Wednesday 31 October 2018

Bitcoin's White Paper Is Not a Bible – Stop Worshipping It

Software evolves, read-only text documents do not.

via CoinDesk https://www.coindesk.com/bitcoins-white-paper-is-not-a-bible-stop-worshipping-it/

Morgan Stanley Report Says Crypto Now An Institutional Asset Class

Cryptocurrencies are now a new institutional investment class, rather than a fully developed electronic cash, a Morgan Stanley report says.

via CoinDesk https://www.coindesk.com/morgan-stanley-says-crypto-is-a-new-institutional-asset-class/

Binance Freezes Funds on Multiple Accounts with Dubious Crypto Exchange

Binance has frozen multiple accounts associated with the cryptocurrency exchange Wex, citing money laundering concerns.

The CEO of Binance went on Twitter recently to announce the freezing of multiple accounts owned by Wex, claiming that Binance will cooperate with law enforcement in any way possible should a criminal investigation result from alleged money laundering.

Wex, a Russian-based cryptocurrency exchange, has had a troubled history, to put it mildly. Going formally under the name of btc-e, it drew community unrest when its alleged operator, Alexander Vinnick, was arrested. It subsequently rebranded to the current name and set up a New Zealand-based server.

People using this exchange have reported being unable to actually use or withdraw their money, with a dedicated website of aggrieved users meeting to share information about possible allegations of theft.

Per the CEO of Binance’s Tweet, it seems as if large amounts of this missing money is being moved through Binance, presumably for the purposes of fraud. To this end, Binance has agreed with the general consensus that criminal activities could be involved.

The CEO went on to state that circumstances such as this are often an unpleasant point in favor of increased centralization for cryptocurrency, as someone does have to be on the hook to help stop fraudulent activity.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/binance-freezes-funds-multiple-accounts-dubious-crypto-exchange/#1541026075

Tether's Price Has Stabilized, But the Stablecoin's Supply Is Still Shrinking

Crypto exchanges are shedding tethers by the million, and millions of USDT are ending up at Bitfinex. From there, they are taken out of circulation.

via CoinDesk https://www.coindesk.com/tethers-price-has-stabilized-but-the-stablecoins-supply-is-still-shrinking/

Vitalik Ends Devcon Talk With Sing-a-Long About Failed Ethereum Ideas

At the Devcon4 developer conference, the founder of ethereum presented the current roadmap to a more scalable network – and a song.

via CoinDesk https://www.coindesk.com/vitalik-ends-devcon-talk-with-sing-a-long-about-failed-ethereum-ideas/

Indian Officials Consider Ban on “Private Cryptocurrencies”

Agents of the Indian government have met to formally discuss a possible ban on private cryptocurrency holdings in the nation.

On October 30, 2018, the Financial Stability and Development Council (FSDC) issued a press release detailing their recent meeting where they “reviewed the current global and domestic economic situation and financial sector performance.”

The council seemed deeply concerned about “the need for identifying and securing critical information infrastructure,” under the guise of “strengthening security in the financial sector.”

To this end, the report mentioned a deliberation “on the issues and challenges of crypto assets/currency, and was briefed about the deliberations of the High-Level Committee … to devise an appropriate legal framework to ban use of private cryptocurrencies in India and encourage the use of distributed ledger technology.”

It should be noted that the council appears to refer to “private cryptocurrencies” as coins that operate on an open-source, permissionless blockchain, and this classification should not be confused with privacycoins, a subset of cryptocurrencies that focus on anonymous transactions.

This stance on the different applications of blockchain technology seems to be an unfortunately common one across different major economies worldwide. Earlier this year, China began to make public its support for the applications of distributed ledger technology, while continuing to remain either silent or generally negative on the prospects of a truly decentralized currency.

The Indian government has recently shown several indicators of a growing hardline stance on cryptocurrency, with the Reserve Bank of India (RBI) banning crypto exchanges in July 2018, and the proprietor of a Bitcoin ATM in Bangalore being arrested in late October.

Other than these general trends in Indian policy, however, crypto speculators abroad have little to go on. The FSDC’s report did not elaborate on their intended meaning of “use,” or whether this means a proposed ban on trading, holding, mining or any other possible interactions with cryptocurrency networks.

It is unclear the extent to which the Indian government will clarify its overall intentions toward cryptocurrency in the days to come.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/indian-officials-consider-ban-private-cryptocurrencies/#1541014638

EY Prototype Allows Private Transactions on Ethereum’s Blockchain

In a bid to lower the barriers to mainstream adoption of blockchain technology, professional services giant Ernst & Young (EY) has launched a solution that it claims will allow companies to transact privately on Ethereum’s blockchain using zero-knowledge proof (ZKP).

Dubbed the EY Ops Chain Public Edition (PE), the solution will reportedly allow enterprises to issue and sell product tokens on a “public blockchain with private access to their transaction records.” This announcement comes on the heels of EY’s launch of the EY Ops Chain, a set of apps and services created to help businesses commercialize the use of blockchain technology.

With millions of users and a market cap of approximately $20 billion, Ethereum's blockchain is larger than most private blockchains, but its ecosystem’s size, which comes with a plethora of smart contract applications and tokens, also requires a considerable amount of computational power to operate it, as well as less transaction privacy than private blockchains. According to the report, EY Ops Chain PE will offer the best of both worlds.

