Friday 31 July 2020

Bitcoin Ends July at Highest Monthly Close Since 2017 Peak

Bitcoin closed July at $11,351, according to Messari.

via CoinDesk https://www.coindesk.com/bitcoin-ends-july-at-highest-monthly-close-since-2017-peak

Florida Teenager Is Charged as ‘Mastermind’ of Twitter Hack

What a Professional Trader Thinks of the Fed, Robinhood and Real Estate, Feat. Tony Greer

The editor of the Morning Navigator newsletter discusses a variety of macro topics and how to trade against a very strange market.

via CoinDesk https://www.coindesk.com/what-a-professional-trader-thinks-of-the-fed-robinhood-and-real-estate-feat-tony-greer

Money Reimagined: Let’s Be Privacy Scolds

Technical solutions to protect financial privacy may not suffice. Stronger cultural norms around minding one’s own business are needed as well.

via CoinDesk https://www.coindesk.com/money-reimagined-lets-be-privacy-scolds

Blockchain Bites: Dollar’s Decline, Ether’s Moneymakers and Coinbase’s Considerations

Coinbase is considering adding 19 new assets, the SEC tapped CipherTrace for its Binance-specific tracing tools and 132% of Ether wallets are in profit.

via CoinDesk https://www.coindesk.com/blockchain-bites-dollar-ether-coinbase

Bitcoin News Roundup for July 31, 2020

With the dollar dropping to its lowest level since May 2018 and a reshuffle in Japan's central bank, CoinDesk's Markets Daily is back.

via CoinDesk https://www.coindesk.com/bitcoin-news-roundup-for-july-31-2020

Proof of Love Ep. 68 - The Truth About Sex Trafficking with Elizabeth Nolan Brown

Reason senior editor Elizabeth Nolan Brown has done extensive research and coverage on the topic of sex work and joins us in this episode to talk about it from a liberty-minded perspective.

She also takes the time to define sex work vs. sex trafficking and explains how authoritarians use the latter term to punish and harm people who engage in sex work without coercion. She also details how inaccurate studies have led to paranoia about child sex trafficking.

There's conversation about how radical feminism colluded with social conservatives to blur the definitions between consensual prostitution and sex trafficking, how criminalization of sex work protects rapists & abusers, whether there's such a thing as "safe" sex work, as well as the rise of webcamming and web galleries as a way for sex workers to avoid exploitation.

There's talk about the recent Wayfair "scandal," as well as the "happy ending" massage parlor phenomenon and how it has become the #1 way for law enforcement to make themselves look like they are effectively fighting trafficking.

You can't miss this incredibly compelling episode of Proof Of Love!

About the Guest:

Elizabeth Nolan Brown is a senior editor at Reason, where she writes regularly on the intersections of sex, speech, tech, crime, politics, panic, and civil liberties, and president ofthe libertarian feminist group Feminists for Liberty. Her writing has also appeared in publications such as The New York Times, the Los Angeles Times, The Daily Beast, Buzzfeed, Playboy, Fox News, Politico, and Libertarianism.org. She lives in Washington, D.C.

Do you have a burning question, or a show idea for us? Please email us at tatiana@proofoflovecast.com!

More Info:

Tatiana Moroz

Crypto Media Hub

Elizabeth Nolan Brown on Reason

Friends and Sponsors of the Show:

Let's Talk Bitcoin

The Tatiana Show

Remember, this is a new show, so if you like it, please be sure to tell 3 friends! Leave a good review on Itunes, and be sure to follow us on our socials!

*You have been listening to Proof of Love. This show may contain adult content, language, and humor and is intended for mature audiences. If that's not you, please stop listening. Nothing you hear on Proof of Love is intended as financial advice, legal advice, therapy or really, anything other than entertainment. Take everything you hear with a grain of salt. Oh, and if you're hearing us on an affiliate network, the ideas and views expressed on this show, are not necessarily those of the network you are listening on, or of any sponsors or any affiliate products you may hear about on the show.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/proof-of-love-ep-68-the-truth-about-sex-trafficking-with-elizabeth-nolan-brown

FinCEN Issues Warning on Coronavirus Scams Demanding Crypto

The advisory regarding cybercriminals exploiting the Covid-19 pandemic asks firms to be especially vigilant regarding their dealings with virtual currencies.

via CoinDesk https://www.coindesk.com/fincen-issues-warning-on-coronavirus-scams-demanding-crypto

Putin Signs Russian Crypto Bill Into Law

Russia's president signed the first of two bills on digital assets into law on Friday.

via CoinDesk https://www.coindesk.com/putin-signs-russian-crypto-bill-into-law

Ripple Paid MoneyGram $15.1M in ‘Market Development Fees’ in Q2

With the $15.1 million in Q2, MoneyGram has so far received $43 million for providing liquidity for Ripple’s XRP-based settlement system.

via CoinDesk https://www.coindesk.com/ripple-paid-moneygram-market-development-fees

Coinbase Considering 19 Additional Cryptos for Exchange Listing

The popular trading platform has once again expanded its list of crypto contenders.

via CoinDesk https://www.coindesk.com/coinbase-considering-20-additional-cryptos-for-exchange-listing

'Payment Sent'-Travel Giant CWT Pays $4.5 Million Ransom to Cyber Criminals

Coinbase continues to explore support for new digital assets

We are continuing to explore the addition of new assets for customers around the world.

Coinbase’s goal is to offer support for all assets that meet our technical standards and which comply with applicable laws. Over time we expect our customers around the world will have access through Coinbase platforms to at least 90% of the aggregate market cap of all digital assets in circulation.

We will continue to evaluate prospective assets against our Digital Asset Framework to assess factors like security, compliance, and the project’s alignment with our mission of creating an open financial system for the world. To apply for listing, fill out an application here.

Digital Assets Under Review

Today we’re announcing that we are exploring the addition of a range of new assets. As part of the exploratory process customers may see public-facing APIs and other signs that we are conducting engineering work to potentially support these assets.

These new assets include, in alphabetical order: Ampleforth, Band Protocol, Balancer, Blockstack, Curve, Fetch.ai, Flexacoin, Helium, Hedera Hashgraph, Kava, Melon, Ocean Protocol, Paxos Gold, Reserve Rights, tBTC, The Graph, THETA, UMA, and WBTC

Our decision to support any asset requires significant technical and compliance review and may be subject to regulatory approval in some jurisdictions. We therefore cannot guarantee whether or when any above-listed asset will be listed on a Coinbase product in any jurisdiction. As per our listing process, we will add new assets on a jurisdiction-by-jurisdiction basis, subject to applicable review and authorizations. The omission of assets from this publication does not disqualify any such asset from active review and potential listing.

Our customers can expect Coinbase to make future, similar announcements as we continue to explore the addition of numerous assets across the platform.

To read previously announced assets that Coinbase may still be exploring see; Jul 13, 2018, Dec 7, 2018, Aug 5, 2019, Sep 1, 2019, June 10, 2020.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, Inc., and its affiliates (“Coinbase”), and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

All images provided herein are by Coinbase. All trademarks are property of their respective owners.

Coinbase continues to explore support for new digital assets was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/coinbase-continues-to-explore-support-for-new-digital-assets-37c9737546b0?source=rss----c114225aeaf7---4

Ethereum 2.0: Closer Than Ever, Still Plenty of Work to Do

Five years later, Ethereum is still chugging along as a decentralized platform for self-executing code. Eth 2.0 is quite close, but for real this time.

via CoinDesk https://www.coindesk.com/ethereum-2-0-closer-than-ever-still-plenty-of-work-to-do

CoinDesk Live Recap: Co-Founders Revisit Ethereum’s Launch Drama

Ethereum was always a wild experiment. Now, five years later, a few early believers explain why they are more bullish than ever.

via CoinDesk https://www.coindesk.com/coindesk-live-recap-co-founders-revisit-ethereums-launch-drama

First Mover: Chainlink’s Soaring Token Shows Lucrative ‘Oracle’ Role in Fast-Growing DeFi

Chainlink's LINK token soared almost 60% in July as cryptocurrency traders fawned over DeFi projects and their rapid growth.

via CoinDesk https://www.coindesk.com/first-mover-chainlink-link-token-cryptocurrency-lucrative-oracle-defi

Bank of Japan Puts Top Economist in Charge of Digital Yen Initiative

The central bank's most senior economist now runs the department responsible for the digital currency task force and working group with other central banks.

via CoinDesk https://www.coindesk.com/bank-of-japan-top-economist-digital-yen-initiative

Bitcoin on Track for Highest July Price Gain in 8 Years

Bitcoin appears on track to register its best July price performance for eight years and confirm a major bullish breakout in the process.

via CoinDesk https://www.coindesk.com/bitcoin-on-track-for-highest-july-price-gain-in-8-years

Elrond Launches Onto Mainnet, Reduces 99% of Token Supply

Elrond’s move onto mainnet will replace 19.98 billion testnet tokens with 20 million mainnet tokens at a rate of 1000:1.

via CoinDesk https://www.coindesk.com/elrond-launches-mainnet-token-supply

Twitter Says Hackers Used Phone to Fool Staff, Gain Access

KeeperDAO Raises Seven-Figure Seed Investment From Polychain, Three Arrows

The funding comes at a time when DeFi has seen an explosion in growth.

via CoinDesk https://www.coindesk.com/keeperdao-raises-seven-figure-sum-seed-round-polychain-three-arrows-defi

Ripple Says XRP Lawsuit Based on ‘Unsupported Leaps of Logic’

Ripple has hit back at the lead plaintiff in an ongoing class-action lawsuit accusing the firm and its CEO of securities fraud.

via CoinDesk https://www.coindesk.com/ripple-says-xrp-lawsuit-based-on-unsupported-leaps-of-logic

Thursday 30 July 2020

Twitter Says ‘Phone Spear Phishing’ Let Hackers Gain Employee Credentials

Twitter has provided an update on what happened the day the social media giant lost control over its platform.

via CoinDesk https://www.coindesk.com/twitter-says-phone-spear-phishing-let-hackers-gain-employee-credentials

Ethereum History in 5 Charts

Five years ago this week, the first general-purpose blockchain went live on mainnet. Here are five charts for understanding Ethereum's evolution.

via CoinDesk https://www.coindesk.com/ethereum-history-in-5-charts

Audius Rallies EDM Artists, Crypto VCs to Back Vision for Music Payments on Ethereum

Audius, a streaming service built on Ethereum, has raised $3.1 million from Multicoin Capital, Blockchange Ventures, Pantera Capital and Coinbase Ventures.

via CoinDesk https://www.coindesk.com/audius-rallies-edm-artists-crypto-vcs-to-back-vision-for-music-payments-on-ethereum

Blockchain Bites: Plus Token Ponzi Popped, Cardano Forked and tZERO Cut

Cardano is now running as a proof-of-stake network, the Marines banned crypto mining and crypto reacts to the congressional inquiry into Big Tech's market dominance.

via CoinDesk https://www.coindesk.com/blockchain-bites-cardano-plus-token-tzero

Suspects Detained in Ukraine for Bomb Threats Demanding Bitcoin

Ukraine's security service detained two suspected terrorists who threatened to blow up buildings if they didn't receive bitcoin.

via CoinDesk https://www.coindesk.com/suspects-detained-in-ukraine-for-bomb-threats-demanding-bitcoin

