoin's Price May Hit 20K by Year End

The path seems open for bitcoin to stage an end of year rally, with $20,000 shaping up as a realistic price target.

CONTACT INFO

-

Email me at TheCryptoCousins@gmail.com

-

Message me at https://Facebook.com/msg/GaryLeland

-

Leave a voice comment at 817-476-0660

YouTube Channel

SUPPORT

Gary is available to keynote or emcee your Bitcoin/Crypto event. Please email GaryLeland@gmail.com for additional info.

DISCLAIMER: This article should not be taken as is, and is not intended to provide, investment advice.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/3-reasons-bitcoin-price-hit-20k-by-year-end

tZERO, Tezos Foundation to Tokenize £500 Million in UK Real Estate

The blockchain startups will tokenize portions of properties financed by U.K.-based Alliance Investments.

via CoinDesk https://www.coindesk.com/tzero-tezos-foundation-to-tokenize-500-million-in-uk-real-estate

Why Google’s Quantum Supremacy Milestone Matters

Bitcoin Eyes First Monthly Price Gain Since June

Bitcoin is on track to end its three-month losing streak, having recovered from recent lows around $7,400 seen a week ago.

via CoinDesk https://www.coindesk.com/bitcoin-eyes-first-monthly-price-gain-since-june

Jack Dorsey Backs $10 Million Round for Token Offering Platform CoinList

CoinList's latest funding round will help it develop a new exchange and wallet.

via CoinDesk https://www.coindesk.com/jack-dorsey-backs-token-offering-platforms-10-million-funding-round

Bitmain Seeking U.S. IPO With Confidential SEC Filing: Report

The bitcoin mining giant is said to have confidentially filed for an IPO in the U.S.

via CoinDesk https://www.coindesk.com/bitmain-seeking-u-s-ipo-with-confidential-sec-filing-report

Binance CEO: ‘Russia Is Our Key Market’

Fans mobbed Binance's CEO like a rock star on his recent visit to Moscow. The warm feelings are mutual, with a big Russian expansion in the works.

via CoinDesk https://www.coindesk.com/__trashed-15

Livepeer Prepares to Unlock New Way for GPU Miners to Earn Crypto

By the end of this year, GPU miners could have a fresh new way to earn crypto – using the idle processing capacity of their chips.

via CoinDesk https://www.coindesk.com/livepeer-prepares-to-unlock-new-way-for-gpu-miners-to-earn-crypto

Tuesday, 29 October 2019

Why Bitcoin Is the Perfect Haven for Argentines in This Economic Crunch

Between the characteristic Latin American lifestyle, the friendly people and the buzzing nightlife, Argentina is a joy to visit. For locals, however, it’s not an easy place to live in. For the eighth time in its 209-year history and the second time in the past 13 years, the country finds itself entering into billions of dollars worth of debt.

In short, the Argentinian economy isn’t doing well at all. Reuters expects its inflation level to reach 53 percent by December 2019, and regardless of the policies set by the past administration (led by the reform-minded and recently-ousted Mauricio Macri), the economy doesn’t seem to be getting any better.

Argentina’s Dollar Dependency and Its Many Facets

To outside observers, perhaps one of the biggest financial quandaries that Argentina faces is its overdependence on the U.S. dollar. In 2014, The Washington Post reported that there was up to $50 billion stashed in cash and dollar-denominated bank accounts domiciled in Argentina. The reason why is not hard to guess: When you live in an economically challenged country, you’ll look for ways to preserve your wealth.

The country’s peso is a hot mess, and instead of struggling with shaky values and fluctuating exchange rates, its citizens have done what many other citizens in debt-ridden countries do: convert their currency to dollars to find some semblance of stability.

In an interview with Bitcoin Magazine, Eduardo Gomez, the head of support at bitcoin-backed savings platform Purse.io, said Argentines are buying bitcoin for different reasons.

“From 2015 to 2019, trading volumes for bitcoin went up on platforms like LocalBitcoins, Ripio, etc. — mainly due to retail interest and speculation, but also to hide wealth from the government,” he said.

Dollar-hoarding has made it difficult for Argentina’s central bank to build its own dollar savings, which has led to a significant drop in the country’s foreign reserves. The same problem has also caused some producers and manufacturers in the country to hoard products. They see selling as unwise, as they believe that a devaluation of the peso is always around the corner.