In an email correspondence with Bitcoin Magazine, Paul Brody, EY global innovation leader of blockchain technology, stated:

“EY Ops Chain PE is a first-of-its-kind application and a major step forward that empowers blockchain adoption. Private blockchains give enterprises transaction privacy, but at the expense of reduced security and resiliency.”

The new EY Ops Chain PE uses ZKP technology to enable the transfer of private tokens without tampering with Ethereum’s consensus algorithm. Developed by the EY blockchain labs in Europe, with patents pending in the United Kingdom and France, the prototype system will also support “payment tokens and unique product and services tokens that are similar to the Ethereum ERC-20 and ERC-721 token standards.”

In practice, a zero-knowledge proof allows users to prove that they know a piece of information, be that a transaction amount or some other value, without actually revealing the underlying information. For corporations and businesses that don’t want to make sensitive financial or business information public, this privacy is considered a must if they are to use blockchain technology for their day-to-day.

“With zero-knowledge proofs, organizations can transact on the same network as their competition in complete privacy and without giving up the security of the public Ethereum blockchain,” Brody concluded.

The new solution will include the EY Blockchain Private Transaction Monitor, which monitors and keeps a record of transactions. The company is working on a public release of the EY Ops Chain PE and the EY Blockchain Private Transaction Monitor for 2019.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/ey-prototype-allows-private-transactions-ethereums-blockchain/#1541014413

Coinbase's Head of Trading Resigns After Six Months on Job

The head of trading at Coinbase, Hunter Merghart, has resigned just six months after joining the crypto startup from Barclays, CoinDesk has learned.

via CoinDesk https://www.coindesk.com/coinbases-head-of-trading-resigns-after-six-months-on-job/

Former Fed Chair Janet Yellen Is Now a Bitcoin Owner

A member of the crypto community has gifted former Fed chair Janet Yellen some bitcoin in response to her negative comments on the cryptocurrency.

via CoinDesk https://www.coindesk.com/former-fed-chair-janet-yellen-is-now-a-bitcoin-owner/

It’s the 10th Anniversary of the Bitcoin White Paper. Have You Read It Yet?

On October 31, 2018, we celebrate the 10th anniversary of Bitcoin’s white paper, the seminal literature of Satoshi Nakamoto’s creation and the new cryptographic field he introduced with the blockchain.

Since its release, the white paper has become a must-read for crypto enthusiasts, be they fledglings or veterans, investors or coders. Part technical primer, economic treatise and constitution, our community has canonized the document as something of a blockchain bible, one that has done its fair share of proselytizing followers over the years. Following the white paper’s release, Bitcoin’s genesis went on to spawn a sprawling ecosystem of altcoins and other related blockchain applications that would continue Nakamoto’s work in numerous iterations.

So for the white paper’s 10th anniversary, it’s only fitting that we revisit the promethean spark that allowed us to rediscover how value can be defined and money managed. You can read the document, “Bitcoin: A Peer-to-Peer Electronic Cash System,” here. If you’ve never read the white paper, there’s no time like the present, especially when the present is 10 years into the future that the document first laid out.

There’s also no time like the present for looking back on how far Bitcoin and blockchain technology — and the community that has grown up around them — have come.

From October 31, 2018, through January 3, 2019 (the 10th anniversary of Bitcoin’s genesis block), Bitcoin Magazine will be publishing a series of retrospectives, interviews and think pieces from the industry’s leading innovators and voices as they reflect on where we’ve come from, where we are now and where we’re going.

As a community built on transparency, inclusion and the freedom of the individual, we all have a role to play in the revolution that Nakamoto inspired. For Bitcoin Magazine, the oldest source of news, information and expert commentary on Bitcoin, blockchain technology and the digital currency industry, our role is to provide thorough analysis, research, educational material and thought leadership to the Bitcoin and blockchain communities.

As we celebrate the white paper and look toward the 10th anniversary of Bitcoin’s launch and beyond, we hope to continue to be a fount of quality information for our readers. We are passionate about Bitcoin, cryptocurrencies and blockchain technology and are keen to share news about a technology we believe is fundamentally changing our world.

If you’re a long-time reader, thank you for sticking with us throughout the years. If you’re a newcomer, welcome to the industry — you’re in for quite the ride. If you’re still on the sidelines and hesitant to get in the game, please join us — the revolution is underway, and you don’t have to buy in to take part.

Prospere procede.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/its-10th-anniversary-bitcoin-white-paper-have-you-read-it-yet/#1541013515

Wasabi Wallet 1.0 Is Here to Make Bitcoin Transactions More Private

Wasabi Wallet 1.0 went live today, October 31, 2018. The release, which Wasabi’s creator Ádám Ficsór humbly called “nothing revolutionary,” cleans up the software and makes it compatible with macOS.

“The 1.0 release is a download and run that works properly on all platforms (Windows, Linux, OSX.) We made the wallet load time faster, caught some memory leaks, [and] rewrote the OSX backend of the UI library we used,” Ficsór told Bitcoin Magazine.