CoinList Launches ‘Pro’ Exchange for Token Sale Buyers

The new CoinList Pro exchange aims to help institutional traders participate in the platform's dozen or so token sales in 2020.

via CoinDesk https://www.coindesk.com/coinlist-launches-pro-exchange-for-token-sale-buyers

Bitcoin News Roundup for July 30, 2020

With the price of bitcoin hovering near recent highs and some wondering whether we're poised for a pullback, CoinDesk's Markets Daily is back for your latest news roundup.

via CoinDesk https://www.coindesk.com/bitcoin-news-roundup-for-july-30-2020

Dharma Adds Uniswap Trading in Bid to Become ‘the Robinhood of DeFi’

Dharma, the Coinbase-backed decentralize finance startup, is adding token-exchange protocol Uniswap as its latest in-app offering.

via CoinDesk https://www.coindesk.com/dharma-adds-uniswap-trading-in-bid-to-become-the-robinhood-of-defi

Ether Addresses in Profit Have Soared 132% in a Year

Even with ether close to yearly highs, profitable addresses have more than doubled since last July.

via CoinDesk https://www.coindesk.com/ether-cryptocurrency-addresses-profit-risen-176-year

SEC Wants to Start Scrutinizing Binance Chain Transactions

Company executives anticipated that regulators might one day take an interest in Binance Chain

via CoinDesk https://www.coindesk.com/sec-binance-ciphertrace

Central Banks Are Privacy Providers of Last Resort

If central banks issue digital currencies, they'll be thrown into a debate about financial privacy in the modern era. Is that what they want?

via CoinDesk https://www.coindesk.com/central-banks-are-privacy-providers-of-last-resort

Bank of England Building Payments Network to Support a Potential Digital Pound

CoinDesk has learned the Bank of England's new settlement system is being built so it can be forwards compatible with a digital currency.

via CoinDesk https://www.coindesk.com/bank-england-settlement-system-support-digital-pound

Coda Protocol Touts User Growth One Year Into Testnet

The O(1) Labs project thinks recursive zk-SNARKs are the key to more manageable blockchains.

via CoinDesk https://www.coindesk.com/coda-protocol-touts-user-growth-one-year-into-testnet

China Aims to Be the World’s Dominant Blockchain Power – With Help From Google, Amazon and Microsoft

China's BSN could be met with geopolitical resistance as it continues to extend its global reach.

via CoinDesk https://www.coindesk.com/china-aims-to-be-the-worlds-dominant-blockchain-power-with-help-from-google-amazon-and-microsoft

Paxful Chips Away at LocalBitcoins’ Russian P2P Market Dominance

Paxful’s year-old foray into Russian crypto markets is paying off for the peer-to-peer exchange.

via CoinDesk https://www.coindesk.com/paxful-russia-peer-to-peer

Circle Gets $25M From DCG to Drive USDC Mainstream

USDC backer Circle is teaming with Genesis Trading in a $25 million deal aimed at pushing the stablecoin to the fintech masses.

via CoinDesk https://www.coindesk.com/circle-gets-25m-from-dcg-to-drive-usdc-mainstream

First Mover: Sleepy Fed Meeting Belies Tense Economic Reality (Brrr) That May Buoy Bitcoin

It didn't really matter to bitcoin traders that the Federal Reserve's meeting this week was so anticlimactic. The real action is ongoing – in the form of more money injections.

via CoinDesk https://www.coindesk.com/first-mover-sleepy-fed-meeting-tense-economic-reality-brrr-buoy-bitcoin-cryptocurrency

Dapp Data Storage Provider Bluzelle to Begin Mainnet Launch in August

Distributed data storage network Bluzelle is starting the launch of its mainnet on Aug. 8, the company announced Thursday.

via CoinDesk https://www.coindesk.com/dapp-data-storage-provider-bluzelle-to-begin-launch-of-its-mainnet-in-august

tZERO Slashes Jobs, Salaries as It Gears Up for Another Funding Round

In an attempt to improve its cash burn rate, tZERO has slashed its headcount and asked senior staff to take equity as it prepares for a new raise.

via CoinDesk https://www.coindesk.com/tzero-jobs-salaries-gears-another-funding-round

Police Arrest 27 Alleged Masterminds Behind $5.7B Plus Token Crypto Scam

Chinese police have arrested 27 leaders and 82 others suspected of operating the Ponzi scheme.

via CoinDesk https://www.coindesk.com/police-arrest-27-alleged-masterminds-behind-5-7b-plus-token-crypto-scam

Malaysia’s Stock Exchange Eyes Blockchain for Bond Market Digitization

Known as Project Harbour, the initiative will use distributed ledger technology as a register for a bond marketplace.

via CoinDesk https://www.coindesk.com/malaysia-stock-exchange-blockchain-dlt-bond-market-digitization

Cardano Introduces Proof-of-Stake With ‘Shelley’ Hard Fork

It's alive! Cardano has successfully hard forked to its major upgrade, Shelley, which introduced proof-of-stake to the network

via CoinDesk https://www.coindesk.com/cardano-introduces-proof-of-stake-with-shelley-hard-fork

Wednesday 29 July 2020

CoinDesk Live Recap: Ethereum’s DeFi Luminaries Discuss What’s Next

MakerDAO's Rune Christensen, Compound's Robert Leshner and Uniswap's Hayden Adams discussed the state of the $3.8 billion DeFi market.

via CoinDesk https://www.coindesk.com/coindesk-live-recap-ethereums-defi-luminaries-discuss-whats-next

CoinDesk Live Recap: The DAO Hack Is Still a Mystery

The DAO attack was a foundational episode in Ethereum history. On Tuesday, CoinDesk Live gathered a handful of blockchain veterans to look back.

via CoinDesk https://www.coindesk.com/coindesk-live-recap-the-dao-hack-is-still-a-mystery

A Crypto Derivatives Exchange Is Getting a Nasdaq Listing in Q3

Originally postponed due to the pandemic, EQUOS.io is still set to be the first crypto exchange on the Nasdaq.

via CoinDesk https://www.coindesk.com/equos-crypto-derivatives-exchange-nasdaq-listing

How DeFi Could Disrupt Traditional Finance, Feat. Sergey Nazarov

"Imagine a world without counterparty risk..." - Chainlink's co-founder Sergey Nazarov shares why the move from brand-based contracts to math-based contracts is inevitable.

via CoinDesk https://www.coindesk.com/how-defi-could-disrupt-traditional-finance-feat-sergey-nazarov

Who should join Coinbase: Builders

Coinbase is an exciting and unique company and as we continue growing, it’s important that we create a strong culture. A few years ago, I wrote in the Coinbase culture doc:

Hire builders

We hire people who are passionate about creating new products with technology. We look for entrepreneurs who are comfortable with ambiguity. We prefer to work with people who actually execute toward ideas, instead of just coming up with them. When the creative moment strikes, we try not to let big company process get in the way or slow them down.

Today, I want to expand on this concept, and flesh out what it means to hire builders, so that people thinking of joining Coinbase can make an informed decision.

What do I mean when I say we want to hire builders?

At the root, builders create value in the world instead of taking or destroying it. They help build companies and make products, because they want to improve the world. When builders make things people want, not only do they solve customer problems, they also create jobs, grow the economy, and generate wealth in society.

Builders love working on important and ambitious missions. They know that the only way to accomplish a mission like this is with relentless focus. They try to ignore all of the other things that can distract a company, and keep the team united toward this goal, with everyone rowing in the same direction. They want to know how their work connects to the mission, and try to maximize the percent of their time that goes to delivering customer value.

Builders are pro technology. They recognize that science and engineering are some of the best levers we have to improve the world. In every industry, including education, financial services, healthcare, entertainment, energy, and more, the greatest improvements we’re seeing are coming from technology. Technology is what can help solve the world’s biggest problems, from climate change to improving education. Technology also drives down costs, making expensive initial prototypes eventually cheap enough for everyone. Builders are technological progressives: they believe that by investing in science, engineering, and technology we can create a better world.

Builders are inherent optimists. They believe the future will be better, and they have a plan to get there. They recognize that, over the arc of history, the human condition has improved dramatically, and that this trend can continue, when smart, dedicated people come together to build solutions. They recognize that “a small group of thoughtful, committed citizens can change the world….[and] indeed, it is the only thing that ever has.”

Builders are supportive of others who are trying to improve the world. They recognize that it’s easy to be a critic, but it’s hard to build something new that really helps people. They celebrate people who attempt the impossible and stumble, instead of trying to tear them down or belittle them, because they know how difficult it is to build.

Builders are unusually resilient and determined. They move from one setback to the next with enthusiasm. They know that it took Thomas Edison many attempts to create the light bulb, the Wright Brothers many attempts to achieve the first powered flight, and NASA many attempts (and human lives) to reach the moon. They have the audacity to believe they can achieve the impossible, and pick themselves up, even after repeated failure. They manage their own psychology to keep morale high, especially when the going gets tough.

Builders work hard. They want to join winning teams where sustained high performance is expected from everyone, because they recognize this improves their chances of building something great. And they also work hard because they love it. They find it incredibly fulfilling to work on something that matters. At the same time, they know how to rest and avoid burnout, to improve their productivity and creativity over the long term.

Builders care about profit because a company without profit is less likely to accomplish its mission. More capital means a company can hire more builders to come join the team, and it is an important measure of whether customer value is really being created. They also want to own a piece of the businesses they help create, not only so they can create wealth for themselves and their families, but also so they can invest it in the future.

Builders care about responsibility to society. They only want to build products that are good for humanity, and minimize negative externalities. But they recognize that this is complex: the things people want are not always what is good for them, and any tool can be used for good or bad purposes. They know that they always have to be able to look themselves in the mirror, and believe they are net contributing to society. They don’t believe in taking shortcuts that would temporarily increase profitability. They optimize for the long term goal.

Builders believe in creative disruption and free markets. They want the best product at the lowest price to win, as determined by the customer, to accelerate progress in society. They don’t want any handouts and they don’t want entrenched incumbents to have an unfair advantage. They want their product to survive solely based on whether customers vote for it with their dollars.

Builders take a global perspective because they want to improve the lives of as many people as possible. They know that focusing on the largest market, say the U.S., may only allow them to reach 4.3% of the global population. With technology improving distribution and lowering costs, builders are increasingly able to have a global reach.

With this understanding of builders, my hope is that people can make a more informed decision about whether Coinbase is the right place for them. It takes a wide variety of people to come together and make a company like Coinbase work. We have many roles and opportunities, but we all share some of these values around how to make a contribution to the world.

The mission of Coinbase is to create an open financial system for the world. This is no small task. It’s going to require dedicated focus for many years to come, and there will be many milestones and setbacks along the way. For those who join the team, they will know that they put a dent in the universe, and helped create economic freedom for millions of people around the world. Please check out our open roles here.