Currency Restrictions Could Bring More Bitcoin to Argentina

The first round of new elections in Argentina was held on October 27, 2019, and it saw Alberto Fernández, a 60-year-old former chief of the cabinet of ministers, emerge victorious. Fernández didn’t have much time to revel in his victory, as he immediately rolled out his first major macroeconomic policy, tightening currency controls even further.

Argentina’s central bank cut the amount of dollars that individuals could buy to $200 per month via bank account and $100 in cash until December 2019, down from a $10,000 limit imposed in September 2019.

As a result, blockchain companies are gearing up for a harvest. Diego Gutiérrez Zaldívar of RSK Labs — the parent company of Latin American social network Taringa — said he believes that this ban would be beneficial for Bitcoin.

“This new forex restrictions in Argentina are very important for Bitcoin,” he told Bitcoin Magazine. “Every time the friction of the traditional financial system grows in the form of capital or forex controls, Argentines seek for alternatives. The traditional alternative for the middle class was always the U.S. dollar and OTC exchanges, but more and more, bitcoin is also becoming an alternative.”

While Argentines seem to have lost faith in their own fiat currency, this restriction will strain their ability to store wealth. In a country where the average family stockpiles groceries for fear of wild price swings, bitcoin can be a saving grace.

Argentina Can Still Thrive With Bitcoin

Latin America has proven to be a testing ground for the application of cryptocurrencies as safe havens during economic turmoil (see Venezuela), and the trend is spreading to Argentina. The country is filled with an abundance of local exchanges, bitcoin brokers and other blockchain startups in search of users who want to adopt cryptocurrency.

“Argentines don’t trust the pesos,” Santiago Molins, a Argentina-based cryptocurrency specialist and entrepreneur, told Bitcoin Magazine. “Our inflation can peak 30 percent in one day, so most people buy food and stock up in case prices rise.”

This uncertainty is driving Argentines to the many bitcoin access points available to them. From centralized exchanges to P2P platforms to bitcoin ATMs, there’s a variety of ways in which Argentines can purchase bitcoin.

According to CoinATMRadar, Argentina has about 11 bitcoin ATMs concentrated in its capital Buenos Aires. And in the week following Fernández’s victory, the trading volume for LocalBitcoins in Argentina amounted to 14.15 million pesos (worth about $240,000), marking the country’s third-highest volume week in history, even while some brokers were selling at higher premiums.

Opportunities for Bitcoin in Argentina

Despite the recent dollar restrictions, local exchanges are not apprehensive about serving customers. Speaking with Bitcoin Magazine, Manuel Beaudroit, the chief marketing officer of Latin America-focused exchange Bitex, said that since the local exchanges transact in pesos, restrictions don’t bother or affect it. It has also witnessed a spike in its volumes since August 2019.

“Successive economic and social turmoil have created the perfect conditions for startups in the crypto ecosystem to thrive and flourish; this demonstrates our natural predisposition for solving this endemic problem by using blockchain technology,” Beaudroit said. “Hopefully, we will be the generation who will end this problem.”

Bitex has been doing its bit to promote Bitcoin adoption in Argentina. In 2018, it partnered with Argentinian bank Banco Masventas to enable customers to process international payments speedily through Bitcoin’s blockchain. Beaudroit said the service is now live in four countries: Argentina, Chile, Paraguay and Uruguay.

For Zaldívar, the new forex controls couldn’t come at a better time for Taringa. According to Zaldívar, the social network site has a strong Argentinian base that is growing, possibly motivated by declining trust in the federal economy.

“Part of our plan for the social network is to give every user a crypto wallet that will support bitcoin and all the stable assets created on the RSK Network,” said Zaldívar. “Once that’s in place, we will integrate a revenue-sharing mechanism with the community that will turn the social network into an open sharing economy.”

The post Why Bitcoin Is the Perfect Haven for Argentines in This Economic Crunch appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/why-bitcoin-is-the-perfect-haven-for-argentines-in-this-economic-crunch

Blockcrunch - Why Matic Network is Bullish on Plasma | Asia Series w/ Sandeep Nailwal, Ep. 73

For this week's Blockcrunch Asia Series, we look to India's Matic Network, a Coinbase and Binance-backed team scaling Ethereum via Plasma.