A self-described “open-source, non-custodial, privacy-focused Bitcoin wallet,” Wasabi’s anonymity features center around ZeroLink, a protocol introduced by its creator, Ádám Ficsór. The protocol is a privacy framework that Ficsór architected by resurrecting a transaction cloaking method that was first proposed in 2013 but which was soon forgotten.

Known as Chaumian CoinJoin, the transaction trick works just as its name would imply. Essentially, it bundles transactions together to obfuscate who is sending what to whom. To work, however, each party needs to be sending the same amount, otherwise it would be easy to discern from the difference in bitcoin sent who is sending and receiving which coins.

Ficsór focused on CoinJoin and his brainchild ZeroLink came after he implemented TumbleBit into Stratis’ Breeze Wallet. The feature offers similar privacy benefits as CoinJoin, though it is more centralized and participants receive a different coin from the one they send.

In our correspondence, Ficsór said Wasabi’s own CoinJoin feature “has seen over 150 BTC [transacted] with equal output amounts,” something that, combined with the team not finding “any remotely serious issues,” made Ficsór and company “pretty confident in promoting the software to be 1.0.”

He also indicated that, while the updated version doesn’t tinker with the CoinJoin protocol in any way, it does include a few fundamental changes to his own invention in ZeroLink.

“I designed ZeroLink in mind so that many wallets would be able to conform to ‘wallet fungibility requirements,’ however this wasn’t feasible in practice … The idea was to not let people ever join two coins together if they were already mixed … To mitigate the risks, we had to come up with a clever labeling system that led us down a road to build a coin control feature with an intra-wallet blockchain analysis tool into Wasabi. This allows the user to make educated decisions on which coins they can join together if they need to.

“Later, when we saw how people use the wallet, it even got better. When designing ZeroLink I did not anticipate users to keep remixing their coins, but they do and to such an extent that it leads to an exponential anonymity increase because the re-mixes are perfect mixes, and today, 40-60 percent of all mixes are remixes. So that was quite a surprising turn of events,” he said.

Ficsór stressed in our conversation that the latest release places heavy emphasis on user experience. Going forward, the team will try to iron out technical kinks even more to create a smoother, more user friendly experience — if funds and manpower allow, that is.

“We are currently occupied by working on stability, performance, UX and code quality. This is our highest priority. New issues will constantly come up as new users try to use the software. At this point, it is unclear if Wasabi will ever have the resources to tackle such things.”

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/wasabi-wallet-10-here-make-bitcoin-transactions-more-private/#1541009663

Planting Bitcoin Part Four: Gardening

Once Satoshi's design for Bitcoin's genetic code was planted, it became time to nurture its development as a wholly new form of money.

via CoinDesk https://www.coindesk.com/planting-bitcoin-part-four-gardening/

Op Ed: Bitcoin’s Energy Consumption Is Neither Frivolous Nor Excessive

As the CEO of Hut 8, one of North America’s largest cryptocurrency miners and the world’s largest publicly traded cryptocurrency miner, I’m often asked questions about energy consumption in the mining of cryptocurrency. Unfortunately, there are many misconceptions around energy use and why it’s required to safely and securely transact cryptocurrencies.

During our ribbon-cutting ceremony in the City of Medicine Hat in September 2018, a reporter asked me how I felt about something “frivolous” like bitcoin using so much energy. I was taken aback by the question. It indicated a lack of understanding of both the important role bitcoin mining plays in improving a wide array of services and systems around the world, and the fact that we purchase electricity in the same way any other business would in a free market.

Is Bitcoin Frivolous?

Let’s take a step back. Today, the world’s biggest industry is the trading of currency, estimated to be over $5 trillion daily! That’s more than 70 times larger than all trade in goods and services and 25 times larger than the world’s GDP. Even at this scale, currency trading doesn’t accomplish stable monetary values across world economies. Instead, the main function of currency trading is to enable traders to speculate on currencies and central banks to maintain more than $250 trillion of debt on the world economy.

Bitcoin is the emergence of a new world monetary system. Gold is the only monetary element that has endured through centuries, and bitcoin is the new gold.

Sound monetary policy is the basis of capitalism. At the beginning of the 20th century, all paper currencies were bills of exchange for precious metals such as gold and silver. However, as the century evolved, governments decoupled their currencies from being underpinned by actual gold reserves. Instead, governments used their power to issue more currency, thus devaluing it.

Governments saw inflation (the printing of more money not underpinned by anything) as a quick way out of debt. Despite that, most world governments continue to accumulate more debt and mint more currency. Look at what’s happening in Venezuela and Argentina. From an economic perspective, all governments are insolvent as fiat currency is now largely backed by debt. Currently, the U.S. government is more than $20 trillion dollars in debt!

Bitcoin is the first reliable digital currency with a market value in excess of $100 billion. The limit on the number of bitcoin to enter circulation creates scarcity similar to gold, making the currency non-inflationary. It’s globally recognized and provides freedom for individual holders to transact in digital form. In a world of looming inflation and governments that print more currency as a magical solution to economic problems, bitcoin represents the evolution of currency to the digital age and a possible solution to current monetary policy failures.

Now that we’ve established what bitcoin’s role is, what is the role of bitcoin miners?

Energy used to mine cryptocurrency is performing an extremely valuable service: It secures data about transactions worth hundreds of billions of dollars.