Who should join Coinbase: Builders was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/who-should-join-coinbase-builders-80e90daa10b9?source=rss----c114225aeaf7---4

Federal Reserve Keeps Rates Close to Zero, Continues Buying Treasurys

The Federal Reserve said Wednesday it would hold benchmark U.S. interest rates close to zero and continue buying Treasury bonds to support the coronavirus-devastated economy.

via CoinDesk https://www.coindesk.com/federal-reserve-keeps-rates-close-to-zero-continues-buying-treasuries

Coinbase Now Offers 2% Rewards on Dai Stablecoin Accounts

The program applies to customers residing in the U.S., U.K., The Netherlands, Spain, France and Australia.

via CoinDesk https://www.coindesk.com/coinbase-now-offers-2-rewards-on-dai-stablecoin-accounts

Indian Users Almost 5 Times More Likely to Encounter Crypto Hacking: Microsoft Report

According to a cybersecurity report by Microsoft, among countries in Asia-Pacific, Sri Lanka faces the highest rate of encounter with such attacks with neighboring India in second place.

via CoinDesk https://www.coindesk.com/indian-users-almost-five-times-more-likely-to-encounter-crypto-hacking-report

Coinbase launches Dai Rewards for customers in the US, UK, Netherlands, Spain, France, and…

Coinbase launches Dai Rewards for customers in the US, UK, Netherlands, Spain, France, and Australia

At Coinbase, we want to offer more ways for customers to earn rewards with their crypto. Last year, for example, we began offering stablecoin rewards to US customers for every USD Coin (USDC) held on Coinbase. We also launched Dai on Coinbase Earn, where customers can earn crypto by watching videos and taking quizzes about different cryptocurrencies.

Today, we’re introducing Dai Rewards, with 2% APY* for customers in the US, UK, Netherlands, Spain, France, and Australia. With yields on savings accounts and government bonds at record lows, earning rewards on stablecoins like Dai and USDC stands out as an alternative way to passively generate income using crypto held on Coinbase.

Stablecoins that aim to maintain a stable value of $1, like USDC and Dai, can be useful because they are not subject to the same volatility as many other cryptocurrencies. This is one reason stablecoins have grown to a market cap of more than $12 billion, as people use them to hold funds without volatility, transfer funds quickly and cheaply, and gain exposure to the US dollar.

Eligible customers will begin earning rewards automatically once they have $1 of Dai in their Coinbase accounts. Initial rewards will be distributed within five business days, then every day following, which means customers can use or withdraw their rewards as soon as they receive them. Customers always maintain control of their funds — their Dai stays in their accounts and can be withdrawn instantly at any time.

To get started with Dai Rewards, customers can simply buy Dai on Coinbase or send Dai to their Coinbase accounts from an external wallet.

*Learn more about eligibility and APY on our support center and our Dai Rewards terms.

Coinbase launches Dai Rewards for customers in the US, UK, Netherlands, Spain, France, and… was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

via The Coinbase Blog - Medium https://blog.coinbase.com/coinbase-launches-dai-rewards-for-customers-in-the-us-uk-netherlands-spain-france-and-1519113f8d2f?source=rss----c114225aeaf7---4

Blockchain Bites: Ledger’s Breach, Celsius’ Contradictions and DeFi’s Next Frontier

Liquidity mining is coming to PoS blockchains, Ledger was breached and why bitcoin's rally has legs.

via CoinDesk https://www.coindesk.com/blockchain-bites-ledger-celsius-defi

DeFi Lender Aave Rolls Out Governance Token on Path to Decentralization

Aave will transfer ownership of the protocol to a “genesis governance” built and approved by LEND token holders. It will also swap LEND tokens for AAVE.

via CoinDesk https://www.coindesk.com/defi-lender-aave-rolls-out-governance-token-on-path-to-decentralization

Bitcoin News Roundup for July 29, 2020

With the battle for CBDC dominance in the East heating up and smart contract use skyrocketing as Ethereum turns five, CoinDesk's Markets Daily is back with another news roundup.

via CoinDesk https://www.coindesk.com/bitcoin-news-roundup-for-july-29-2020

Marine Corps Bans Crypto Mining Apps From Government-Issued Mobile Devices

The Tuesday memo does not give a specific reason for the bitcoin mining ban but broadly cited security concerns.

via CoinDesk https://www.coindesk.com/marines-ban-bitcoin-mining-government-phones

Binance Australia Is Actually Run by the Founders of TravelbyBit

CoinDesk has discovered Binance Australia is operated by InvestbyBit, a company that shares directors with tourist crypto payments provider, TravelbyBit.

via CoinDesk https://www.coindesk.com/binance-australia-run-founders-travelbybit

Marathon Boosting Bitcoin Mining Game With 1,360 More Rigs Arriving in August

The publicly traded firm has bought hundreds of rigs from mining hardware rivals MicroBT and Bitmain.

via CoinDesk https://www.coindesk.com/marathon-boosting-bitcoin-mining-game-with-1360-more-rigs-arriving-in-august

Why Bitcoin Is Protected by the First Amendment

Bitcoin's role as a communications and associative network - not just a financial network - means it deserves constitutional protection.

via CoinDesk https://www.coindesk.com/why-bitcoin-is-protected-by-the-first-amendment

Carbon Credits Have a Double-Spend Problem. This Microsoft-Backed Project Is Trying to Fix It

The Microsoft-backed IWA sustainability group is building a tokenization standard that aims to bring transparency to carbon accounting.

via CoinDesk https://www.coindesk.com/carbon-credits-have-a-double-spend-problem-this-microsoft-backed-project-is-trying-to-fix-that

Bitcoin Looks Overbought But Analysts Play Down Drop Fears

Bitcoin's rally looks overstretched, according to a technical indicator, but short-term price consolidation looks more likely than a drop, say analysts.

via CoinDesk https://www.coindesk.com/bitcoin-looks-overbought-but-analysts-play-down-drop-fears

First Mover: Crypto Traders ‘Greedy’ as Goldman Warns on Dollar

As the dollar faces a diluted world status, cryptocurrencies like ether and bitcoin are soaring, with a popular sentiment index now registering "greed."

via CoinDesk https://www.coindesk.com/first-mover-crypto-traders-greedy-as-goldman-warns-on-dollar

Digital Yen Now ‘Top Priority’ for Japan Central Bank, Says Senior Official

The comments mark a shift in priority for Japan as it seeks to counter the economic threat from regional rival China.

via CoinDesk https://www.coindesk.com/digital-yen-now-top-priority-for-japan-central-bank-says-senior-official

Why DeFi on Ethereum Is Like Algorithmic Trading in the ‘90s

DeFi's surge has created an interesting dynamic: Traditional fund managers are beginning to experiment with what decentralization has to offer.

via CoinDesk https://www.coindesk.com/why-defi-on-ethereum-is-like-algorithmic-trading-in-the-90s

How the EEA Made Ethereum Palatable to Big Business

Formed in 2017, the Enterprise Ethereum Alliance (EEA) helped large corporates and tech providers experiment with blockchain.

via CoinDesk https://www.coindesk.com/how-the-eea-made-ethereum-palatable-to-big-business

Crypto Wallet Maker Ledger Loses 1M Email Addresses in Data Theft

An unknown hacker gained access to the wallet maker's marketing database, stealing a million email addresses as well as personal information for 9,000 customers.

via CoinDesk https://www.coindesk.com/crypto-wallet-ledger-email-addresses-data-theft

Pantera Capital Leads $2.6M Seed Round for DEX Protocol Injective

The protocol, incubated by Binance Labs, sets out to solve some of the issues facing users of decentralized exchanges.

via CoinDesk https://www.coindesk.com/pantera-capital-leads-2-6m-seed-round-for-dex-protocol-injective

605 Days Later: How ArCoins Got the SEC Go-Ahead as an Ethereum-Traded Treasuries Fund

A look inside Arca and TokenSoft’s 605-day crusade to register the first Ethereum blockchain-native ‘40 Act Fund.

via CoinDesk https://www.coindesk.com/arcoins-blockchain-traded-fund-arca-tokensoft

Australian Crypto Exchanges Partner With Koinly to Simplify Tax Reporting for Users

With tax reports for crypto transactions being complex and time-consuming to prepare, Koinly said its service automates the process in just minutes.

via CoinDesk https://www.coindesk.com/australian-crypto-exchanges-partner-with-koinly-to-simplify-tax-reporting-for-users

Tuesday 28 July 2020

EU Outlines Tech Specs for Nodes in Its Blockchain Services Testnet

Participating member states can stage their testnet nodes on hardware with specs roughly equivalent to a PC gamer’s tower.

via CoinDesk https://www.coindesk.com/eu-blockchain-testnet-nodes

Is Bitcoin Mining Legal in India? Miners Still Don’t Know

Following a recent Supreme Court decision, India's crypto industry is optimistic about the future. But miners still don't know if what they do is illegal.

via CoinDesk https://www.coindesk.com/is-bitcoin-mining-legal-in-india-miners-still-dont-know

Digital Intelligence Firm Cellebrite Launches Crypto Tracing Tool Powered by CipherTrace

Israel-based digital forensics firm Cellebrite announced the launch of its cryptocurrency and blockchain tracing tool on Tuesday.

via CoinDesk https://www.coindesk.com/cellebrite-launches-crypto-tracing-tool-powered-by-ciphertrace

Expectations for Even Further Bitcoin Gains Keep Lid on Futures Contracts Liquidations

Only $133 million in futures were liquidated on BitMEX as bitcoin soared above $11,400.

via CoinDesk https://www.coindesk.com/expectations-for-even-higher-bitcoin-price-keep-lid-on-futures-contracts-liquidations

Foundation Devices Enters The Sovereign Hardware Game With Passport Bitcoin Wallet

A new hardware provider is entering the Bitcoin fray with the launch of a cold storage wallet and some ambitious plans to serve Bitcoiners with a full stack of sovereignty tools.

The Boston-based Foundation Devices announced today its new Passport hardware wallet, an air-gapped device that sports a camera for scanning QR codes, a physical keypad, open-source software and a screen with circuitry etched into the glass — all in the name of creating the most secure solution on the market that is also easy for newbies to use.

“Hardware wallets are the most established consumer hardware market in the Bitcoin space, with an assortment of companies competing for market share,” Zach Herbert, the CEO of Foundation Devices, told Bitcoin Magazine. “But in our opinion, none of these incumbents have made a product that, one: strikes the right balance between security and design and, two: makes it easy for new Bitcoiners to self-custody their coins.”

On the security front, perhaps the most notable feature is the Passport’s complete lack of USB or wireless communication, minimizing the attack vectors through which malicious actors might try and access the device. The only ways that data breaches the wallet is through its built-in camera or via a microSD card. This puts the Passport in the same league as the Cobo Vault, which is also air gapped.

On the usability front, the Passport does not ask users to maintain a 12- or 24-word recovery seed in case they need to recover their wallet. Foundation instead stores the recovery seed on a microSD card and encrypts this with a password. This means that users can more easily recover their bitcoin, by simply inserting the card and entering the password, but that this recovery is still relatively secure, as an attacker would need to access both the card and the password to steal funds. Foundation Devices includes two microSD cards with every wallet.

“We believe that the recovery seed is a challenging concept for new Bitcoiners and also represents a significant attack vector — no matter how secure a user’s hardware wallet, if an attacker finds the recovery seed, then it is game over,” Herbert explained. “We feel strongly that this will enable a better user experience and reduce user error.”

But Foundation Devices doesn’t want to stop at offering an intuitive and secure hardware wallet. Herbert envisions the company as a full stack provider for those who hope to achieve sovereignty through technology that protects their privacy. He said that he hopes to add phones and computers to its roster by the end of this decade, but will be focusing on more Bitcoin-specific hardware next.

“Our next product will be a Bitcoin full node that’s elegant, easy to use and more functional than existing offerings,” he said. “We are also interested in open-source security chips and meshnet hardware.”