COO Sandeep Nailwal joins me in discussing:

- Why (still) Plasma?

- The technical trade-offs of Matic

- Matic vs. other layer 2 solutions

- Go-to-developer strategy

- Indian crypto regulation

Host: Jason Choi (@MrJasonChoi). If you enjoyed the show, consider tipping! This show is not financial advice.

- BTC: 3EFSLnPpme6Lo6DynN1bVV9owooueFvEmJ

- ETH: 0xdec40AA30B9C562aB4b839529BfC290C1B5Da61E

Resources:

Disclaimer: Jason Choi is an investor at Spartan Capital, the hedge fund arm of The Spartan Group. All opinions expressed by Jason and podcast guests are solely their own opinions and do not reflect the opinion of The Spartan Group and any of its subsidiaries and personnel. This podcast is for information purposes only and should not be relied upon as a basis for investment decisions. The Spartan Group and its clients may hold positions in assets described in the episode. Detailed‚disclaimers available at jasonchoi.me and‚spartangroup.io/disclaimer

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/blockcrunch-why-matic-network-is-bullish-on-plasma-asia-series-w-sandeep-nailwal-ep-73

Nik Bhatia on Bitcoin is a Response to Central Banks - WBD161

'œThe reason why I love Bitcoin; I think that it improves on all the things that gold is lacking and gold really is, historically, the world's best money.''" Nik Bhatia

Location: Los Angeles

Date: Friday, 18th October

Project: OpenNode & Tantra Labs

Role: Research Strategist

State adoption of Bitcoin is unclear but countries such as Iran, North Korea and Venezuela are believed to be holding and using Bitcoin. While these countries are in the minority, some believe it is just a matter of time before Bitcoin becomes a generally accepted state-level monetary tool.

State-level censorship resistance is useful for nations subject to tight sanctions. The unique properties of Bitcoin could make governmental ownership of Bitcoin a necessity in the future and increased accumulation by governments around the world may lead to the U.S Dollar being replaced by Bitcoin as the global reserve currency.

Further, the global economy is becoming increasingly uncertain, with negative interest rates and the Fed's growing intervention in the repo market standing as warning signs of an imminent global recession.

Could all these factors speed up the shift towards Bitcoin adoption?

In this interview, I talk to Nik Bhatia, Research Strategist at OpenNode and Tantra Labs. We discuss how banking works, the global economic outlook and why Bitcoin is a response to centralised and monopolistic money creation by central banks.

This episode is also on:

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/nik-bhatia-on-bitcoin-is-a-response-to-central-banks-wbd161

New Tool Will Find Secrets – Including Crypto Keys – In Your Public Code

A clever tool scours GitHub for secret keys and passwords that programmers inadvertently made public.

via CoinDesk https://www.coindesk.com/new-tool-will-find-secrets-including-crypto-keys-in-your-public-code

Cartoon: The Challenges of Liquidity

Cryptocurrencies require an even distribution of sellers and buyers to create a healthy, liquid market. However, many cryptocurrencies have an insufficient number of buyers, and therefore rapidly fall into a frozen state that is very hard to reverse. In this context, bitcoin floats relatively close to the top.

The post Cartoon: The Challenges of Liquidity appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/cartoon-the-challenges-of-liquidity

FTX Launches Futures on Index of 8 China Cryptos Amid Xi Blockchain Pump

Derivatives exchange FTX has launched an index of eight popular Chinese cryptocurrencies, as well as futures offering exposure to the basket.

via CoinDesk https://www.coindesk.com/ftx-launches-futures-on-index-of-8-china-cryptos-amid-xi-blockchain-pump

Rhys Lindmark: MIT's Digital Currency Initiative '" Why We Need Blockchain Ethics

Blockchain and cryptocurrencies have the potential to change the world in meaningful ways. And this change may drastically impact people's lives‚'" both for the better and for the worse. While ethics are often discussed for technologies like AI, the ethical considerations around blockchain technologies have received less focussed attention.