Through their computational work, bitcoin miners are essential to the operation of bitcoin as they provide security to the bitcoin ecosystem in lieu of a government or central bank. Bitcoin mining secures the Bitcoin blockchain and empowers millions of people around the world to use the cryptocurrency, which is an anti-inflationary store of value. Like any technology, mining consumes energy.

It’s All Relative

When compared to the energy required for everyday activities such as sending emails, using social media, driving cars or flying airplanes, mining doesn’t require a disproportionate amount of energy. Despite bitcoin mining’s exponentially lower consumption of energy than these activities, miners are currently receiving high levels of criticism for their energy use.

It would be difficult to imagine consumers of traditional financial services calling Wells Fargo, or any other major institution, and complaining that it’s consuming too much energy keeping money or financial assets accounted for and secure; or social media users protesting against Facebook or Instagram for the enormous amounts of energy usage consumed to run their platforms.

It's Efficient and Scalable

Let’s consider the amount of energy used to consummate a financial transaction in the traditional sense, which involves several players. Online banking, traditional banking and credit card companies all require expensive ledger storage systems and capital movement systems that are inefficient, slow and costly.

In contrast, a bitcoin transaction is settled the moment it hits the blockchain, never traveling through third-party institutions that collect fees along the way. The miner who added it to a block did use electricity, but that amount is substantially less than the energy needed to keep Fortune 500 financial companies running at full steam for a few days. How much electricity is consumed daily to maintain over $5 trillion of daily currency trading operating?

In addition, miner energy use rises or falls depending on the amount of competition between miners, not the number of transactions being validated. It’s a misconception that additional bitcoin use would lead to more energy consumption.

It’s Less Impactful on the Environment

When calculating the use of energy, one needs to consider the environmental impact and cost of printing paper currency and producing metal coins all around the world. In the digital age, why do we need coins made of gold, silver, copper or aluminum? Paper currency? Plastic credit cards?

In the U.S., the Bureau of Engraving and Printing produces 38 million notes a day with a face value of approximately $540 million. 95 percent of the notes printed are used to replace notes already in circulation. What’s the environmental impact of that on an annual basis?

Unlike traditional mining, bitcoin mining does not require actual digging of holes into the earth or extraction of metals and minerals. Traditional mining operations ravage the landscape and contaminate groundwater and soil.

Hut 8’s bitcoin mining farms sit on remote fields. They produce no pollution, no discharge of any type except for some heat from the operating computers. There is also no noise pollution. Outside of the energy consumed, there is no environmental impact. In and of itself, the way we use energy does not pollute the environment. Our output is a digital asset that is the alternative to a traditional physical asset, and a contribution to the communities in which we operate, through job creation, infrastructure improvements, and financial contributions to local schools and sports teams.

Technology Is Evolving Fast!

Bitcoin mining is becoming energy efficient quickly. Electricity is the single largest cost for a bitcoin miner, thus we not only seek out inexpensive and clean sources of electricity but also the most efficient technology to harvest the electricity. Today, we’re seeing huge advances in chip design that enable greater mining capacity for far less energy consumption. There’s a good chance the energy use stays constant or even decreases while the number of transactions skyrockets.

Just as the consumer electronics revolution drove massive computing efficiencies, the Bitcoin revolution could drive a similar explosion of innovation in clean, efficient energy — not just in mining but in all other energy-consuming production.

Final Thoughts

Criticizing bitcoin mining as an energy waste would be like comparing the electricity used in traditional mail delivery versus email. Yes, email consumes more electricity. However, that doesn’t take into account the cost of a stamp, the use of paper or the infrastructure used to collect, sort and physically deliver the mail. Comparing bitcoin solely on energy use to traditional fiat would have the same flaws unless everything required to operate the fiat system is taken into account. Bitcoin will displace traditional fiat currencies and allow individuals to transact directly without the need of third parties in a more efficient way, like email.

I think back to the question posed by the reporter — is bitcoin mining a waste of energy for a frivolous use? It strikes me as the wrong question; the question should be, what is the price of securing billions of dollars in daily transactions and empowering individuals through an online peer-to-peer payments infrastructure that anyone with a smartphone and internet connection can use?

My view is that bitcoin represents an environmentally superior alternative to the amount of energy consumed worldwide by traditional financial institutions to perform a similar function. The world needs a global, digital currency that is not subject to inflation and is based on a computer algorithm to keep it secure — and that energy consumed to secure it is a small price to pay for the vast benefits it delivers.

This is a guest post by Andrew Kiguel, CEO of Hut 8. Views expressed are his own and do not necessarily reflect those of Bitcoin Magazine or BTC Inc.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/op-ed-bitcoins-energy-consumption-neither-frivolous-nor-excessive/#1540931733

Indian Officials Met to Discuss Possible Ban on 'Private Cryptocurrencies'

The Indian government is considering imposing a ban on what it calls "private cryptocurrencies," according to an official release.

via CoinDesk https://www.coindesk.com/indian-officials-met-to-discuss-possible-ban-on-private-cryptocurrencies/

Promise: A Startup Based on an Anonymous Paper Plans to Replace ACH

With $47 trillion flowing through it every year, ACH is a juicy target for blockchain disruption. Can a new startup called Promise pull it off?

via CoinDesk https://www.coindesk.com/promise-how-a-startup-based-on-an-anonymous-paper-plans-to-replace-ach/