As it continues down this path toward a suite of hardware offerings, the Foundation Devices team emphasizes its domestic manufacturing. Not only does this mean the company can maintain tighter control over its supply chain, but this makes it fairly unique in the hardware wallet space and Herbert pointed out that users may leverage that fact to gain a new level of multisig security.

“Multisig users may want to protect against supply chain risk by purchasing hardware wallets made in different geographic locations,” he said. “For example, a Coldcard made in Canada, a Trezor made in Europe and a Passport made in the U.S.A. could make for a more secure multisig setup.”

Foundation Devices is offering the first 1,000 unit run of Passport wallets for reserve on its website. It expects to launch the device for preorder in August and to ship them by the upcoming holiday season.

The post Foundation Devices Enters The Sovereign Hardware Game With Passport Bitcoin Wallet appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/foundation-devices-enters-the-sovereign-hardware-game-with-passport-bitcoin-wallet?utm_source=rss&utm_medium=rss&utm_campaign=foundation-devices-enters-the-sovereign-hardware-game-with-passport-bitcoin-wallet

Deribit Reports Daily Record $539M of Bitcoin Options Traded, More Than Double Prior High

Exchange Deribit has more than doubled on its previous daily record with well over $500 million worth of bitcoin options traded.

via CoinDesk https://www.coindesk.com/deribit-bitcoin-options-traded-biggest-day

With Bitcoin ATMs, CoinFlip Is Banking The Unbanked

This is a promoted article provided by CoinFlip.

There are now many ways to obtain bitcoin and join the growing revolution in sovereign digital wealth. Among them, you can mine bitcoin, you can earn bitcoin in exchange for goods or services and you can buy bitcoin for fiat currency through a credit card or bank account on an online exchange.

But perhaps no other vehicle for gaining bitcoin is as frictionless for the underbanked and unbanked around the world than Bitcoin ATMs.

As their name implies, Bitcoin ATMs are automatic teller machines that are quite similar to traditional ATMs, except that they allow users to buy and sell bitcoin, rather than withdraw fiat currency from their bank accounts. They serve those around the world who want to onboard to Bitcoin — a system designed to remove the financial gatekeepers that create inequality in the traditional economic system — by providing all of the interfacing needed to convert cash in hand into the world’s preeminent digital currency.

CoinFlip, which operates 750 Bitcoin ATMs across the United States as the highest-volume provider in the space, maintains some of the lowest barriers to buying bitcoin for those who could use it most.

In addition to a bitcoin wallet and any fiat cash they are hoping to convert, users can begin buying bitcoin at a CoinFlip ATM with as little as a mobile phone number and a name.

“Bitcoin ATMs are general tools for banking the unbanked because unlike other cryptocurrency onramps, people are able to get access to bitcoin with cash and do not require a bank account,” Dustin Wei, CoinFlip’s head of business development, said. “While many other cryptocurrency onramps claim they want to foster the idea of banking the unbanked, an unbanked customer would not actually be able to use their services.”

CoinFlip has found that a significant portion of its Bitcoin ATM user base is comprised of underbanked and low-income individuals who want to transact primarily in cash. By accessing bitcoin, they have a brand new avenue for paying bills, transferring money seamlessly around the world, investing in a new asset, and more.

“There is no other way to buy cryptocurrency that’s nearly as inclusive and straightforward as a Bitcoin ATM,” Wei explained. “CoinFlip provides financial access to those who have been failed by traditional banks and also features 24/7 customer service to make the process less daunting. Satoshi would be proud.”

Ultimately, it’s this type of grassroots effort — making bitcoin accessible where it’s needed the most with as little barrier to entry as possible — that will help CoinFlip push bitcoin adoption far and wide. More so than with any other portal to bitcoin, this propulsion is the real narrative of Bitcoin ATMs.

CoinFlip recognizes bitcoin as a tool that’s increasingly helping people around the world send funds to their relatives overseas, which can be accomplished in minutes through its machines. To build on this, CoinFlip operates a trading desk (called CoinFlip Preferred) that can process wire transfers for cryptocurrency and handle credit card transfers on its website.

“CoinFlip hopes to create a global ecosystem of kiosks in order to push adoption,” said Wei. “CoinFlip also hopes to continue its mission to get crypto into as many people’s hands as possible. We are fast becoming a crypto conglomerate.”

The post With Bitcoin ATMs, CoinFlip Is Banking The Unbanked appeared first on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/with-bitcoin-atms-coinflip-is-banking-the-unbanked?utm_source=rss&utm_medium=rss&utm_campaign=with-bitcoin-atms-coinflip-is-banking-the-unbanked

Why Bitcoin-Like Scarcity Would Be a Disaster for the Dollar

Calls to restrict the Fed's money printing powers fail to recognize the likely consequences, including price instability.

via CoinDesk https://www.coindesk.com/why-bitcoin-like-scarcity-would-be-a-disaster-for-the-dollar

Swiss Exchange Lists World’s First Active Bitcoin ETP

FiCAS has listed the world's first actively-managed bitcoin ETP on Switzerland's SIX exchange.

via CoinDesk https://www.coindesk.com/actively-managed-bitcoin-etp

Fireblocks Claims Exchange Program Enables Zero-Confirmation Crypto Deposits

Fireblocks says its new system provides crypto deposits on exchanges with zero confirmations and in real time.

via CoinDesk https://www.coindesk.com/fireblocks-claims-new-program-enables-zero-confirmation-crypto-deposits

Bitcoin Futures Volume Surges 186% as Price Hits $11K

The market for Bitcoin futures snapped back into life on Monday as the cryptocurrency's price surged up to an 11-month high.

via CoinDesk https://www.coindesk.com/bitcoin-futures-volume-price

First Mover: The Dollar Drop May Have Helped Push Bitcoin Past $11K

As the U.S. dollar’s value slides, prices are suddenly rising for just about everything priced in dollars. That includes bitcoin, which shot up some 13% on Monday for its biggest gain in almost three months. Prices soared past levels reached in February, prior to the pandemic-induced sell-off, reaching a new 2020 high of $11,180. You’re reading First […]

via CoinDesk https://www.coindesk.com/first-mover-dollar-drop-helped-bitcoin

One Billion, Two Billion, Three Billion, Four? DeFi’s Knocking on TradFi’s Door

DeFi is an overnight success years in the making. From "The DAO" hack to $3.6 billion in total value locked, here's the history of decentralized finance.

via CoinDesk https://www.coindesk.com/ethereum-defi-platforms-eth-history

Memories of London’s Devcon 1, Ethereum’s ‘Woodstock’ Moment

Ethereum’s Devcon 1, held in London in November 2015, featured adventuresome bankers and Big 4 consultants mingling with dreadlocked coders.

via CoinDesk https://www.coindesk.com/devcon-1-ethereum-woodstock-moment

Australian State Treasury Proposes ‘Flexible’ Regulatory Reform for Blockchain

The New South Wales Treasury is exploring regulatory reform for blockchain technology citing the need to promote innovation.

via CoinDesk https://www.coindesk.com/australian-state-treasury-proposes-flexible-regulatory-reform-for-blockchain

Israel’s Stock Exchange Launches Blockchain Platform for Securities Lending

The new blockchain platform can facilitate peer-to-peer trading and allow the securities lending market to reach its full potential, the exchange said.

via CoinDesk https://www.coindesk.com/israels-stock-exchange-blockchain-platform-securities-lending

Staking on Ethereum 2.0 Takes First Step With Test System for Validators

The transition to Ethereum 2.0 and its proof-of-stake consensus model is finally underway.

via CoinDesk https://www.coindesk.com/staking-on-ethereum-2-0-takes-first-step-with-test-system-for-validators

Firm Uses Ethereum to Tokenize Sustainable Infrastructure in Fight Against Climate Change

UK-based fintech company Fasset aims to bridge the $15 trillion gap in sustainable infrastructure development with blockchain-backed investments.

via CoinDesk https://www.coindesk.com/firm-uses-ethereum-to-tokenize-sustainable-infrastructure-in-fight-against-climate-change

P2P Exchange LocalBitcoins Adds Crypto Surveillance Tools From Elliptic

Elliptic's tracing software bolsters the peer-to-peer exchange's anti-money laundering safeguards.

via CoinDesk https://www.coindesk.com/localbitcoins-adds-crypto-surveillance-tools-from-elliptic

Monday 27 July 2020

CoinDesk Live Recap: Ethereum Culture, Explained

Maker Foundation board member Tonya Evans and former ConsenSys CMO Amanda Cassatt joined Leigh Cuen on Monday to discuss Ethereum’s ethos.

via CoinDesk https://www.coindesk.com/coindesk-live-recap-ethereum-culture-explained

Tetras Capital Shuts Down Crypto Hedge Fund After 75% Loss

Tetras Capital, once a $33 million crypto hedge fund, is shutting down due to negative returns.

via CoinDesk https://www.coindesk.com/tetras-capital-shuts-down-crypto-hedge-fund-after-75-loss

Delphi Digital Podcast - Macro Matters: Laurence Kotlikoff - America is Broke

iframe: Host Jose Maria Macedo sits down with economist Laurence Kotlikoff, professor of economics at Boston University, president of Economic Security Planning, New York Times best-selling author and 2x presidential candidate. We discuss the US's fiscal state, $200T in off balance sheet liabilities, MMT as well as Laurence's solutions to the problems facing the US. We also spend some time discussing digital assets and the role they may play in this.

Thank you to our sponsor Crypto.com for making this happen! Visit bit.ly/cryptodelphi for more information!

Support The Show

To sponsor this top crypto research podcast, email Tom@DelphiDigital.io

Disclosures: This podcast is strictly informational and educational and is not investment advice or a solicitation to buy or sell any tokens or securities or to make any financial decisions. Do not trade or invest in any project, tokens, or securities based upon this podcast episode. The host may personally own tokens that are mentioned on the podcast. Tom Shaughnessy owns tokens in ETH, BTC, STX, SNX, RUNE, sUSD and HNT. Let's Talk Bitcoin is a distribution partner for the Chain Reaction Podcast, and our current show features paid sponsorships which may be featured at the start, middle and/or the end of the episode. These sponsorships are for informational purposes only and are not a solicitation to use any product or service. Guest host Kevin Kelly holds tokens in BTC, ETH, RUNE, and LEO.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/delphi-digital-podcast-macro-matters-laurence-kotlikoff-america-is-broke

Digital Bank Revolut Adds Stellar to List of Supported Cryptocurrencies

Users will now be able to buy and sell XLM on Revolut’s platform, the fintech firm announced Tuesday.

via CoinDesk https://www.coindesk.com/digital-bank-revolut-adds-stellar-to-list-of-supported-cryptocurrencies

Market Wrap: Bitcoin Blasts Past $10,000; Ethereum Fees Up 550% in 2020

Bitcoin is experiencing high volumes, pushing the price close to $11,000. Meanwhile, Ethereum fees are up 550% this year.

via CoinDesk https://www.coindesk.com/market-wrap-bitcoin-blasts-past-10000-ethereum-fees-up-550-in-2020

SPACs 101: A Bubble, the Future or Both?