We're joined by Rhys Lindmark, Head of Community and Long-Term Societal Impact at the MIT Media Lab's Digital Currency Initiative. Previously the host of the podcast 'œCreating a Humanist Blockchain Future,' Rhys' approach to blockchain was always about considering its potential impact. Since joining the DCI, his podcast, now 'œGray Mirror,' continues to explore these questions. He has also recently started teaching a blockchain ethics course with the DCI's Director, Neha Narula.

Topics discussed in this episode:

- Rhys' background as a podcaster and proponent of Effective Altruism

- His advocacy work around universal tithing and donating to charity

- The controversy surrounding the MIT Media Lab and the resignation of their Director Joi Ito

- The difference between ethics and morals

- Why we need to study blockchain ethics

- Should we have ethics committees in blockchain as there exists about AI

- The ethical considerations for different use cases and applications of blockchain technology

- The role of miners and should they have ethical obligations to censor certain transactions

- The DCI's blockchain ethics class and what students learn

Links mentioned in this episode:

- Blockchain Ethics Class

- Blockchain Ethics Class Syllabus

- Why it's time to start talking about blockchain ethics (MIT Technology Review)

- Jeffrey Epstein case: Federal prosecutors broke law, judge says (Miami Herald)

- Director of M.I.T.'s Media Lab Resigns After Taking Money From Jeffrey Epstein (New York Times)

- MIT Digital Currency Initiative

- Rhys Lindmark on Twitter

Sponsors:

- Cosmos: Change the future of finance at the SF Blockchain Week Defi Hackathon '" $50,000 prize pool for winning teams

- Trail of Bits: Trust the team at the forefront of blockchain security research

- B9Lab: Level up and become a Solidity smart contract auditor '"‚5% off the with the code EPICENTER

This episode is hosted by Sebastien Couture & Friederike Ernst. Show notes and listening options: epicenter.tv/311

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/epicenter-rhys-lindmark-mits-digital-currency-initiative-why-we-need-blockchain-ethics

Video: Tone Vays on Technical Analysis and Bitcoin Regulation

Bitcoin trader and advocate Tone Vays has been under a lot of scrutiny in October 2019. Between stirring controversy among community members for charging 0.3 BTC per hour for consultancy (which he later revealed as being his corporate service rate, which he set when the bitcoin price was $3,000 and forgot to change), agreeing to join a panel with Craig Wright just to defy his claims and making his tweets private due to incoming negativity, Vays can’t seem to catch a break.

However, during this exclusive interview which was shot at the Transylvania Crypto Conference in Cluj, Romania, just a week prior to his clash with Craig Wright, Vays was humble, candid and seemingly unaffected by the social media storm. He took time to explain his role in the Bitcoin space, justified his focus on education and evangelism, and offered insights on his understanding of Bitcoin regulation in the U.S.

“I am known as a trader in the space, I am made fun as a trader in the space, but there is a reason why I don’t trade. I didn’t join this space as a trader, but as a Bitcoin evangelist.”

Vays explained why his advocacy requires a revenue generation system.

“Unlike people like Roger Ver and some of the others, I didn’t get into Bitcoin early enough to have a bunch of BTC and not have to worry about money ever again,” Vays said. “So, unfortunately, I still have to make a little bit of a living while doing my Bitcoin evangelism.”

Furthermore, Vays’ content production and frequent conference participation doesn’t pay the bills either; rather, they bring in extra expenses.

“Conferences don’t exactly pay, my YouTube channel costs me more money to maintain than it brings in, my conference speaking and travelling costs me more money than it brings in, so I gotta finance all that somehow,” Vays explained. “I’m leveraging my skills as a trader to make enough money to keep doing what I’m doing — otherwise, I’ll go back to Wall Street and make hundreds of thousands of dollars, which is what I used to do.”

Technical Analysis: Providing Structure and Discipline to Trading

“I think TA is always relevant, but the right question is, ‘Is TA relevant for you?’”

Vays is one of the most vocal proponents of technical analysis (TA) in bitcoin, in spite of the asset’s low liquidity (as compared to other currencies and commodities) and high volatility. Though he openly acknowledges that some trades will bring in losses due to incorrect predictions, Vays presents TA as a “structure to be disciplined in your trades.”