Hong Kong Stock Exchange Taps Digital Asset for Post-Trade Blockchain Trial

The Hong Kong Stock Exchange has teamed up with DLT startup Digital Asset to develop a blockchain platform for post-trade processing.

via CoinDesk https://www.coindesk.com/hong-kong-stock-exchange-taps-digital-asset-for-post-trade-blockchain-trial/

The Pen Is Mightier Than the Sword? Bitcoin's White Paper Proves It

The pen is mightier than the sword, or so Satoshi Nakamoto proved with bitcoin.

via CoinDesk https://www.coindesk.com/the-pen-is-mightier-than-the-sword-bitcoins-white-paper-proves-it/

October Close May Prove Decisive for Bitcoin Price

Bitcoin's monthly close today may reveal the cryptocurrency's directional bias after a long period of low volatility.

via CoinDesk https://www.coindesk.com/october-close-may-prove-decisive-for-bitcoin-price/

EY Reveals Zero-Knowledge Proof Privacy Solution for Ethereum

EY has announced a prototype that uses zero-knowledge proofs to allow companies to create ethereum tokens while keeping transaction private.

via CoinDesk https://www.coindesk.com/ey-reveals-zero-knowledge-proof-privacy-solution-for-ethereum/

The Bitcoin White Paper's Birth Date Should Give Us All a Scare

Knowing Satoshi, Halloween was no coincidence.

via CoinDesk https://www.coindesk.com/the-bitcoin-white-papers-birth-date-should-give-us-all-a-scare/

#259 Gavin Wood: Substrate, Polkadot and the Case for On-Chain Governance

From one of the main Ethereum clients, to Polkadot to Substrate; Parity has become exceptional at developing successful open-source blockchain projects. Their latest effort Substrate provides a framework to easily create custom blockchains. Building on cutting-edge technologies like Web Assembly, Substrate also offers automated on-chain upgrades.

We were joined by Gavin Wood, who was previously co-founder and CTO of Ethereum and founded Parity. We talked about the early Ethereum days, how Parity got started, Substrate, Polkadot and his views on on-chain governance.

Topics discussed in this episode:

- The genesis story of Ethereum

- Why Gavin prefers reasoning from first principles to reading

- How Parity shunned Silicon Valley principles to build an developer-driven company

- Why they decided to work on a scalable blockchain from scratch instead of improving Ethereum

- An overview of Substrate

- The relationship between Substrate and Polkadot

- How Substrate allows switching consensus in a live blockchain

- Why Ethereum's governance process is centralized

- Polkadot and the case for on-chain governance

Links mentioned in this episode:

- Parity Technologies Website

- Polkadot Website

- E199 - Peter Czaban - Polkadot: The Internet of Blockchain Networks

- Substrate: A Rustic Vision for Polkadot by Gavin Wood at Web3 Summit 2018

- Substrate in a nutshell

- What is Substrate?

- How Polkadot tackles the biggest problems facing blockchain innovators

- Substrate testnet launched

- Epicenter episode from 2014 with Gavin Wood about Ethereum & Ether Sale

Sponsors:

- Azure: Deploy enterprise-ready consortium blockchain networks that scale in just a few clicks

- Toptal: Simplify your hiring process & access the best blockchain talent' '" Get a $1,000 credit on your first hire

Support the show, consider donating:

- BTC: 1CD83r9EzFinDNWwmRW4ssgCbhsM5bxXwg (https://epicenter.tv/tipbtc)

- BCC: 1M4dvWxjL5N9WniNtatKtxW7RcGV73TQTd (http://epicenter.tv/tipbch)

- ETH: 0x8cdb49ca5103Ce06717C4daBBFD4857183f50935 (https://epicenter.tv/tipeth)

This episode is also available on :

Watch or listen, Epicenter is available wherever you get your podcasts.

Epicenter is hosted by Brian Fabian Crain, Sƒbastien Couture, Meher Roy & Sunny Aggarwal.

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/epicenter-259-gavin-wood-substrate-polkadot-and-the-case-for-onchain-governance