A primer on, and critical look at, one of Wall Street’s hottest trends: special purpose acquisition companies.

via CoinDesk https://www.coindesk.com/spacs-101-a-bubble-the-future-or-both

How Millennials Are Shaping the Future of Money

The desire for autonomy, self-sufficiency and personalization is driving innovation in personal finance, including the shift to crypto.

via CoinDesk https://www.coindesk.com/how-millennials-are-shaping-the-future-of-money

Bitmain Spin-Off Launches Crypto Exchange to Go After Booming Options Market

Matrixport has set up its own derivatives exchange and now wants to take on Deribit, the market leader for crypto options.

via CoinDesk https://www.coindesk.com/bitmain-spin-crypto-exchange-capture-options-market

Blockchain Bites: Ethereum’s Lifestyle Brand, Twitch’s Crypto Discounts and MakerDAO’s $1B Milestone

A Ripple executive built an XRP payments platform, a Washington. D.C.. court ruled bitcoin is money and Ethereum miners' profits are soaring.

via CoinDesk https://www.coindesk.com/blockchain-bites-ethereums-lifestyle-brand-twitchs-crypto-discounts-and-makerdaos-1b-milestone

Why Debt Financing May Be a Double-Edged Sword for Bitcoin Miner Bitfarms

BitFarms used high-interest-rate debt with large balloon payments to expand operations. Now it may struggle to pay off its debt, according to CoinDesk Research.

via CoinDesk https://www.coindesk.com/why-debt-financing-may-be-a-double-edged-sword-for-bitfarms

Crypto News Roundup for July 27, 2020

With BTC breaking out, ETH exploding and gold at all-time highs, CoinDesk's Markets Daily is back with another crypto news roundup.

via CoinDesk https://www.coindesk.com/crypto-news-roundup-for-july-27-2020

Private Sector Could Bring Value to Future CBDC Launches, Says IMF Official

A director at the IMF has spoken of the value the private sector could bring to central bank digital currencies, should they be adopted by nations.

via CoinDesk https://www.coindesk.com/private-sector-could-bring-value-to-future-cbdc-launches-says-imf-official

Leading Austrian Telecom Provider Adds Cryptocurrencies to Its Cashless Payment Network

A1 Telekom Austria announced cryptocurrencies will now be available to use in its cashless payment app, allowing over 2,500 merchants to accept bitcoin, ether and dash.

via CoinDesk https://www.coindesk.com/leading-austrian-telecom-provider-adds-cryptocurrencies-to-payment-network

Silvergate’s Bitcoin-Backed Lending Product Grew 80% in the Last Quarter

Silvergate Bank continued to add a steady drip of crypto customers in Q2 but its issuance of bitcoin-collateralized loans is what stood out.

via CoinDesk https://www.coindesk.com/silvergates-bitcoin-backed-lending-product-grew-80-in-the-last-quarter

US Government Files Fresh Charges Against PlexCoin ICO Organizers

Having only settled with the SEC last year, the PlexCoin founders now face a fresh round of charges from the Department of Justice.

via CoinDesk https://www.coindesk.com/us-government-files-fresh-charges-against-plexcoin-ico-organizers

Odds of Bitcoin Hitting Record High in 2020 Are (Slightly) Up, Options Data Suggests

The likelihood of bitcoin challenging 2017's record high by the end of this year may have just nudged up – but don't raise your hopes too high just yet.

via CoinDesk https://www.coindesk.com/bitcoin-record-high-2020-slightly-up-options-data

You Can Now Buy Hedera Hashgraph’s HBAR Token via Simplex

Users can buy and sell cryptocurrency with a debit or credit card through global payment processor Simplex’s fiat gateway solution.

via CoinDesk https://www.coindesk.com/you-can-now-buy-hedera-hashgraphs-hbar-token-via-simplex

Bitstamp Backs BCB’s SWIFT Alternative for Instant Cash-Crypto Settlements

BCB Group is launching an instant settlement network for cash and crypto.

via CoinDesk https://www.coindesk.com/bitstamp-backs-bcbs-swift-alternative-for-instant-cash-crypto-settlements

First Mover: Bitcoin at Last Passes $10K, But Why Has It Struggled While Gold Shone?

It's a tricky thing to explain why bitcoin has been underperforming as central-bank money printing helps drive gold to a new record.

via CoinDesk https://www.coindesk.com/first-mover-bitcoin-at-last-passes-10k-but-why-has-it-struggled-while-gold-shone

FTX to Launch ‘Scalable’ Decentralized Exchange in Weeks

Building on the Solana blockchain means the new platform's operations are less restricted than those on Ethereum, the firm says.

via CoinDesk https://www.coindesk.com/ftx-to-launch-scalable-decentralized-exchange-in-weeks

MakerDAO Passes $1 Billion Milestone in DeFi First

The total value of ether locked in DeFi's oldest project has surpassed $1 billion for the first time.

via CoinDesk https://www.coindesk.com/makerdao-passes-1-billion-milestone-in-defi-first

Ripple’s Director of Product Unveils P2P Payments Platform Using XRP

Craig DeWitt has unveiled the beta release of a personal peer-to-peer payments project that will work in popular web browsers.

via CoinDesk https://www.coindesk.com/ripples-director-of-product-unveils-p2p-payments-platform-using-xrp

Twitch Doubles Down on Crypto, Gives Subscribers 10% Discount

By offering a discount, video streaming platform Twitch is encouraging users to actually use cryptocurrencies for goods and services.

via CoinDesk https://www.coindesk.com/twitch-doubles-down-crypto-users-discount

Ethereum Miners’ Income Soars by 60% in a Month – Outruns Ether’s Price Jump

Ethereum miners may have benefited the most from ether’s recent price rise and soaring transaction fees.

via CoinDesk https://www.coindesk.com/ethereum-miners-income-soars-by-60-in-a-month-outruns-ethers-price-jump

85% of Italian Banks Are Exchanging Interbank Transfer Data on Corda

Banks across Italy are using R3’s Corda blockchain to vastly speed up the process of double-checking transaction logs.

via CoinDesk https://www.coindesk.com/85-of-italian-banks-are-exchanging-interbank-transfer-data-on-corda

Sunday 26 July 2020

Ethereum as Lifestyle Brand: What Unicorns and Rainbows Are Really About

Ethereum is more than a technology, it’s a lifestyle. Beyond cryptocurrency, the software has attracted a diverse community of contributors.

via CoinDesk https://www.coindesk.com/ethereum-as-lifestyle-brand-what-unicorns-and-rainbows-are-really-about

Crypto Long & Short: Where Fintech Ends and Crypto Begins

Parts of fintech may be embracing crypto, but Noelle Acheson argues that doesn’t mean crypto is fintech – it’s more than that.

via CoinDesk https://www.coindesk.com/crypto-long-short-where-fintech-ends-and-crypto-begins

The Future for Unregulated Bitcoin Exchanges

CoinDesk's Anna Baydakova talks to non-custodial p2p exchanges Hodl Hodl and Bisq about why we still want no-KYC bitcoin.

via CoinDesk https://www.coindesk.com/the-future-for-unregulated-bitcoin-exchanges

Bitcoin Rises Above $10,000 for First Time Since Early June

Bitcoin Price Logs Two-Month High Above $10,000

The DeFi-led rally in Ethereum's ether token looks to have spilled over into the bitcoin market, one analyst said.

via CoinDesk https://www.coindesk.com/bitcoin-price-logs-two-month-high-above-10000

Is This China’s Century or the US’s? Maybe It’s Both

This Long Reads Sunday is a reading of Adam Tooze's recent review of four books on the growing conflict between the U.S. and China.

via CoinDesk https://www.coindesk.com/is-this-chinas-century-or-the-uss-maybe-its-both

Saturday 25 July 2020

What Sex Workers Want to Do With Bitcoin

Sex workers are starting their own businesses and working online, thanks to social media, according to this adult content creator.

via CoinDesk https://www.coindesk.com/what-sex-workers-want-to-do-with-bitcoin

As Economic Indicators Get Worse, the US Revs Up the Next Multi-Trillion Stimulus

The Breakdown Weekly Recap covers growing U.S.-China tensions, worsening job numbers and the next casual $1-$3 trillion in stimulus.

via CoinDesk https://www.coindesk.com/as-economic-indicators-get-worse-the-us-revs-up-the-next-multi-trillion-stimulus

From Enron to Wirecard: How Blockchain Tech Could Have Helped

If blockchain technology is used within a regulated financial system, Wirecard-esque scandals can be a thing of the past, writes BRD CEO Adam Traidman.

via CoinDesk https://www.coindesk.com/from-enron-to-wirecard-how-blockchain-tech-could-have-helped

Elon Musk, Blasting Off in Domestic Bliss

Friday 24 July 2020

The Delphi Podcast - Ryan Gill: A Crucible Moment Pt 1 - Metaverse Musings

Host Piers Kicks sits down with Ryan Gill the Founder and CEO of Crucible for Episode 02 of Metaverse Musings. Both Ryan and his Co-Founder Toby Tremayne have been hard at work laying the foundations for an exciting chapter in the evolution metaverse. Keep an eye on Crucible as more information comes online in the coming weeks as the company officially moves out of stealth. We talk through Ryan's White Mirror philosophy, their blueprints for the open metaverse, and the worlds of tomorrow. Stay tuned for Part 2 which will feature Toby for a more granular technical exploration of the themes covered. https://crucible.network/

Support The Show

- AltoIRA With an Alto CryptoIRA, just open and fund a Traditional, Roth, or SEP CryptoIRA account, then get ready to invest.

To sponsor this top crypto research podcast, email Tom@DelphiDigital.io

Disclosures: This podcast is strictly informational and educational and is not investment advice or a solicitation to buy or sell any tokens or securities or to make any financial decisions. Do not trade or invest in any project, tokens, or securities based upon this podcast episode. The host may personally own tokens that are mentioned on the podcast. Tom Shaughnessy owns tokens in ETH, BTC, STX, SNX, RUNE, sUSD and HNT. Let's Talk Bitcoin is a distribution partner for the Chain Reaction Podcast, and our current show features paid sponsorships which may be featured at the start, middle and/or the end of the episode. These sponsorships are for informational purposes only and are not a solicitation to use any product or service. Guest host Kevin Kelly holds tokens in BTC, ETH, RUNE, and LEO.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/the-delphi-podcast-ryan-gill-crucible-moment-metaverse-musings

CoinDesk’s Twitter Hack Proved the Media Can’t Rely on Web 2.0

Last week's Twitter hack, which downed a key CoinDesk channel for seven days, showed how news groups are overly dependent on social media.

via CoinDesk https://www.coindesk.com/coindesks-twitter-hack-proved-the-media-cant-rely-on-web-2-0

Market Wrap: Bitcoin Near $9,600 as Gold Hits High, Uniswap Liquidity Over $100m

Bitcoin is up for the week, gold gets a new high and DeFi keeps growing.

via CoinDesk https://www.coindesk.com/market-wrap-bitcoin-near-9600-as-gold-hits-high-uniswap-liquidity-over-100m

Could the European Recovery Plan Actually Break Europe Apart?

The EU’s Recovery Plan agreement has been widely hailed, but some argue that it is taking Europe down a dangerous path.

via CoinDesk https://www.coindesk.com/could-the-european-recovery-plan-actually-break-europe-apart

Around the Block #7: Understanding yield farming and the latest developments in DeFi

Coinbase Around the Block, sheds light on key issues in the crypto space. In this edition, Justin Mart explores the rapidly evolving DeFi landscape and the emergence of “yield farming”, as well as other notable news in the space.