During the fall of 2018 while the price of bitcoin was stagnating in the $6,500 area, Vays was the most popular bear, and he correctly called a new bottom in the $3,000s. His further prediction proved to be incorrect, as he expected prices below the $1,500 threshold; then the trend reversed and once again brought significant increases.

“The 2018 bottom of $3,150 wasn’t as low as I would have liked for the ultimate dip, but I’m still very concerned about the price,” he said.

Going forward, Vays’ technical analysis still points toward bearish outcomes. However, he warns his followers to keep in mind that his expert opinion is not financial advice and that they should always do their own research prior to making any financial decisions.

“I don’t like the way bitcoin started rising early this year and I don’t like the way it topped at $14,000,” he said. “It’s now lost about a half of the value and I’m still uncomfortable with the current price as the low for this downturn. I give it a greater chance than 50 percent to go lower than $7,700.”

Bitcoin Education and Evangelism

The bitcoin trader and evangelist also emphasized his role as an educator who encourages individuals to develop their own approach to technical analysis.

“I teach people how to trade so they don’t have to rely on my opinion and [can] make their own decisions,” Vays said.

Halfway through the interview, Vays made the distinction between fundamental analysis and TA: “If you are a big hedge fund, if you’re JP Morgan or Goldman Sachs, you’re not doing TA. You have the resources to do real fundamental analysis. You hire a person whose sole job is to research an asset for eight hours a day until a report is produced on that company or asset. An average person who may have a job or work as a full-time trader still doesn’t have the resources to do real fundamental analysis. Therefore, the question isn’t whether TA is the right choice — it is the only choice for an individual trader, whether full-time or part-time.”

Vays then issued a warning to those who may look at other people’s success stories but fail to see the risks of high volatility and possibly put the blame on price manipulation.

“If you trade a low-liquid asset like bitcoin and a guy with $10 billion can move the price, imagine what a guy can do for an altcoin,” he said. “If you’re scared that a whale can move the price, then you’re trading in the wrong market or you shouldn’t be trading. Everyone always claims that there is manipulation. Manipulation is just a move in the unexpected direction. If you complain about manipulation, go trade something else or don’t trade.”

Bitcoin Regulation and Taxes

“The tax law on bitcoin is terrible. The government needs to understand that bitcoin is used as currency for transactions and treat it just like foreign currencies.”

According to Vays, government regulations are necessary as a way of guaranteeing the same rules for all players on the market. Nonetheless, it’s hard for any piece of law to cover all the complexities of Bitcoin.

“In the crypto casino, you don’t know what kind of information the exchange is giving to certain players,” he said.

Vays expressed his willingness to work with the U.S. government in order to educate congressmen and specialized agency members about what Bitcoin is and how it works.

His motivation stems from the general tendency to consider Ethereum a decentralized project that is on par with Bitcoin.

“I would love to inform the government about what Bitcoin is and how it works,” Vays said. “I think they understand it, but at the same time I question it because of the way they perceive Ethereum. And the biggest thing on which I would like to educate the U.S. government is the difference between Bitcoin and Ethereum.”

Indeed, his presentation in Romania highlighted the reasons why bitcoin reigns supreme and every altcoin is doomed to fail.

Having a cushion which allows BTC holders not to be liable for taxes on gains under a certain threshold is also essential, according to Vays. In his view, bitcoin should be treated by U.S. regulators just like every other foreign currency.

“If I come back from Romania, I keep the currency in a drawer and it appreciates in value over time, then I don’t own any taxes because there’s a cushion there,” Vays explained. “But if I’m a trader and I deal with currencies, then I owe taxes on price appreciation. In the law, there is a difference between currency for commerce and currency for speculation. The IRS needs to give bitcoin a bit of a cushion — give it maybe $1,000 of a cushion for commerce use and stop making citizens worry about small amounts.”

In closing, Vays recommended all enthusiasts HODL for a longer amount of time. In his view, all of the legislative and economic issues will have been solved within a decade, so it’s better not to bother with today’s early regulation attempts.

“These frameworks are usually bad. Hold your own keys, buy some bitcoin, stash it for 10 years and then return when the world finally figures out what it is,” Vays suggested.

The post Video: Tone Vays on Technical Analysis and Bitcoin Regulation appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/video-tone-vays-on-technical-analysis-and-bitcoin-regulation