Tuesday 30 October 2018

Factbox: Ten Years of Bitcoin

Early Bitcoin Investors Count Winnings After Volatile Decade

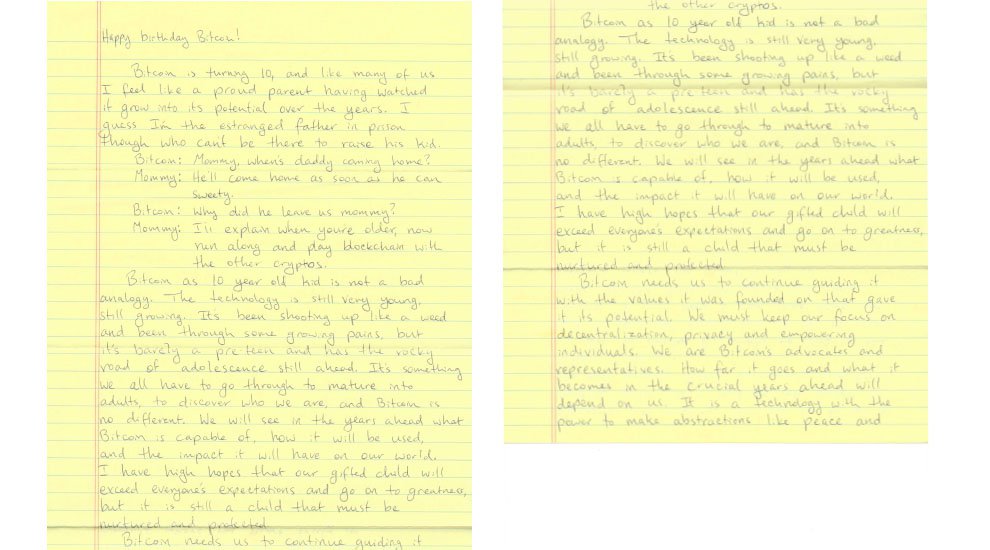

Happy Birthday, Bitcoin! A Letter From Ross Ulbricht

Happy Birthday, Bitcoin!

Bitcoin is turning ten, and like many of us, I feel like a proud parent, having watched it grow into its potential over the years. I guess I’m the estranged father in prison though, who can’t be there to help raise his kid.

Bitcoin: Mommy, when’s Daddy coming home?

Mommy: He’ll come home as soon as he can, sweetie.

Bitcoin: Why did he leave us, Mommy?

Mommy: I’ll explain when you’re older. Now run along and play blockchain with the other cryptos.

Bitcoin as a 10-year-old kid is not a bad analogy. The technology is still very young, still growing. It’s been shooting up like a weed and been through some growing pains, but it’s barely a pre-teen and has the rocky road of adolescence still ahead. It’s something we all have to go through to mature into adults, to discover who we are, and Bitcoin is no different.

We will see in the years ahead what Bitcoin is capable of, how it will be used, and the impact it will have on our world. I have high hopes that our gifted child will exceed everyone’s expectations and go on to greatness, but it is still a child that must be nurtured and protected.

Bitcoin needs us to continue guiding it with the values it was founded on, that gave it its potential. We must keep our focus on decentralization, privacy and empowering individuals. We are Bitcoin’s advocates and representatives. How far it goes and what it becomes in the crucial years ahead will depend on us. It is a technology with the power to make abstractions like peace and equality into reality. But it’s up to us to embody such ideals and be role models for the ever-growing Bitcoin community and for Bitcoin itself.

I’m so excited for what’s to come in the next ten years, for Bitcoin and all of its crypto cousins. I just hope I can come home and make up for these lost years and show everyone where my heart truly is.

This is a guest post by Ross Ulbricht. It was shared, with permission, with Bitcoin Magazine by Ross's mother, Lyn Ulbricht. To learn more about Ross, sign his petition for clemency, and support the campaign to free him, please visit freeross.org. Follow @free_ross, @RealRossU and the #freeross hashtag on Twitter. Visit Free Ross on Facebook and freerossulbricht on Instagram.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/happy-birthday-bitcoin-letter-ross-ulbricht/#1540933044

SAFE Crossroads #45, Approaches to Alpha 3, with Nikita Baksalyar

In this episode we catch up on some of the things that have been going on in SAFE Network development, where it's been and what's coming down the line now, including the roll out of public testing of the automated peer-to-peer connection library, Crust (standing for "Connected" "Rust").

How do you ensure all the nodes of an amorphous P2P network get and stay connected, even past firewalls and routers? How do you do it when most nodes are being run by non-technical people using their spare computer resources?

The demands are high. Will Crust be up to the job?

Music

Music for this episode: Safe Crossroads Beta, an original piece composed and performed by Nicholas Koteskey of Two Faced Heroes

Links

Medium article -- "SAFE-Fleming: Our Next Major Milestone"

MaidSafe Dev Update release of PARSEC

SAFE Crossroads #43, PARSEC - Efficient, Provable Consensus Has Arrived, with Pierre Chevalier

SAFE Crossroads #44, PARSEC Consensus Code Release, with Bart…'omiej Kami…"ski

SAFE Crossroads subscription links

via The Let's Talk Bitcoin Network https://letstalkbitcoin.com/blog/post/safe-crossroads-45-approaches-to-alpha-3-with-nikita-baksalyar

19 Words Prove Just How Audacious Bitcoin Really Was

Getting back to basics means capturing the spirit also.

via CoinDesk https://www.coindesk.com/19-words-prove-just-how-audacious-bitcoin-really-was/

Crypto Price Tracker Poses Malware Threat for Macs: Report

A legitimate-looking cryptocurrency price tracker app may also be monitoring users' keystrokes, according to Malwarebytes.

via CoinDesk https://www.coindesk.com/crypto-price-tracker-poses-malware-threat-for-macs-report/

Crypto Wallet Maker Ledger to Expand Support for Stablecoins, Including Tether

Benjamin Soong, Ledger's newly hired head of Asia-Pacific operations, says tether remains popular in the region despite the token's recent troubles.

via CoinDesk https://www.coindesk.com/hardware-wallet-crypto-ledger-asia-stablecoins-usdt/

Bitcoin Price Analysis: Weekly Consolidation Hints Toward Sustained Breakout

Another week has passed as bitcoin continues to coil in a tighter and tighter consolidation. Both price and volume continue to consolidate as bitcoin decides where the next major move will be. A trend of higher lows and lower highs shows a balance of both supply and demand, but ultimately one will win out:

Figure 1: BTC-USD, Daily Candles, Macro Consolidation

Figure 1: BTC-USD, Daily Candles, Macro Consolidation

To gain a perspective of *just* how tightly wound the market is, a great tool analysts often use are Bollinger Bands (bbands). Bbands are a visual representation of forecasted volatility. If the bands are squeezing, there is a forecast for increased volatility in the future. Conversely, if the bands have already expanded and are beginning to round/bulge, there is a forecast for decreased volatility. In our case, on the weekly candles, the bands are squeezing tighter than they have in several years:

Figure 2: BTC-USD, Weekly Candles, Bollinger Band Squeeze

Figure 2: BTC-USD, Weekly Candles, Bollinger Band Squeeze

During the bull run, we could see a very clear trend of support being found on the bband midline for several years. However, at the beginning of our bear market, the midline has continuously proven itself to become resistant to every single rally over the last few months. However, as the price begins to consolidate further and further, the midline has drawn itself within striking distance, while the price trend has established a series of higher lows.

Even though a breakout has yet to happen, there are some early signs we can keep an eye out for, using the weekly Bollinger bands. I believe this next move will be a strong, sustained move that will paint the course of the market for months to come.

It’s very easy to get lost in the weeds while trading bitcoin because it is so volatile on low timeframes, but if you look at the bigger picture on daily and weekly candles, we can see the strength of the trend.

One early sign of a directional breakout is when the bbands begin to expand again. As I stated earlier, bbands are a visual representation of consolidation and can forecast volatility. If the bbands begin to expand, that is an indication that the volatility has chosen a direction and will likely continue in that direction until the bbands round/bulge — thus indicating a forecast for decreased volatility until it consolidates once again.

An early sign of a bullish trend reversal will be on the close of the weekly candle. If bitcoin can manage to close above the weekly midline, that will be a sign that we have broken resistance.

However, it’s important to note that just because we close above the midline doesn’t mean we *must* continue. The next candle (the one following the candle close above the midline) will give us more information. If we can establish two consecutive candles closing above the weekly midline, this will be a definite change of character for our trend as we have yet to see two consecutive closes above the midline:

Figure 3: BTC-USD, Weekly Candles, BBands Midline Rejections

Figure 3: BTC-USD, Weekly Candles, BBands Midline Rejections

Summary:

- Bitcoin continues to wind tighter and tighter as both price and volume consolidate in a sideways fashion with both higher lows and lower highs.

- On a macro scale, the consolidation can be visualized using weekly candle Bollinger Band trend. We are currently the most consolidated the market has been in several years and the breakout of this consolidation with undoubtedly be a strong, sustained move..

- Early signs of a breakout direction will be found with the BBand trend on the weekly candles. If the weekly candles can manage to close above midline of the BBands and, most importantly, find support, this will be a strong sign of a change of market character on a macro scale.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/bitcoin-price-analysis-weekly-consolidation-hints-toward-sustained-breakout/#1540934354

Standardized Specifications for Enterprise Version of Ethereum Announced

On October 29, 2018, the Enterprise Ethereum Alliance (EEA) announced in Prague at DevCon 4 two new software specifications that will help businesses standardize future code developments on an enterprise version of the Ethereum blockchain.

The first specification, Client Specification V2, defines the implementation requirements for Enterprise Ethereum clients, including interfaces to the external-facing components of Enterprise Ethereum and how they are intended to be used.

The standardization of performance, permissioning and privacy demands of enterprise deployments are viewed as a necessary step by the EEA in order to help the growing number of vendors developing Ethereum clients to ensure that different clients can communicate with each other and all reliably work on an enterprise Ethereum network.

EEA Executive Director Ron Resnick stated that “using the EEA Specification, Ethereum developers can write code that enables interoperability, thus motivating enterprise customers to select EEA specification-based solutions over proprietary offerings”. It should be noted that, while Ethereum has been basis for the majority of enterprise blockchain projects, 2018 has also seen developments using Cardano, EOS, QTUM and TRON, among others.

Aside from digital currency, enterprise or platform tokenization remains a hotbed for blockchain-based startups, with the vast majority of those needing an ecosystem where users can change the software they use to interact with a running blockchain, disambiguating the need for single-vendor support.

The second specification, Off-Chain Trusted Compute Specification V0.5, specifies enabling APIs that support private transactions, allowing offloads for compute intensive processing and permitting attested oracles. The EEA believes these objectives can be achieved by executing some parts of a blockchain transaction off the main chain in an off-chain trusted compute. The EEA currently endorses three types of trusted compute for this specification including a trusted execution environment, zero knowledge proofs and trusted multi-party compute.

Both specifications were lauded by Brian Behlendorf, executive director of Hyperledger, who lent his support to the announcements. The EEA and Hyperledger joined each other’s organizations as associate members on October 1, 2018.