DeFi and the Yield Farming Phenomenon

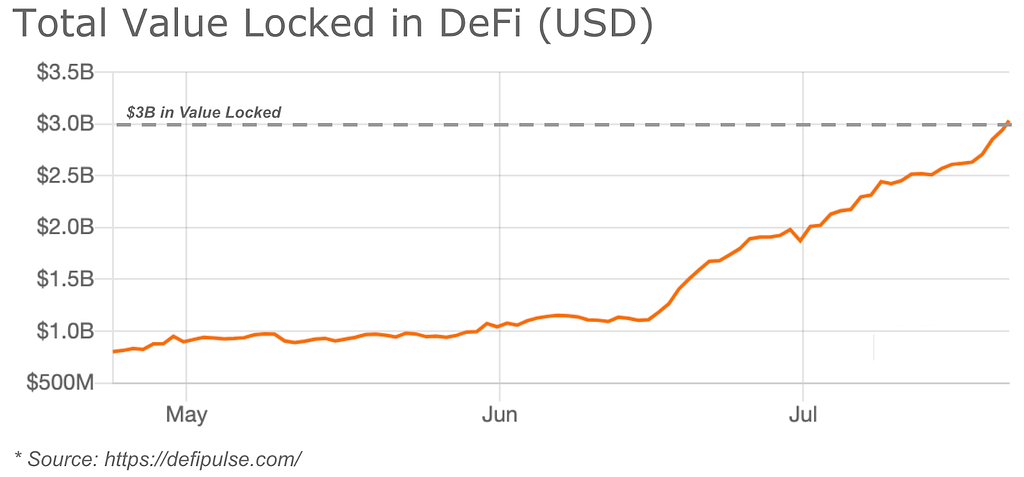

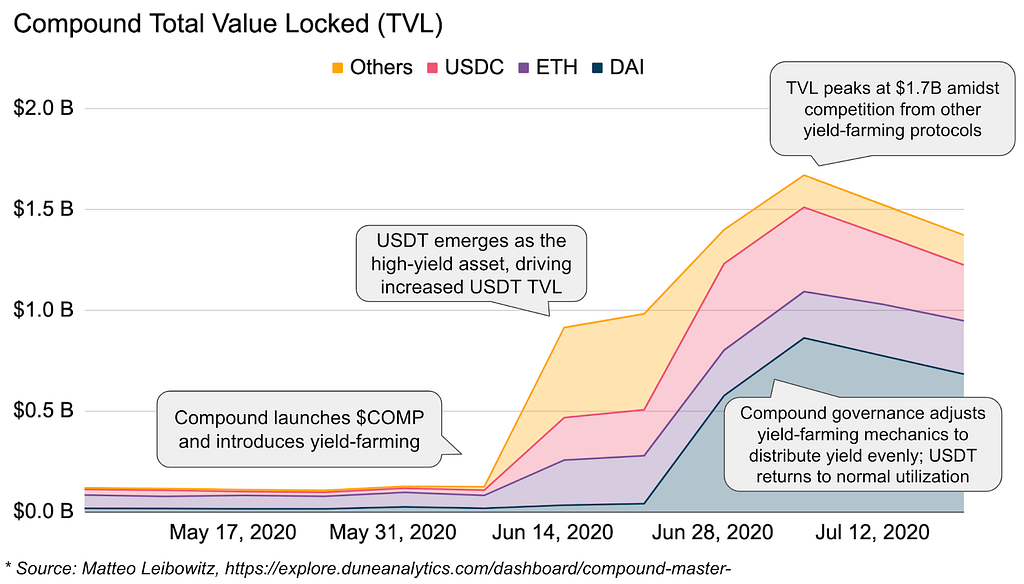

DeFi protocols exploded in all metrics over the last month, passing $3B in Total Value Locked (TVL), triggered by the launch of the Compound governance token ($COMP) and subsequent “yield farming.”

What is Yield Farming?

Most crypto protocols are designed to be decentralized. For base-level networks (like Bitcoin and Ethereum), this is achieved through Proof of Work, where anyone can be a miner and earn some BTC or ETH in exchange for helping secure the network. In so doing, control of the network is more or less democratic (one CPU one vote).

But how do projects built on Ethereum achieve decentralization? One path is to hand over governance in the form of tokens to the users of a protocol, effectively turning users into stakeholders. This is precisely what Compound (an autonomous borrow/lend protocol) pioneered. They are releasing $COMP tokens, which provides governance rights over the Compound protocol, to the users of the network, distributed pro-rata according to how much they use the protocol.

Sounds good, right? Two observations:

- $COMP governance tokens hold value. Compound is the leading DeFi borrow/lend protocol, and governance rights over this network are powerful.

- Distributing $COMP pro-rata to users of the protocol is free yield. It’s an added bonus just for using Compound.

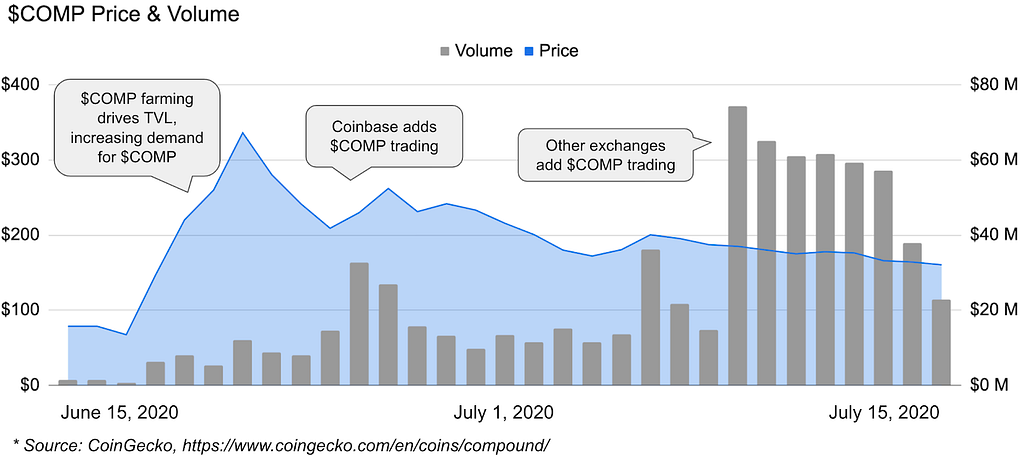

When $COMP was released, the token quickly appreciated in value owing to Compound’s leading position in the DeFi ecosystem. The community quickly realized that adding assets to Compound and/or borrowing against them resulted in significant interest rates due to the additional $COMP being distributed (topping 100% APY at some points).

Ergo, the practice of using a protocol to earn native platform tokens is known as “yield farming.”

What Happened with Compound

Yield farming drove a flood of capital into Compound — in a single week in mid-June nearly half a billion dollars was added to Compound, driving total value locked (TVL) from $100M to over $1.7 B at the peak. $COMP similarly opened trading around $80 and exploded to over $300.

However, not all metrics are as honest as they appear. With Compound, it’s possible to recursively invest your capital, multiplying your yield. It goes like this:

- Add 100 USDC as collateral to Compound (earning interest + $COMP)

- Borrow 70 DAI against your 100 USDC collateral (paying interest but earning $COMP)

- Trade 70 DAI for 70 USDC (bonus: on a DEX)

- Repeat Step 1

DeFi composability adds another dimension, where it’s also possible to stack your yield across different protocols. For example, you could lock DAI in Compound, and deposit your compound-DAI tokens into Balancer for additional yield farming.

Popular DeFi tracker defipulse.com does some cleaning on reported TVL to account for these effects. As of July 23, 2020 they report Compound’s TVL at $550M.

Yield Farming is Not Without Risk

In efficient markets, increased yield is reflective of increased risk. While DeFi is a largely inefficient market today, outsized DeFi yields are still indicative of additional risk:

- Smart Contract risk: Smart contracts are prone to exploits, with several examples just this year (bZx, Curve, lendf.me). The surge in DeFi has led to millions in value being slammed into nascent protocols, increasing the incentive for attackers to find exploits.

- System design risk: Many protocols are nascent and the incentives can be gamed. (E.g., Balancer, where FTX was able to capture >50% of the yield due to a simple flaw)

- Liquidation risk: Collateral is subject to volatility, and debt positions are at risk of becoming undercollateralized in market swings. Liquidation mechanisms may not be efficient, and could be subject to further loss.

- Bubble risk: The price dynamics of the underlying network tokens (like $COMP) are reflexive because expected future value follows usage, and usage is incentivized by expected future value.

In general, DeFi protocols with significant capital are honeypots for exploits. In just one week, the Balancer protocol was gamed by an exchange, changed its protocol rules, got hacked, and saw the token price go up 3x! In some ways DeFi is still the wild west — be careful out there.

Downstream effects: A Look at the Broader DeFi Ecosystem

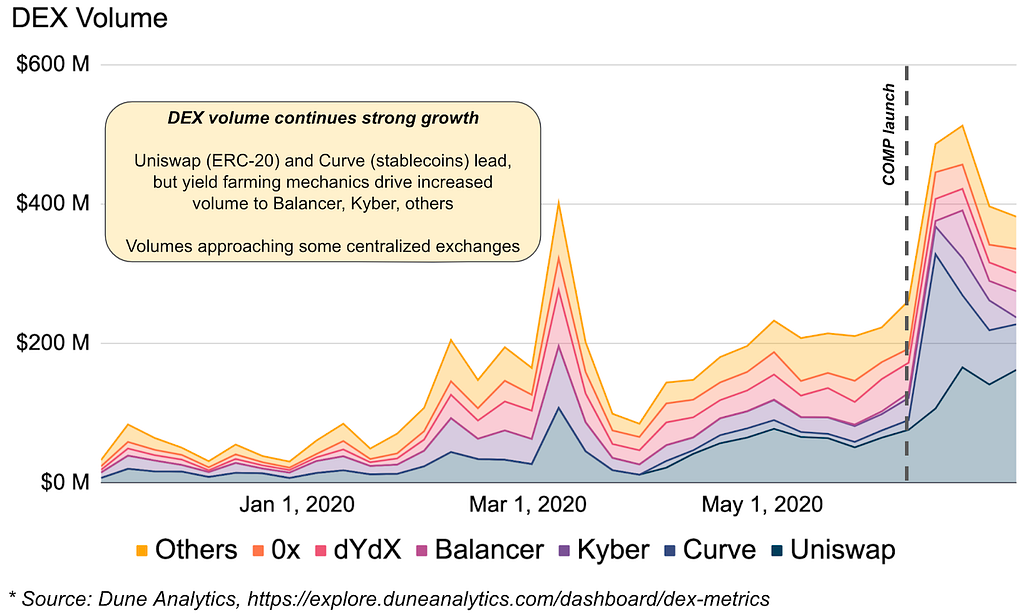

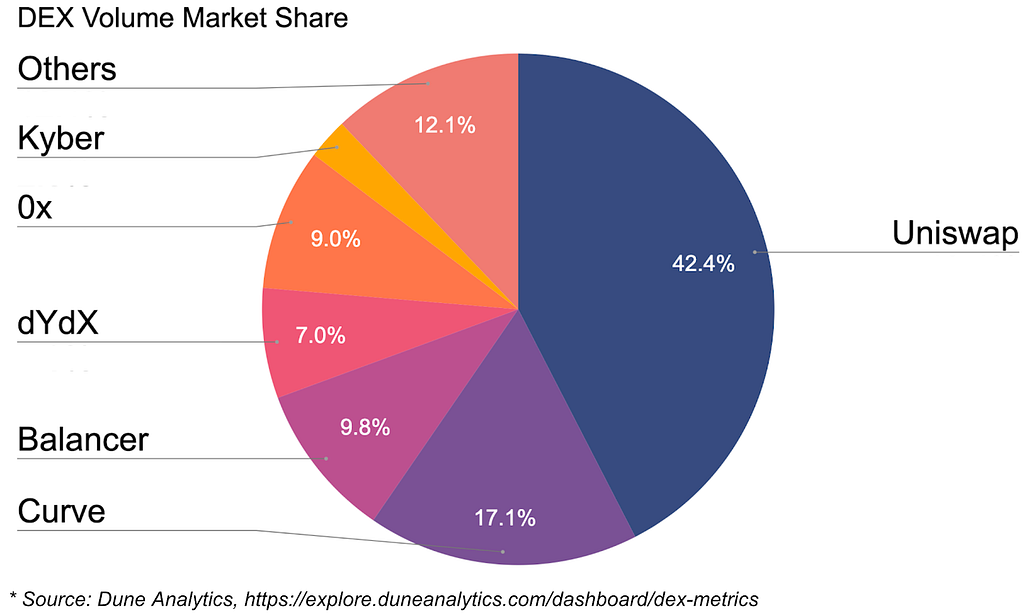

DEX Volume explodes, begins to rival Centralized Exchange volumes

DEX volume rocketed upwards over the last month, and has begun to rival some centralized exchanges.

This is a direct result of yield farming, especially when recursively borrowing and lending requires swapping between two different ERC-20 tokens. Stablecoins have been most preferred (as in the example above), which led to Curve’s rise to dominance (a stablecoin-specific DEX).

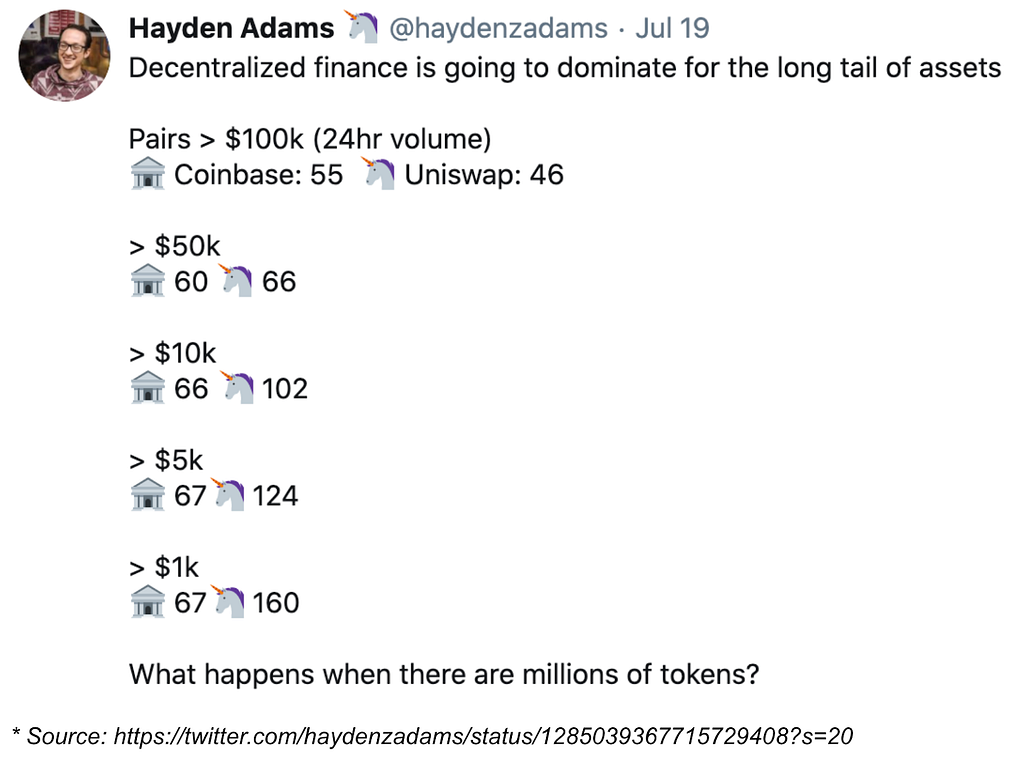

DEXs are also following a similar and proven growth strategy that gave rise to popular exchanges in early 2017: access to the long-tail of tokens / assets not listed on other exchanges. In this case, DEXs provide liquidity for all DeFi tokens and projects. Token creation will likely outpace how quickly centralized exchanges can add them, making DEXs the natural playground for novel new assets and the long-tail of smaller assets.

DEXs have done over $1B in total DEX volume over the last 7 days, over 3x of total 2019 DEX volume! More volume than ever is flowing through DEXs. See a prior Around the Block analysis on DEXs and their coming potential for more.

DeFi Stablecoins see strong Q2 growth

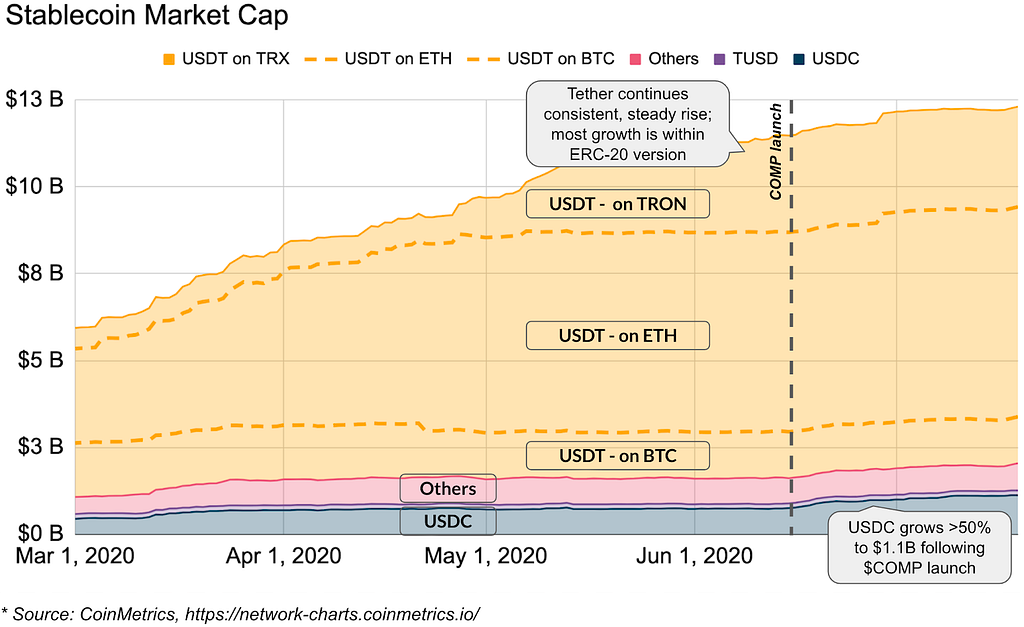

Stablecoins used within DeFi (notably Dai and USDC) saw record Q2 growth, as these are preferred yield-farming assets owing to their low volatility which prevents liquidation risk. Both USDC and Dai market caps saw >50% growth, moving from $700M to $1.1B, and $100M to $150M respectively since the launch of $COMP.

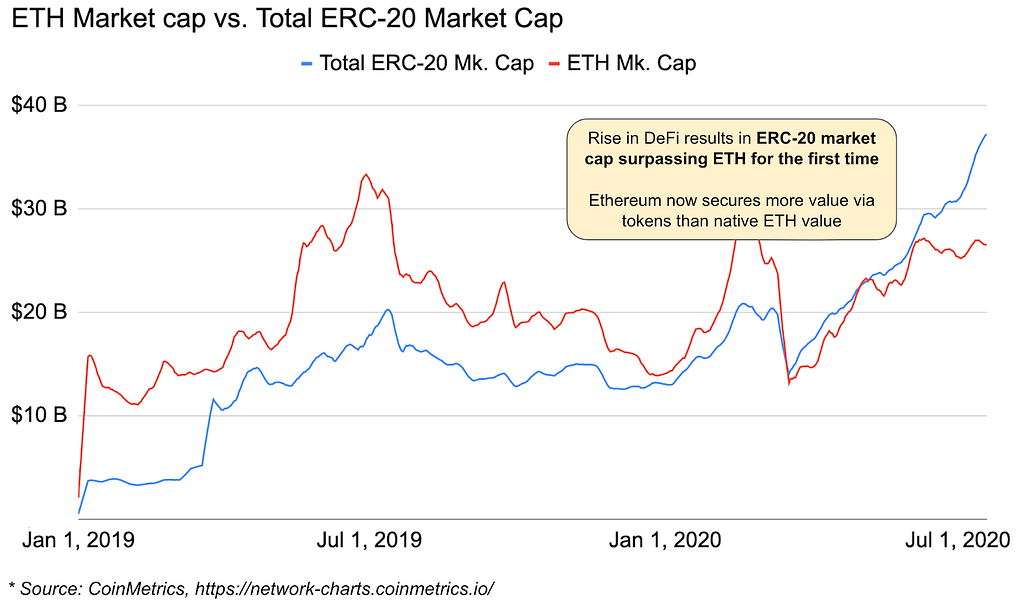

Market Cap of All ETH Tokens Surpasses ETH

The market cap of all ETH tokens recently surpassed the market cap of ETH itself. While driven mostly by a few assets (LINK and CRO), this is still an intriguing flip showing how the ETH ecosystem is expanding in value faster than the base native asset.

If you believe in the fat protocol thesis, then it may indicate ETH is undervalued, as growth in the utility layer would eventually accrue to the base layer. But if you don’t, it could raise questions around Ethereum’s long-term security model, where it might be economically rational to attack Ethereum in order to extract value from assets sitting on top.

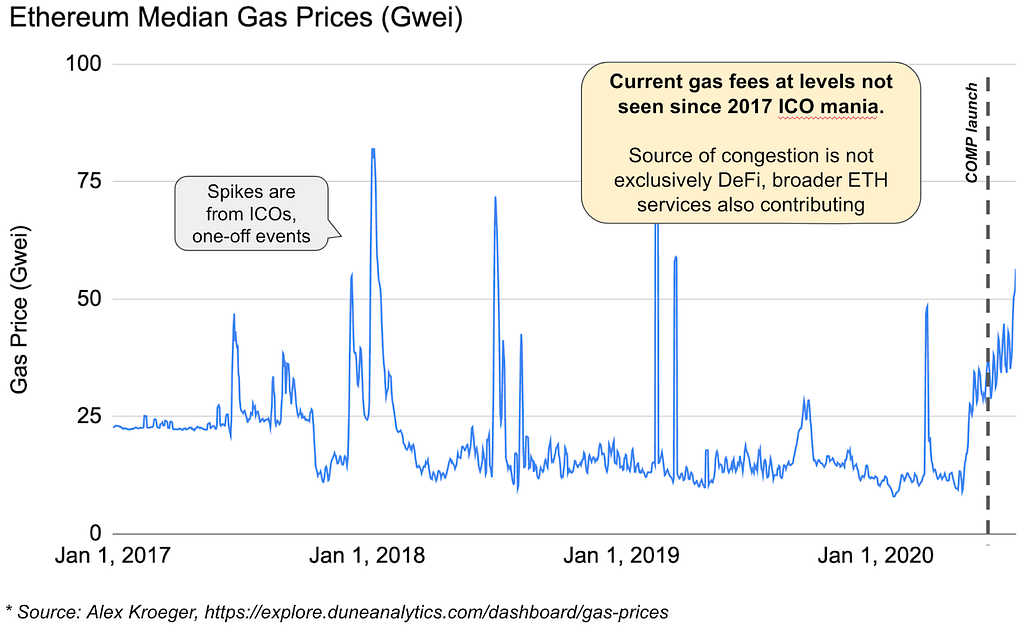

Ethereum Suffers Periods of Congestion; Highlighting Scaling Challenges

Predictably, DeFi activity produced a rise in median gas prices, ranging between 40 and 70 Gwei today. A single ETH transfer costs ~$0.35, but more complex operations like swapping assets on a DEX or entering and exiting multiple yield-farming positions can be substantially more expensive (at times >$10 per transaction).