Behlendorf stated, “We are pleased to see the EEA reach and release its V2 and Off-Chain Trusted Compute V.05 specifications. Both organizations believe standards, specifications and certification all help with the adoption of enterprise blockchain technologies by helping customers commit to implementations with confidence …”

The new specifications are backed by the EEA’s 500+ global membership, notably including banks like Santander and J.P. Morgan Chase; blockchain startups like blk.io; and traditional tech companies like Accenture, Intel and Microsoft.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/standardized-specifications-enterprise-version-ethereum-announced/#1540927160

Data Shows Millions Leaving Crypto Wallets Tied to Long-Troubled Exchange

Binance has frozen accounts that received more than 93,000 ether (over $18.9 million) from wallets indirectly linked to troubled Russian exchange WEX.

via CoinDesk https://www.coindesk.com/data-shows-millions-leaving-crypto-wallets-tied-to-long-troubled-exchange/

New Bank of America Patent Hints at Plan to Store Cryptocurrency Keys

A new Bank of America patent outlines a "hardened storage device" that can protect private keys from theft.

via CoinDesk https://www.coindesk.com/new-bank-of-america-patent-hints-at-plan-to-store-cryptocurrency-keys/

Crypto Platform Coinbase Secures $300 Million in Series E Funding Round

Popular cryptocurrency exchange Coinbase has raised a fresh $300 million in a Series E financing round, bringing the company valuation to $8 billion.

Coinbase plans to use the funding to "accelerate the adoption of cryptocurrencies," as it plans to remain the "entry-point into crypto" for millions of investors, according to a published blog post.

The new investment round was led by investment firm Tiger Global with Y Combinator Continuity and Andreessen Horowitz, with others participating. In August 2017, Coinbase was valued at $1.6 billion, after receiving a $100 million from a Series D round led by Institutional Venture Partners investors (IVP).

Rumors of the funding had turned up in early October with Mike Novogratz, the CEO at cryptocurrency-focused merchant bank Galaxy Digital, arguing that the rumors added legitimacy to the cryptocurrency market.

“Here’s the poster child of the crypto space worth $8 billion — that’s a real company, and Tiger’s not a flake of an investor. These are smart, savvy guys,” he had stated at a finance conference, at the time.

“We see hundreds of cryptocurrencies that could be added to our platform today, and we will lay the groundwork to support thousands in the future,” Coinbase Chief Operating Officer Asiff Hirji remarked in the post.

It will also build its infrastructure to support regulated, fiat-crypto trading across the world, such as the launch of British pound sterling (GBP) trading pairs on Coinbase Pro and Prime.

The digital asset platform also plans to focus on “utility applications” for cryptos such as the launch of its USDC stablecoin, fully collateralized by the U.S. dollar and supported by Coinbase and blockchain firm Circle.

Based on a Fortune report, Coinbase has been mostly profitable, but the slump in crypto prices has affected trading volumes on exchanges across the board. Reduced trading volumes equate to reduced fees, which has driven the company to search for alternative sources of revenue.

Flush with cash, the platform will have its eyes on the custodial fees from institutional investors whose cryptocurrencies are kept with the digital asset platform. The platform also announced the addition of a wide range of crypto assets for its custodial services in August 2018 and the launch of a suite of tools and services that institutional investors can rely on when trading crypto.

“We see Coinbase’s growth as validation that the ecosystem will only continue to grow in size, influence, and impact — ultimately ushering in a more open financial system for the world,” Hirji concluded.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/crypto-platform-coinbase-secures-300-million-series-e-funding-round/#1540921902

Distributed Dialogues: Political Censorship in China

On the latest episode of Season 2 of Distributed Dialogues, the hosts took a deep dive into the state of political repression in the People’s Republic of China. Interviewing experts and dissidents at the Oslo Freedom Festival, this thorough examination of Chinese political life combines insight and research with the real, lived experiences of people in the nation.

The podcast episode compared two people’s interactions with the state machines of China, one of whom was a U.S. citizen working as a journalist in China, the other a Chinese dissident made to flee his country. The journalist, Megha Rajagopalan, claimed that despite Western conceptions of Chinese political life, most citizens are “not concerned about the lack of freedom of speech.”

Technologies with the power to harm human freedoms are developed and deployed in countries with a strong emphasis on protecting these freedoms, but then they are “exported to other parts of the world where things like the rule of law and privacy rights aren’t very developed, with disastrous consequences.”

To showcase some of these consequences, this experience with modern China is intercut with the life of Fang Zheng, a promising Chinese athlete who was run over by a tank and lost both of his legs in the Tiananmen Square protests. Ever since then, his desire to represent his country as an international paralympic athlete has been subverted, and the government hounded him with more and more sophisticated methods over the years.

The episode serves as a documentary on the state organs of Chinese political repression, a well-researched examination into the context and effects of this ossified state power. However, the episode is not entirely bleak, as it also involves a look into how blockchain technology can evade China’s Great Firewall.

Justin Hunter, the founder of Graphite, talks about his censorship-resistant decentralized information storage, that can allow citizens to keep data without any government holding the ability to subpoena. A small measure at a glance, the very existence of information outside of government control is still a revolutionary act.

Topics in Distributed Dialogues Season 2 will continue to address human rights violations around the world and to bring in a number of experts who will describe these offences in stark detail. To listen to the full episode, as well as other episodes as they become available, visit the LTB Network.

This article originally appeared on Bitcoin Magazine.

via Bitcoin Magazine https://bitcoinmagazine.com/articles/distributed-dialogues-political-censorship-china/#1540922404