High gas fees are sneakily insidious because they restrict access to DeFi to only those with sufficient capital. When it costs $10 to enter and exit yield farming positions, the subset of users with limited balances are cut off.

High gas fees are a direct consequence of scaling challenges. While still a drag today, efforts around ETH 2.0 and Layer-2 solutions show meaningful progress, but we’ll have to wait and see how those efforts play out.

Other DeFi projects surge

- Wrapped BTC Projects: Wrapped BTC projects create an Ethereum ERC-20 token that is redeemable 1:1 for BTC on the Bitcoin blockchain, thus marrying the BTC and ETH chains and bringing BTC’s balance sheet into DeFi. These projects rose substantially as users sought out more capital for yield farming. BitGo’s wBTC and Ren’s rBTC are notable standouts, with ~$140M BTC locked between them (and wBTC the clear leader with $130M).

- Balancer: A liquidity provider and DEX similar to Uniswap launches with a yield farming governance token, and quickly grows to over $200M TVL.

- Aave: A borrow / lend protocol similar to Compound, but with added flash-loan capabilities, a native $LEND governance token, and differentiating loan products. $LEND value has increased significantly following $COMP’s rapid rise, and Aave’s TVL has similarly exploded to over $450M.

- Synthetix: A synthetic-asset protocol on Ethereum with similar yield-farming mechanics, Synthetix has also seen incredible growth. Their synthetic dollar sUSD has captured volume amidst the stablecoin explosion.

- yEarn Finance: A suite of DeFi products, including a robo advisor that allocates your deposits to the highest-yielding protocols. They released a governance token over the weekend ($YFI) with unique properties in that it has no previous owners and no outside funding, a fixed supply, and is earned through yield farming. Upon launch, capital rushed toward farming and yields went as high as 1,000% APR.

- Infrastructure: Chainlink, aiming to become the oracle bridge powering the suite of crypto and DeFi Dapps, surges to ATH above $8 and cracks top-10 by market cap; InstaDapp surges to nearly $200M in TVL as a simple platform to easily manage yield farming positions.

- Others: Ampleforth’s unique “uncorrelated token” surges; UMA releases a synthetic COMP token (yCOMP) to enable shorts, and a yield-dollar for fixed-interest loans; mStable holds token sale for their stablecoin protocol standard; bZx jumps on with uniswap offering of their governance token.

Implications: Is this activity genuine?

For all the impressive metrics, the rise in asset valuations, and meteoric growth in value locked, is it really genuine activity?

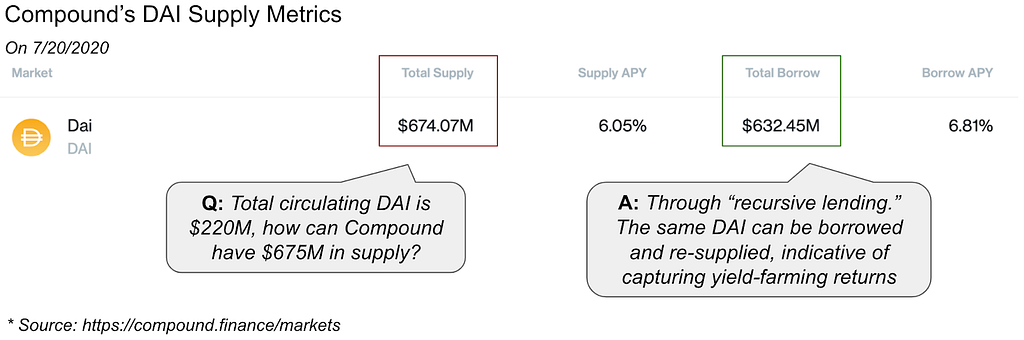

We noted earlier that value locked can be gamed, where assets can be recursively deposited or stacked across other protocols. This has certainly led to some strange results. Consider Compound’s accounting for DAI, where they list more DAI in Compound’s supply than DAI that exists! This can only be possible when the same DAI is supplied, borrowed, and re-supplied in a recursive loop.

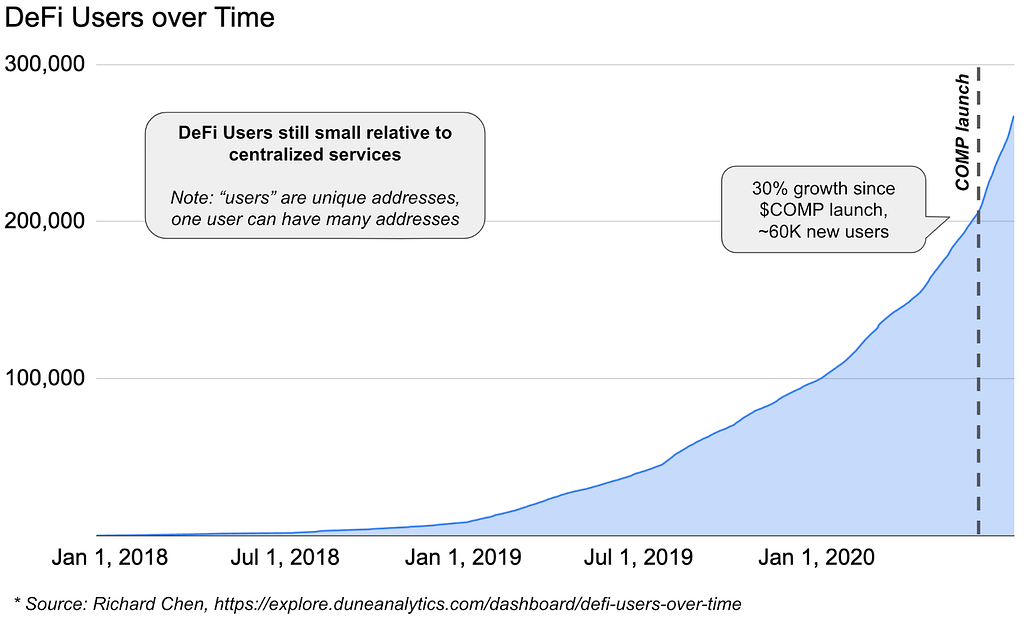

So if we can’t take TVL at face value, what can we say about the number of users accessing DeFi?

Numbers are low relative to traction enjoyed by mainstream exchanges (like Coinbase with 35M+ accounts), but the DeFi trend has still driven strong growth, over 100% YTD. Note that there are no “accounts” in DeFi, just unique addresses, so numbers should be taken with a grain of salt.

It’s relatively clear that the DeFi phenomenon is still refined to the sophisticated crypto user, able to navigate the world of self-custodial wallets and understand the risks and opportunities that lie within.

And yet, the metrics still cannot be ignored. Even accounting for recursive yield mechanisms, $3B in TVL across all of DeFi is hard to argue against. The traction and usage is on a clear upwards trajectory, and DeFi is the prominent narrative within crypto today.

Are the valuations and returns sustainable?

Taking a step back, we can see a clear cycle:

- Protocols add yield-farming governance tokens

- Total Value Locked (TVL) increases as users farm governance tokens

- Governance token valuations increase on the back of skyrocketing TVL and metrics

- Yield farming incentives increase, repeating step 2

Such cycles are usually indicative of valuations divorced from fundamentals.

However, this is how crypto historically bootstraps growth. Outsized financial incentives drive increased user awareness, and people run through brick walls to participate. Over time, the onramps become smoother, the revenue models more refined, and the products get more user-friendly.

So this looks similar to what was happening with Bitcoin in 2013. Only a select few were able to get ahold of Bitcoin back then, but price movements drove awareness and growth. The destinations were a bit sketchy (Mt. Gox), but got much better over time.

Today, DeFi returns are sparking similar levels of awareness, but only the crypto-sophisticated are running through hoops to capitalize. There is some fuzziness in the numbers, but the trend is hard to argue against, and the products and experience will get better over time.

Where the markets and interest rates move from here is speculation, but for more see this insightful Twitter thread.

Links

Coinbase news

- Coinbase to acquire leading institutional crypto brokerage, Tagomi

- Paul Grewal, former US Magistrate Judge, joins Coinbase as Chief Legal Officer

- Coinbase Custody selected by 21Shares for Bitcoin ETP

- Compound (COMP) launches on Coinbase Earn and Coinbase Pro

- Coinbase open sources software used to integrate new blockchains

- Maker (MKR) and Algorand are now available on Coinbase

- Coinbase Custody launches staking for Cosmos

- Coinbase prevented Twitter hackers from receiving over $280K in BTC

News from the crypto industry

- Twitter accounts of major exchanges, and political figures compromised amidst Twitter hack to perpetuate Bitcoin giveaway scam

- Paypal announces plans to add crypto trading services; partners with Paxos

- Crypto-card issuer Wirecard implodes, leaving crypto card companies scrambling

- Mastercard welcomes Crypto Companies via new card program in partnership with Wirex

- Binance to launch crypto payments card in Europe; acquires debit card provider Swipe

- Brave partners with Gemini to offer crypto trading in-browser

Institutional crypto news

- US Bank regulators approve US Banks to offer crypto custody services

- Grayscale reports record $900M inflows in Q2 🔥

- BitMEX parent company restructures, potentially exploring products outside crypto

- Anchorage announces Anchorage Finance to offer crypto-collateralized cash loans

- Galaxy Digital gearing up for Prime Brokerage offering

- Huobi to launch options trading

- Kraken’s Crypto Facilities wins UK license to offer derivatives trading

News from emerging crypto businesses

- Uniswap rivals Gemini’s daily volume amidst DeFi explosion; launches decentralized frontend via IPFS

- USDC’s inaugural use for Angel Investment Angel Investment 💪; hits $1B in AUC

- FTX adds compound-token markets, enabling exposure to Compound yield farming while trading

- Balancer exploited for $500K amidst yield farming phenomenon

- UMA launches yCOMP and yield-dollar, enabling shorting on $COMP and fixed-interest loans

- Liquid (Bitcoin sidechain) held brief moment where 2 of 3 operators could have stolen all funds

- Bitcoin mining hits new All-Time High shortly after halvening

- Bitcoin Gold 51% attack attempt foiled by core devs

- ETH 2.0 final testnet set to go live; prediction markets show a near 60% chance of going live in 2020

- Aave launches service for unsecured P2P loans on ETH

The opinions expressed on this website are those of the authors who may be associated persons of Coinbase and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase, and all trademarks are the property of their respective owners.